Sabine Royalty Stock: 10.3%-Yielder Hiked Monthly Payout 166%

Why Investors Should Pay Attention to SBR Stock

Regardless of the future price of oil, the outlook for Sabine Royalty Trust (NYSE:SBR), an oil and natural gas company, is solid.

When it comes to oil and gas price projections, analysts sometimes get it wrong. Case in point: in September, analysts thought crude oil would reach $100.00 this fall. Instead, it’s been hovering around $80.00 per barrel.

What about next year?

The outlook for crude oil is promising, with JPMorgan Chase & Co (NYSE:JPM) predicting that Brent crude will average $83.00 per barrel in 2024. JPMorgan expects oil prices to be energized by resilient demand in the U.S., growth in emerging markets, and stability in Europe.

For 2025, the bank expects Brent crude to average $75.00 per barrel.

A lot can change over a matter of months, though, so who knows what will really happen?

As for Sabine Royalty Trust, investors can rely on it to reward them with reliable, monthly, high-yield dividends. Even during the COVID-19 pandemic, the worst economic environment in 100 years, the company never skipped a beat, continuing to pay its shareholders every month.

Sabine has royalty and mineral interests in producing and undeveloped oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. (Source: “About Us,” Sabine Royalty Trust, last accessed November 29, 2023.)

As a trust, it has no capital expenses; it just pumps out oil and gas and passes the royalties on to investors. It doesn’t explore for, nor invest in, new wells.

As of January 1, the company’s net proved reserves were appraised at approximately 5.9 million barrels of oil and 47.4 billion cubic feet of gas, with a future net value of about $657.9 million. With these estimated quantities, the company’s reserves are expected to have a lifespan of eight to 10 years. (Source: “Sabine Royalty Trust Announces Monthly Cash Distribution for June 2023,” Sabine Royalty Trust, June 5, 2023.)

As might be expected, the trust’s revenues are directly dependent upon the price of oil and gas, as well as the quantities it produces. As noted above, the outlook for oil and gas prices in 2024 is bright. That’s even before factoring in unknown factors like the next U.S. presidential election and Black Swan events.

Sabine Royalty Stock Pays Reliable, Monthly Dividends

In October, Sabine Royalty paid a monthly cash distribution of $0.27869 per unit. In November, it paid $0.720840 per unit. (Source: “Sabine Royalty Trust Announces Monthly Cash Distribution For November 2023,” Sabine Royalty Trust, November 3, 2023.)

As of this writing, the November dividend works out to a yield of 10.25%.

The 168.65% month-over-month increase in SBR stock’s distribution was a result of an increase in oil and gas prices, as well as an increase in the trust’s oil production. Sabine Royalty Trust’s November distribution reflects its oil production in August and its gas production in July.

The big fluctuations in Sabine Royalty stock’s distributions, as shown in the following monthly and yearly tables, are why investors need to pay close attention to commodity prices.

| Month in 2023 | Distribution Per Unit |

| November | $0.72084 |

| October | $0.27869 |

| September | $0.3643 |

| August | $0.29858 |

| July | $0.32047 |

| June | $0.32591 |

| May | $0.499 |

| April | $0.69954 |

| March | $0.46547 |

| February | $0.6373 |

| January | $0.63151 |

(Source: “Cash Distributions,” Sabine Royalty Trust, last accessed November 29, 2023.)

As might be expected, SBR stock’s annualized distributions change from year to year, too.

| Year | Distribution Per Unit |

| 2022 | $8.65404 |

| 2021 | $3.21752 |

| 2020 | $2.39665 |

| 2019 | $3.01979 |

| 2018 | $3.34906 |

| 2017 | $2.3837 |

(Source: Ibid.)

So far in 2023, Sabine Royalty Trust has distributed $5.24161 per unit. With less than a month to go in the year, it’s safe to say that Sabine Royalty stock’s annual payout will be less than what it was in 2022 but about double what it was in previous years.

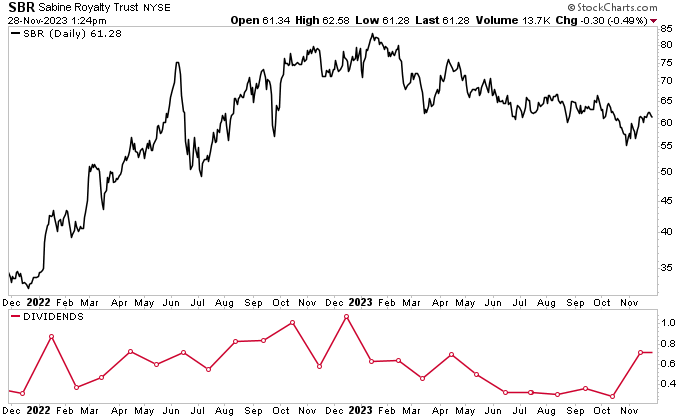

SBR stock’s inflation-busting monthly dividends can help unitholders weather the unpredictability of its share price. Sabine Royalty units entered 2023 with great momentum, hitting an all-time record high of $84.90 on January 18. Since then, Sabine Royalty stock has been feeling industry pressure.

As of this writing, Sabine Royalty Trust’s units are up by six percent over the last month but down by 14.5% year-over-year. Longer-term, SBR stock is up by 76% over the last two years and up by 275% since hitting a pre-pandemic low of $16.33 on March 23, 2020.

Chart courtesy of StockCharts.com

The Lowdown on Sabine Royalty Trust

Sabine Royalty stock is an oil and gas play that pays reliable, ultra-high-yield monthly dividends. As mentioned earlier, Sabine Royalty Trust never missed a monthly dividend during the pandemic, and its distribution has grown since then, rising by 34% in 2021 and 168% in 2022.

SBR stock’s price is up significantly from where it was before the pandemic at the start of 2020. It might be in the red this year, but the outlook for the oil and gas industry in 2024 is bullish.

This all bodes well for Sabine Royalty Trust’s unit price and monthly distributions.