A Secure and Growing 8.2% Yield in Energy

This 8.2% Yield Really is Safe

Today, we look at an industry that cranks out some of the highest yields around: pipelines.

Longtime readers know America’s booming oil output has driven big gains for these partnerships. With more crude flowing through their networks, these businesses have passed on large dividend hikes to unitholders.

Case in point: Tallgrass Energy Partners LP (NYSE:TEP). The partnership owns a number of pipelines across the Midwest, in addition to a few processing plants. And with a yield approaching 8.2%, the business has gained a following with income investors.

But can Tallgrass maintain such a large payout? Any time you see a big yield, it should raise eyebrows. Let’s dig into the numbers.

This payout looks reasonably secure, first of all. Through the first nine months of 2017, the business generated $469.7 million in distributable cash flow. Of that total, management paid out $304.7 million in distributions.

Also Read:

MLP Stock List: Earn Reliable Income from These Energy Partnerships

That comes out to a payout ratio of 65%. Generally, I like to see companies pay out 75% or less of their profits to unitholders, just for the sake of a little wiggle room. So Tallgrass’s conservative distribution allows owners to sleep at night, even if the business runs into a bad year or two.

Better still, that payout will likely continue to grow. New technologies have unlocked vast quantities of oil and natural gas across the country. That has increased demand for everything from pipelines and terminals to storage tanks and processing facilities.

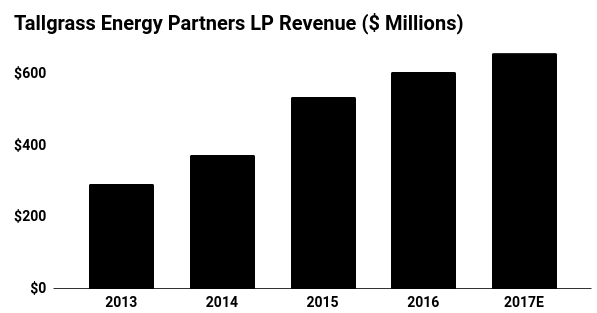

Tallgrass represents one of the biggest winners from this boom. Over the past four years, fee income from pipelines has more than doubled. Management has passed on most of these profits to unitholders, increasing the distribution almost threefold over this same period.

(Source: “Tallgrass Energy Partners LP,” Google Finance, last accessed January 9, 2017.)

That trend will likely continue. Over the next five years, analysts expect distributable cash flow to grow at a mid-teen annual clip. Based on the partnership’s track record, investors can expect the distribution to increase roughly in line with profits.

Of course, the Tallgrass story comes with some risk. Management funds most of their growth initiatives through debt. Higher interest rates would slow the partnership’s expansion.

Lower oil prices could also clip units. Generally, pipeline profits depend more on the volume of crude flowing through the network, rather than the price of oil itself. But, when a sector goes out of favor on Wall Street, traders will dump even high-quality assets.

Yet, even in both of these scenarios, Tallgrass will likely keep cranking out reliable, growing distributions for owners.