OCSL Stock: 13.47%-Yielder to Generate Income

A BDC with a 17-Year Dividend Streak

Interest rates are heading lower over the next few years unless we see any new macro shocks that might lead to higher inflation. For now, my base case is for lower interest rates, which should lead to increased lending activity and capital spending.

Assuming the ratcheting down of interest rates, business development companies (BDCs) could do quite well. These specialty finance companies invest in and work with emerging and higher-risk companies that the traditional banks generally avoid.

Oaktree Specialty Lending Corp (NASDAQ:OCSL) is a BDC with a market valuation of $1.35 billion that has paid regular dividends.

The BDC provides financing to companies with limited access to capital. Oaktree’s solutions comprise first- and second-lien loans, unsecured and mezzanine loans, and preferred equity.

Oaktree Specialty Lending targets companies with a strong business model and sound fundamentals. At the end of September, the BDC had $205.0 billion in assets under management. Its operations are found in 23 cities and 17 countries. (Source: “Corporate Profile,” Oaktree Specialty Lending Corp, last accessed December 11, 2024.)

The risk is that achieving success in the specialty finance business is dependent on making the right investments and generating steady income flows. This has been the case for Oaktree, which has paid steady dividends in 17 consecutive years.

But while Oaktree Specialty Lending has paid regular dividends over time, OCSL stock has generally not delivered any significant capital appreciation for investors. The stock is geared to income investors who seek regular dividends and some capital appreciation.

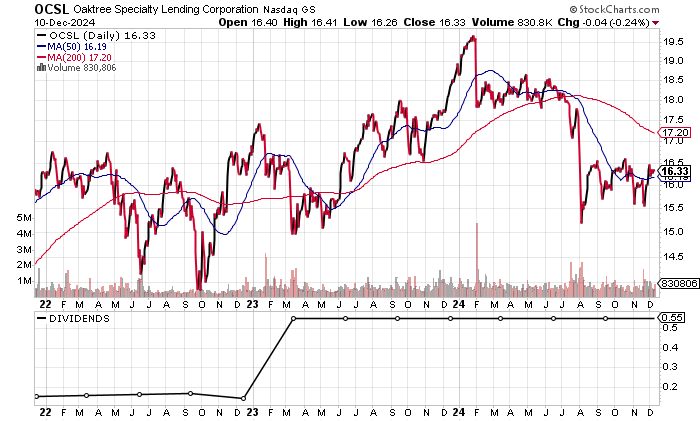

Trading at the current price of $16.33, OCSL stock hovers just above its 52-week low of $15.40 and well below its range high of $21.64, down 20% in 2024 as of December 11.

Technically, OCSL stock is trading just above its 50-day moving average (MA) of $16.16. If the stock can hold, we could see Oaktree Specialty Lending stock move towards the 200-day MA at $18.00 and the 52-week high.

Chart courtesy of StockCharts.com

Four Straight Years of Revenue Growth

Oaktree Specialty Lending reports in a fiscal year ending September 30. The analysis is based on the fiscal 2024 results.

Key financial metrics used by Oaktree consist of total investment income representing the company’s revenues, generally accepted accounting principles (GAAP) net investment income (GAAP earnings), and adjusted net investment income (adjusted earnings).

On the top line, Oaktree’s total investment income grew 0.6% to a record $381.7 million in fiscal 2024 versus $379.3 million in fiscal 2023. The soft results drove the share price weakness despite revenue growth in four straight fiscal years. (Source: “Oaktree Specialty Lending Corporation Announces Fourth Fiscal Quarter and Full Year 2024 Financial Results and Declares Quarterly Distribution of $0.55 Per Share,” Oaktree Specialty Lending Corp, November 19, 2024.)

Looking ahead, analysts expect some weakness. Oaktree Specialty Lending is expected to report lower revenues of $359.5 million in fiscal 2025, followed by $344.1 million in fiscal 2026. (Source: “Oaktree Specialty Lending Corporation (OCSL),” Yahoo! Finance, last accessed December 11, 2024.)

The BDC’s bottom line has shown consistent GAAP net investment income in seven straight years going back to fiscal 2018. GAAP net investment income came in at $2.18 per share in fiscal 2024, down from $2.51 per share in fiscal 2023.

Oaktree reported adjusted net investment income of $2.23 per share in fiscal 2024 versus $2.47 per share in fiscal 2023. On a positive note, the total $179.3 million in adjusted net investment income was above the comparative $177.8 million in fiscal 2023. (Source: Oaktree Specialty Lending Corp, op. cit.)

The company’s balance sheet is typical of what you would expect with a specialty finance company. At the end of September, Oaktree’s total debt was $1.66 billion or roughly 1.12 times equity, which is manageable.

Generating Income & Paying Dividends

Oaktree Specialty Lending has been a steady dividend payer with the goal of producing regular dividends for investors.

OCSL stock’s dividend is primarily paid out from the company’s distributable (taxable) income. In cases when the total dividend is greater than the distributable income (i.e., payout ratio above 100%), Oaktree makes up the difference from its retained capital.

The Lowdown on OCSL Stock

OCSL stock is for income investors who want steady dividends and the potential for higher dividends and some share appreciation.

The risk with this pick is that the specialty finance business could see mixed results, but so far, Oaktree has delivered decent results that can support its dividend.

Moreover, with lower interest rates on the horizon, this could lead to higher loan demand from the company’s target market. The end result could be higher investment income and dividends.