NAT Stock: Could 14.71%-Yielder Go Up 64%?

Why Wall Street Likes Nordic American Tankers

Today’s stock in the spotlight is NAT stock.

In the U.S., crude oil transported on land is largely carried via huge networks of pipelines, a method that tends to be the most cost-effective. Secondary modes of transport include rail and trucks.

But, on a global scale, the major mode of transport is across oceans via the use of oil tankers. This option accounted for around 76% of the world’s transport of oil in 2023. (Source: “World Oil Transit Chokepoints,” U.S. Energy Information Administration, June 25, 2023.)

This is where Nordic American Tankers Ltd (NYSE:NAT) comes in, with a market valuation of $568.9 million as of January 30.

The company maintains a fleet of 20 Suezmax oil tankers. These tankers are classified as medium-sized, slotted in between the smaller Aframax tankers and the biggest oil tankers of them all, called Very Large Crude Carriers (VLCCs). (Source: “Investors,” Nordic American Tankers Ltd, last accessed January 30, 2025.)

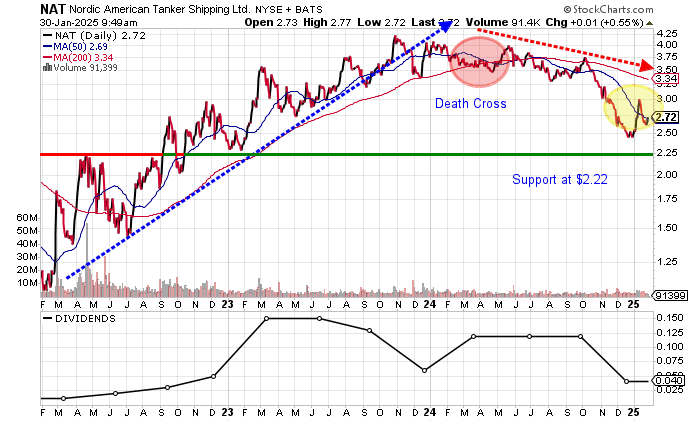

The price chart shows NAT stock struggling since breaking below its upward trendline in late 2023, down 36% over the last year to January 30. The stock is above its 52-week low of $2.41, but well off its range high of $4.55. Moving back to April 2020 and July 2015, NAT stock was trading at $9.00 and $17.30, respectively. This implies plenty of upside potential.

At this time, NAT stock is in a bearish death cross following the breakout, in a downward trend below its 200-day moving average (MA) of $3.49. The stock is hovering at its 50-day MA of $2.71, which needs to hold or there could be a move towards key support at $2.22. If NAT stock holds, we could see a strong rally.

Chart courtesy of StockCharts.com

2024 Looks Soft, But There Should Be Better Times Ahead

Nordic American Tankers has generated annual revenues in excess of $300.0 million in four of the last five years, with the exception of 2021, when the world was recovering from the pandemic.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $317.2 | N/A |

| 2020 | $354.6 | 11.8% |

| 2021 | $195.8 | -44.8% |

| 2022 | $339.3 | 73.4% |

| 2023 | $391.7 | 15.4% |

(Source: “Nordic American Tankers Limited (NAT),” MarketWatch, last accessed January 30, 2025.)

Revenues in the first three quarters of 2024 came in at $245.1 million, including a low $52.0 million in the third quarter. So, unless Nordic American Tankers reports a stellar fourth quarter, it will fall short of its 2023 results.

In a positive sign, the company’s gross margins expanded significantly to 51.6% in 2023, the highest in five years. This generally aids profitability.

| Fiscal Year | Gross Margins |

| 2019 | 34.5% |

| 2020 | 47.0% |

| 2021 | -2.5% |

| 2022 | 31.1% |

| 2023 | 51.6% |

The bottom line shows a five-year high in generally accepted accounting principles (GAAP) profits in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.07 | N/A |

| 2020 | $0.34 | 561.6% |

| 2021 | -$0.73 | -319.3% |

| 2022 | $0.07 | 110.2% |

| 2023 | $0.47 | 531.9% |

(Source: MarketWatch, op. cit.)

The third quarter saw Nordic American Tankers fall short on earnings, with $0.04 per diluted share versus the consensus $0.06 per diluted share. This followed a 21.2% second-quarter beat.

So, 2024 looks like it was a down year, with analysts expecting Nordic American Tankers to report a drop to $0.25 per diluted share. This is supported by a combined $0.21 per diluted share earned in the first three quarters of 2024.

There’s some optimism for 2025, with analysts expecting the consensus earnings to rebound to between $0.45 and as high as $0.91 per diluted share. (Source: “Nordic American Tankers Limited (NAT),” Yahoo! Finance, last accessed January 30, 2025.)

Nordic American’s balance sheet is manageable, with $40.8 million in cash and $286.7 million in total debt. The total debt-to-equity of 54.5% is reasonable for this high-capital-expenditure business. (Source: Yahoo! Finance, op. cit.)

The profitability and free cash flow generated in 2023 suggest there are no concerns at this time; the interest coverage ratio of 5.5 times in 2023 supports this.

Nordic American Tankers has easily covered its interest expense via higher earnings before interest and taxes (EBIT), except in 2021.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2021 | -$147.9 | $29.0 | N/A |

| 2022 | $38.6 | $23.5 | 1.6X |

| 2023 | $127.8 | $23.4 | 5.5X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a fragile reading of 3.0 for Nordic American, which is below the midpoint of the 1.0 to 9.0 range. Prior to this, the company’s reading averaged 6.0 from 2019 to 2023.

A 28-Year Dividend Streak

NAT stock has paid a dividend in each quarter since 1997.

Nordic American paid dividends of $0.40 per share for 2024, down from $0.49 per share in 2023. However, it was well above the $0.11 and $0.06 paid respectively in 2022 and 2021 when the pandemic hit. (Source: “Dividends,” Nordic American Tankers Ltd, last accessed January 30, 2025.)

Back in 2016, NAT stock paid out $1.37 per share in dividends, so there’s clearly a pathway to higher dividends.

The company has paid a high dividend relative to its share price. NAT stock has a high dividend yield of 14.71% based on the dividends paid in 2024. Based on the last quarter’s dividend of $0.12 per share, the forward dividend yield jumps to 17.65%. NAT stock’s 10-year average dividend yield is 11.4%, with a five-year average of 10.5%.

Be warned that Nordic American Tankers could make a dividend cut in 2025 given that the payout ratio is 160% based on the 2024 consensus, but this could improve to 88.9% based on the 2025 consensus.

The Lowdown on NAT Stock

Institutional ownership is decent, with 259 institutions holding a 42% stake in the outstanding NAT shares. (Source: Yahoo! Finance, op. cit.)

While there can be inconsistencies in operating results in this business, Nordic American Tankers Ltd has managed to consistently pay dividends.

The valuation is typical of maritime shippers and tends to be on the lower end. NAT stock trades at 1.1 times book value, six times the 2025 consensus EPS.

NAT stock is ideal for the income investor who requires steady income and the potential for price appreciation.