7.4%-Yielding Antero Midstream Stock Up 15.3% to New High

AM Stock Delivers Capital Appreciation & Income

The yield on the U.S. 10-year Treasury bond was recently five percent, which sent investors to the exits, seeking the lower risk of short-term cash equivalents.

But there are still income alternatives to bonds that provide capital appreciation potential and tax advantages. Antero Midstream Corp (NYSE:AM) is one of them.

The $6.0-billion market-cap company is a full-service midstream energy business that operates in the active Appalachian Basin. Its assets comprise gathering pipelines and compression facilities. It also has interests in processing and fractionation plants, as well as water handling systems in the Marcellus and Utica Shale regions. (Source: “About Antero Midstream,” Antero Midstream Corp, last accessed October 26, 2023.)

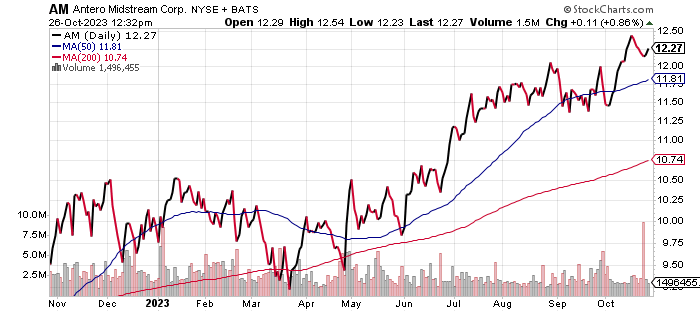

Antero Midstream stock’s price reached a 52-week high of $12.75 on October 18, up by an S&P 500-beating 15.3% in 2023 (as of this writing).

Chart courtesy of StockCharts.com

For income investors, AM stock has paid dividends for seven straight years. The company currently pays quarterly dividends of $0.225 per share, translating to a yield of 7.4%.

| Metric | Value |

| Dividend Streak | 7 Years |

| 5-Year Average Dividend Yield | 19.2% |

| Dividend Coverage Ratio | 1.6 |

Revenue Growth & Positive Free Cash Flow

Antero Midstream Corp’s revenue picture has been largely consistent over its last four reported years, with revenue growth in two of those years. In 2022, its revenues came in at a record-high $990.7 million.

Analysts estimate that the company will soon pass the $1.0-billion revenue threshold, generating $1.04 billion in revenues in full-year 2023. This is expected to be followed by a further 8.9% revenue increase to $1.13 billion in 2024. (Source: “Antero Midstream Corporation (AM),” Yahoo! Finance, last accessed October 26, 2023.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $849.6 | N/A |

| 2020 | $971.4 | 14.3% |

| 2021 | $968.9 | -0.3% |

| 2022 | $990.7 | 2.2% |

(Source: “Antero Midstream Corp.” MarketWatch, last accessed October 26, 2023.)

On the bottom line, Antero Midstream generated generally accepted accounting principles (GAAP) profits in 2021 and 2022, following losses in 2019 and 2020. The company’s flat GAAP-diluted earnings per share (EPS) in 2022 likely prevented the company from raising its dividends.

But there’s optimism that its dividends will begin to ramp higher. Analysts expect Antero Midstream Corp to report higher earnings of $0.78 per diluted share for full-year 2023, followed by $0.94 per diluted share for 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.80 | N/A |

| 2020 | -$0.26 | 67.6% |

| 2021 | $0.69 | 365.4% |

| 2022 | $0.68 | -1.4% |

(Source: MarketWatch, op. cit.)

Moving over to the company’s funds statement, Antero Midstream Corp has been a free cash flow (FCF) machine, which allows for dividends and share buybacks.

The company estimates that its adjusted FCF after dividends will increase by $5.0 million to between $135.0 and $155.0 million in full-year 2023. (Source: “Antero Midstream Announces Third Quarter 2023 Financial and Operating Results,” Antero Midstream Corp, October 25, 2023.)

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $230.4 | N/A |

| 2020 | $556.7 | 141.6% |

| 2021 | $476.9 | -14.3% |

| 2022 | $184.0 | -61.4% |

(Source: MarketWatch, op. cit.)

The current high interest rate environment will have an impact on the company’s margins and costs, but it’s not a concern. The company’s balance sheet held debt of $3.3 billion at the end of June.

Antero Midstream Corp’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a relatively strong 6.0, which is well above the Piotroski score’s range of 1.0 to 9.0.

The company had a reasonable interest coverage ratio of 3.3 in 2022. The following table shows that the company can easily cover its interest expense via its significantly higher earnings before interest and taxes (EBIT) in 2021 and 2022.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2019 | -$347.2 | $110.4 |

| 2020 | -$31.2 | $147.0 |

| 2021 | $151.6 | $44.4 |

| 2022 | $633.7 | $189.9 |

(Source: Yahoo! Finance, op. cit.)

Third-Quarter Results

Antero Midstream Corp had wonderful third-quarter results.

The company’s net income in the quarter was $98.0 million, or $0.20 per diluted share, an 18% year-over-year per-share increase. Its adjusted net income was $111.0 million, or $0.23 per diluted share, a 15% year-over-year per-share increase (using a non-GAAP measure). (Source: Antero Midstream Corp, October 25, 2023, op. cit.)

The company’s third-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $251.0 million, a 12% increase compared to the same prior-year quarter and a three-percent increase sequentially (using a non-GAAP measure).

Its third-quarter FCF before dividends was $138.0 million, and its FCF after dividends was $30.0 million (using non-GAAP measures).

Antero Midstream Corp’s capital expenditures in the third quarter were $57.0 million.

The company’s gathering and compression volumes increased in the quarter by 13% and 17%, respectively, compared to the prior year’s third quarter.

The Lowdown on Antero Midstream Corp

Antero Midstream stock has a decent amount of institutional ownership, with 443 institutions holding 52.9% of the outstanding shares. Company insiders have a 29.5% interest in the outstanding shares. That’s high, which should incentivize the company to deliver better results. (Source: Yahoo! Finance, op. cit.)

Given Antero Midstream Corp’s higher expected earnings over the next two years, I like the potential for the company to raise its dividends while providing capital appreciation. The company’s ability to grow its revenues and FCF is attractive to income investors.