ADP Stock: This Top Dividend Stock Is on the Verge of a Breakout

ADP Stock’s Dividend Could Double in Five Years

The official slogan of Wall Street could be “out with the old and in with the new.” Investors are always looking forward, searching for the next crop of great businesses with new products, services, and/or ideas. These innovations often serve as catalysts for outsized shareholder returns.

Growth investors have long understood the power of new ideas. Such innovations often come from young, emerging concerns that have just gone public. In other cases, established businesses reinvent themselves with game-changing products or new management teams. Think about the time Steve Jobs returned to Apple Inc. (NASDAQ:AAPL) as CEO and the string of revolutionary gadgets that came after, including the “iPod,” “iPhone,” and “iPad.”

But dividend investors can benefit from fresh ideas too. New products, services, and management teams can inject fresh life into stodgy businesses. These events often put a new bid under stock prices, in addition to a fresh wave of distribution hikes for stockholders.

For proof, consider some of my most profitable recommendations to my paid subscribers: Nike Inc (NYSE:NKE), Union Pacific Corporation (NYSE:UNP), and Iron Mountain Inc (NYSE:IRM). These stocks all soared after their respective management teams shook up existing operations.

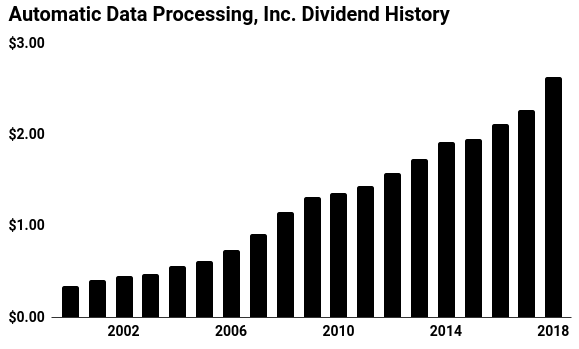

Case in point this month: payroll processing giant Automatic Data Processing (NASDAQ:ADP). For shareholders, this quiet business has been an income machine. Management has boosted the distribution every year since the early 1970s, earning the company a spot on the elite list of “Dividend Aristocrats.”

Over the past 25 years, ADP shares have delivered a total return, including dividends, of 2,100%. For comparison, the broader S&P 500 delivered a total gain of only 516% during the same period.

And this could just be the beginning. At the company’s recent analyst day presentation, Automatic Data Processing introduced a slew of new executives to its management roster. Senior managers have promised to revamp operations by cutting costs, rolling out new services, and expanding into new markets.

And I’m not the only one excited. Billionaire Bill Ackman has backed the company’s new strategy, investing more than $533.0 million into the company. Other hedge funds, including Jim Simons, Steve Cohen, and D.E. Shaw, have also started purchasing shares. Several top Wall Street houses have also upgraded ADP stock, almost begging their clients to buy shares.

This Top Dividend Stock Gushes Cash Flow

If you have ever collected a biweekly paycheck, there’s a good chance you did business with Automatic Data Processing. The company is the world’s largest payroll processor, with more than 740,000 clients. Each time an employee of one of these clients gets paid, the company charges a commission. In total, ADP delivers about one out of every six paychecks in the country. (Source: “How ADP Turns Payroll into Cash,” CFO, April 5, 2013.)

Analysts gush over this business model for one key reason: switching costs. ADP signs up customers to long-term contracts, and once the company gets its hooks into a business, it tends to become ingrained in day-to-day business processes. That can make moving operations over to a different vendor a hassle.

Worse, the transition process introduces the risk of making mistakes or errors in processing payments. That can damage relations with employees, not to mention lead to expensive fines from regulators.

The end result? The typical ADP client stays with the company for more than 10 years, leading to a steady stream of recurring cash flows. This type of loyalty also allows management to raise prices year after year with little fear of losing clients to rivals.

But here’s the real genius of ADP’s business model: before transferring any cash to employees, the company keeps these funds, called the “float,” in its own account. During this period, ADP earns interest.

Last quarter, the company held $23.6 billion on average each night for clients, earning an average annual return of 2.2%. This income stream added up to $191.1 million in interest. That amounts to “free” money, padding the company’s bottom line. (Source: “ADP Reports Second Quarter Fiscal 2019 Results,” Automatic Data Processing, January 30, 2019.)

For proof of how profitable this business can be, take a look at ADP’s financial results. Last year, its gross margins topped 43%, while its operating margins topped 20%. Those kinds of numbers put the company in the ranking of top dividend stocks like PepsiCo, Inc. (NASDAQ:PEP), The Coca-Cola Co (NYSE:KO), and Procter & Gamble Co (NYSE:PG).

But here’s the number that really impresses me. Since 2009, the business has generated $0.32 in profit on every dollar of capital invested in the business.

Any company can earn returns like that from time to time. Eventually, however, competition tends to bite into profitability. When you see a firm deliver such impressive financial performance over such a long period, you know you’re looking at a wonderful business—exactly the kind of operation that can build wealth for investors over the long haul.

And what does ADP do with all that money? It gives most of it back to the owners of the business. Last year, management spent $981.0 billion on stock buybacks; that’s the rough equivalent of a tax-deferred 2.4% dividend yield. Since 2000, the company has reduced its share count by more than a third. This program increases investors’ claims to future cash flows, increasing the value of remaining shares.

Automatic Data Processing pays out a boatload of cash to shareholders through dividends, too. Management has mailed out a check to investors every year since going public in 1974. Since 2000, that payout has grown more than ninefold.

(Source: “Dividend History,” Automatic Data Processing, last accessed April 3, 2019.)

These Catalysts Could Send ADP Stock Surging

Automatic Data Processing is exactly the kind of quiet, yet lucrative, business I love to recommend in the Retirement Riches newsletter. But a new set of executives promises to kick those returns into overdrive over the next few years. At their 2018 analyst day presentation, management revealed a three-part plan to reshape the company’s operations.

First, the company plans to slash costs. Last year, ADP offered early retirement packages to about six percent of its workforce. The decision resulted in a $250.0-million pre-tax charge during the fourth quarter of 2018. But over the long haul, this decision should pay off. Management estimates that the measure will save the company $150.0 million annually going forward. (Source: “BRIEF-ADP Offers Voluntary Early Retirement Program To Certain U.S.-Based Associates,” Reuters, March 1, 2018.)

ADP executives see other opportunities to squeeze more profit out of every dollar of revenue. Last June, for instance, the company announced plans to close smaller regional offices and fold them into a handful of supercenters. The company also wants to reduce overhead by automating routine tasks and pushing suppliers for discounts. (Source: “ADP used to have a lot of small offices. Now, it wants big service centers like Allentown,” The Morning Call, June 15, 2018.)

Second, ADP intends to introduce new payroll services. Payroll processing has become a commoditized business in recent years. New competitors have started stealing ADP’s smaller customers by offering cheaper services, while larger clients have tried saving costs by bringing payroll functions in-house. To combat these challenges, the business wants to roll out a suite of new services.

In 2020, for example, ADP will launch its new payroll engine. The upgrade will allow customers to keep up with changing regulations in different jurisdictions and pay wages in real-time.

Automatic Data Processing has also rolled out its new “Wisely” payment app, targeted toward companies with a lot of millennial and Generation Z employees. The program makes it easier to pay remote and freelance workers, one of the fastest-growing sections of the labor force.

And that’s only a sample of what ADP has in store. By introducing new products, the company can protect its market share and justify price hikes to customers.

Third, ADP hopes to become a consultant for clients, rather than just a payroll processor. At the same presentation that detailed its three-part plan, the company rolled out its new “DataCloud” application. The service provides real-time data to help clients analyze patterns and trends in their business, such as overtime, compensation, and turnover.

Employers can use this information to make better operational decisions, such as offering more competitive pay packages or ensuring equitable wages. All of which means a happier workforce, lower turnover, and lower costs.

To lead the transition, ADP’s board of directors promoted longtime executive Dermot O’Brien to the position of Chief Transformation Officer. The board has also brought in several external hires, including a new Chief Strategy Officer and Chief Financial Officer.

“ADP is a world-class company using its strengths to capitalize on the many opportunities we see as the way people and companies work continues to evolve rapidly,” said Carlos Rodriguez, President and Chief Executive Officer. (Source: “ADP Holds Investor Day To Present Strategic Vision, Transformation Initiatives And Financial Outlook,” PR NewsWire, June 12, 2018.)

“As we build on our positive momentum and accelerate the pace of execution, our strong financial outlook reflects the strength of ADP’s business and our flexibility to pursue a robust strategy through organic innovation and thoughtful acquisitions.”

This Dividend Keeps on Growing

All of this could have a big impact on ADP’s financials.

Between 2019 and 2021, executives project that the company will grow its top-line sales at a seven-to-nine-percent compound annual clip. More of that money should also flow to the bottom line. The company hopes to boost adjusted earnings before interest and taxes from 20% today to 25% by 2021. That should translate into an adjusted earnings per share (EPS) growth rate of 16% to 19% per year. (Source: Ibid.)

For investors, this could result in tidy capital gains. Automatic Data Processing has one trait that analysts drool over: accelerating earnings growth. Not only is the company increasing its profits, but it’s doing so at an even faster rate than in previous years. Investors will usually pay a premium multiple for stocks with this characteristic.

In the past, ADP has traded at about 14 to 16 times its forward earnings. That was a fair price to pay for a company growing its earnings at a low-teen annual clip. But if management can deliver on their growth promises (up to 19% yearly EPS growth), it wouldn’t be surprising to see investors slap a forward earnings multiple of 20 to 22 on this business.

At least that’s a conservative figure, given the valuation we see on other companies with a comparable growth rate. If that plays out as I expect, that would be a considerable catalyst for ADP’s stock price.

Income hunters will cash in too. Once again, let’s make some assumptions here. First, if management can hit their growth targets, the business will generate $7.50 per share in earnings by 2021. Second, let’s assume that the executives maintain their historical payout ratio of 75%.

In that scenario, ADP stock will pay out $5.63 per share in 2021—nearly double what it pays out today. Based on the current ADP share price, that comes out to a yield on cost of nearly four percent. Not a bad income stream for retirees.

ADP Stockholders Need to Keep an Eye on This

Of course, we can’t call this story a sure thing. First, Automatic Data Processing increases its revenue every time a business adds an employee. That model pays off during a boom, but it can backfire in the event of a recession.

I don’t worry too much about this risk though. Over the next 50 years, investors can expect a handful of down years. We can’t predict when and where those slumps will occur, but over the long haul, the U.S. labor force will likely continue to grow. That should result in a growing stream of dividends for shareholders. Still, it’s a risk to keep an eye on.

The real risk comes from ADP’s new business strategy. Management’s growth outlook assumes large increases in top-line sales, which may or may not play out. We have no guarantee that any of the company’s new products or services will resonate with customers. Moreover, the payroll processing business continues to get more competitive.

For small businesses, technological advances have allowed operators to opt for cheaper, do-it-yourself software-as-a-service solutions. At the same time, large enterprise customers have the resources and bargaining power to drive down prices. Both of those factors could hurt ADP’s bottom line, slowing the pace of dividend hikes for shareholders.

Early financial results, however, show that the company’s new strategy has started paying off. Last quarter, ADP’s revenues jumped eight percent year-over-year to $3.5 billion. Adjusted earnings before interest and taxes expanded by 320 basis points and adjusted net earnings jumped 29% to $587.0 million.

More importantly, the company also raised its earnings outlook for fiscal 2019. Executives now see EPS growing between 20% and 22%, compared to the prior outlook of between 18% and 20%. Those numbers suggest that the company’s new products and services have resonated with customers.

Moreover, prospective ADP investors don’t have a lot of downside buying at today’s share price. At 16-times forward earnings, you can’t call the stock cheap. But it’s not exactly in bubble territory, either. If management’s new strategy doesn’t play out as we expect, share prices don’t have that much room to fall. In the worst-case scenario, investors get to own a wonderful, though slightly less profitable, dividend stock.

The Bottom Line on ADP Stock

Wall Street always watches for the next best thing, whether that’s a new company disrupting an industry or an established business reinventing itself. Either way, something new can translate into profits.

Automatic Data Processing’s fresh executive team has a plan to overhaul its payroll processing business for the 21st century. Investors have to admire the company’s audacious plan to slash costs, roll out improved services, and break into new businesses. That should translate into a growing share price (and growing dividends) for holders of ADP stock.