AG Mortgage Investment Trust Stock: Could 11.5%-Yielder Rally 138%?

Why Wall Street’s Bullish on MITT Stock

High interest rates hurt all companies but they’re especially painful to businesses that rely on heavy financing to drive their operations.

So, it’s a good thing that interest rates are likely to head lower in 2025 and into 2026. This downward move in rates will benefit companies that require access to capital and carry high debt.

Real estate investment trust (REIT) vehicles will benefit from the lower financing rates, which will be an advantage for REIT investors.

REITs are ideal for investors seeking income, because these structures are required to distribute at least 90% of taxable income to shareholders in any given year.

In this space, mortgage REITs in particular will due well with lower interest rates due to the reduced financing costs. While the income from mortgage rates falls, a mortgage REIT also will see a decline in its carrying costs. Ultimately, as long as the interest-rate spread between the mortgage investment and cost to finance the purchases holds or rises, it’s positive for the REIT.

AG Mortgage Investment Trust Inc (NYSE:MITT) is a small mortgage REIT with a market valuation of $195.1 million, but there’s tons of potential for price appreciation.

It’s a pure-play residential mortgage REIT with approximately 65% of its portfolio invested in residential mortgage-related assets in the U.S. mortgage market.

AG Mortgage Investment Trust looks to deliver healthy returns to investors over the long term via dividends and capital appreciation. (Source: “About Us,” AG Mortgage Investment Trust Inc, last accessed January 28, 2025.)

At the end of September 2024, the REIT’s investment portfolio was valued at $6.8 billion and yielding an average of 5.9%. And with around $6.4 billion financed at an average cost of 5.3%, this positive interest rate spread means income for investors.

The major risk of mortgage REITs is the heavy borrowing, which means that lower interest rates will help in lowering the debt cost. (Source: “Fact Sheet,” AG Mortgage Investment Trust Inc, last accessed January 28, 2025.)

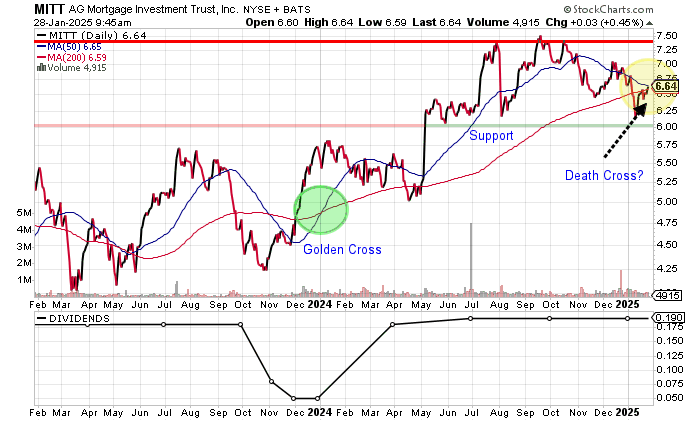

The chart shows AG Mortgage Investment Trust stock trading at $6.61, below its 52-week high of $7.95 and 10-year high of $59.85 from December 2017.

AG Mortgage Investment Trust stock is currently in a bullish golden cross around its 50-day moving average (MA) of $6.64 and 200-day MA of $6.59. But be careful, as we could see a move into a death cross should the 50-day MA break below the 200-day MA, which would be bearish. If this occurs, look for support at around $6.00 as an opportunity. If AG Mortgage Investment Trust stock can hold, we could see a break higher towards the $8.00 level.

Chart courtesy of StockCharts.com

Revenues Set to Jump

AG Mortgage Investment Trust reports its revenues as total net interest income and earnings as earnings available for distribution (EAD).

Total net interest income declined to $47.8 million in 2023 versus $61.4 million in 2022. The drop occurred despite interest income rising to $260.3 million in 2023, compared to $180.3 million in 2022. This was due to AG Mortgage Investment Trust seeing its interest expense surge to $212.5 million in 2023 from $118.9 million in 2022. The lower interest rates in 2024 helped. (Source: “Form 10-K,” AG Mortgage Investment Trust Inc, last accessed January 28, 2025.)

In the third quarter of 2024, AG Mortgage Investment Trust reported a rise in total net interest income to $14.9 million versus $11.5 million in the third quarter in 2023. In the nine months to September 30, total net interest income was $48.5 million, compared to $34.5 million for the same period in 2023. The company has a pathway to surpass its 2023 results. (Source: “Form 10-Q,” AG Mortgage Investment Trust Inc, last accessed January 28, 2025.)

Analysts expect AG Mortgage Investment Trust to increase its total net interest income by 45.9% to $69.8 million in 2024, followed by a 20.2% jump to $83.9 million in 2025. (Source: “ AG Mortgage Investment Trust, Inc (MITT), ” Yahoo! Finance, last accessed January 28, 2025.)

On the bottom line, despite the decline in the total net interest income, AG Mortgage grew its EAD to $0.39 per diluted share in 2023 from $0.08 per diluted share in 2022.

The third-quarter EAD jumped to $0.17 per diluted share, compared to $0.10 per diluted share for the third quarter of 2023. Analysts had expected EAD of $0.21 per diluted share, but it was only the first miss over the last four quarters.

Analysts expect AG Mortgage Investment Trust to report higher EAD of $0.78 share in 2024, followed by $1.02 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

On the balance sheet, the heavy debt of $6.38 billion at the end of September 2024 is what you would expect from a mortgage REIT that relies on financing.

I’m not concerned at this time, especially as interest rates begin to fall and reduce the carrying cost. The working capital is extremely strong at 8.11 times and the Piotroski score is a healthy 6.0. (Source: Yahoo! Finance, op. cit.)

14 Consecutive Years of Dividends

Historically, mortgage REITs tend to have inconsistency in dividends due to moves in interest rates and the health of the economy.

AG Mortgage Investment Trust stock has paid dividends in 14 straight years, with dividends growing in 2024.

The REIT paid combined dividends of $0.75 per share in 2024, up from $0.72 per share in 2023. The last two dividends were $0.19 per share in both September and December.

If $0.19 per share holds, this would translate to a forward yield of 11.5% based on a stock price of $6.61.

The Lowdown on AG Mortgage Investment Trust Stock

Institutional ownership in AG Mortgage Investment Trust stock is moderate, with 124 institutions holding a 37.3% stake. (Source: Yahoo! Finance, op. cit.)

Wall Street is bullish on AG Mortgage Investment Trust stock, with an average price target up at $15.71 or 138% above the current price.