Altria Stock: 8.12%-Yielder Outperforming the Nasdaq

Altria Stock Paying Dividends for 54 Years

There’s a dividend-yielding sin stock I’d like you to take a look at: Altria stock.

The world has taken a tough stance against tobacco companies, citing the health risk. From added taxes on cigarette sales to health warning labels on packages, the pushback has been a headwind for tobacco companies.

It has not been easy for tobacco companies to operate in this negative environment, but despite the headwinds, people continue to smoke, especially in the emerging markets.

However, one top-yielding dividend stock in this sector has delivered strong price appreciation for income investors: Altria Group Inc (NYSE:MO).

The company, which has been around since 1822, is famous for its “Marlboro” brand. Altria is a leading harvester and seller of tobacco in the U.S. and globally. (Source: “Corporate Fact Sheet,” Altria Group Inc last accessed July 18, 2024.)

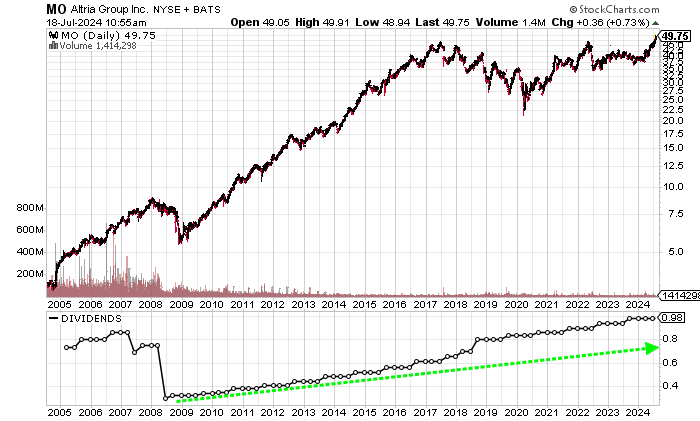

Altria stock has a long history of paying regular dividends. The company’s reign as a dividend king, after growing dividends in at least 50 straight years, ended in 2007–2009 when Altria Group Inc cut its dividend. However, since 2010, Altria has raised its dividend in 14 consecutive years to 2023, and I expect this to continue.

For income investors, MO stock has also advanced 23.3% in 2024 at the time of writing, easily beating the 17.7% return by the S&P 500 and the 20.4% move in the Nasdaq. Altria stock set a 52-week high on July 18.

Altria stock continues to trade at a compelling valuation despite the price appreciation.

The chart shows MO stock holding in a bullish golden cross, with the 50-day moving average (MA) of $46.06 above the 200-day MA of $42.70. This suggests more gains ahead.

Chart courtesy of StockCharts.com

Steady Revenues & Higher Profitability

Altria Group Inc has produced steady revenues in excess of $20.0 billion since 2020. The growth rate is in the single digits, but profits and free cash flow (FCF) have been rising.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $19.80 | 0.9% |

| 2020 | $20.84 | 5.3% |

| 2021 | $21.11 | 1.3% |

| 2022 | $20.69 | -2.0% |

| 2023 | $20.50 | -0.9% |

(Source: “Altria Group, Inc,” MarketWatch, last accessed July 18, 2024.)

Analysts estimate that Altria will report a slight revenue contraction of 0.3% to $20.45 in 2024, followed by a 0.6% increase to $20.56 billion in 2025. (Source: “Altria Group, Inc. (MO),” Yahoo! Finance, last accessed July 18, 2024.)

A look at the cost side shows the company consistently generating consistent gross margins of over 60%, including a 10-year high in 2023.

| Fiscal Year | Gross Margins |

| 2019 | 64.2% |

| 2020 | 64.7% |

| 2021 | 66.0% |

| 2022 | 68.6% |

| 2023 | 69.5% |

On the bottom line, Altria Group Inc has delivered generally accepted accounting principles (GAAP) profits in four of the last five years and nine of the last 10 years. The five-year best of $4.57 per diluted share in 2023 was the highest since 2017.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.70 | -119.0% |

| 2020 | $2.40 | 442.8% |

| 2021 | $1.34 | -44.4% |

| 2022 | $3.19 | 138.7% |

| 2023 | $4.57 | 43.2% |

(Source: MarketWatch, op. cit.)

Analysts expect adjusted earnings to rise to $5.10 per diluted share in 2024, compared to $4.95 per diluted share in 2023. This is expected to be followed by $5.29 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

The funds statement shows Altria churning out strong FCF over the past five years, with growth in three of them. FCF was a record in 2023.

The strong FCF should allow Altria Group to continue with its 54 years of dividend payments and even raise its payouts.

| Fiscal Year | FCF (Billions) | Growth |

| 2019 | $7.59 | -6.9% |

| 2020 | $8.15 | 7.4% |

| 2021 | $8.24 | 1.1% |

| 2022 | $8.05 | -2.3% |

| 2023 | $9.09 | 12.9% |

(Source: MarketWatch, op. cit.)

On the balance sheet, Altria had high total debt of $25.0 billion at the end of March. This is partially offset by $3.6 billion in cash. (Source: Yahoo! Finance, op. cit.)

While the debt load appears daunting on the surface, the company’s profitability and FCF and its ability to cover interest payments shouldn’t pose an issue.

The table shows Altria Group easily covering its interest expense via a much higher earnings before interest and taxes (EBIT). The interest coverage ratio was a healthy 1,059 times in 2023.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2019 | $10.49 | $1.28 | 8.20X |

| 2020 | $10.87 | $1.22 | 8.9X |

| 2021 | $11.56 | $1.19 | 9.71X |

| 2022 | $8.52 | $1.13 | 7.54X |

| 2023 | $12.10 | $1.15 | 10.52X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a strong reading of 7.0 for Altria, just below the top of the 1.0–9.0 range.

Dividend Yield Drops, But Altria Stock Price Jumps

The strong price appreciation has resulted in the forward dividend yield declining to the current 8.12% from over 9.0%. But that’s okay, as the strong capital gains are welcome and you still get a nice high yield. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Growth Streak | 14 years |

| Dividend Streak | 54 years |

| Dividend 7-Year CAGR | 7.0% |

| 10-Year Average Dividend Yield | 8.2% |

| Dividend Coverage Ratio | 1.3 |

The Lowdown on Altria Stock

Altria stock has broad institutional ownership, with 2,286 institutions holding 62.1% of the outstanding shares. (Source: Yahoo! Finance, op. cit.)

Insiders are also adding to the tune of a net 361,680 shares over the last six months. (Source: Yahoo! Finance, op. cit.)

The bottom line is that Altria Group Inc has a long history of paying dividends. Moreover, following the dividend cuts from 2007 to 2009, the company has raised dividends in each year. Altria has also returned capital to investors via buying back its shares. It bought back $1.0 billion in stock in 2023 and around $7.0 billion since 2018. (Source: MarketWatch, op. cit.)