11.66%-Yielding ABR Stock Up 12.2% Over 3 Months

Arbor Realty Stock Trading Just Above Book Value

Real estate investment trust (REIT) structures are ideal vehicles for income investors who seek companies where the primary objective is paying dividends. And since REITs generally have high capital expenditure structures, a downward move in interest rates is bullish.

Take the case of Arbor Realty Trust Inc (NYSE:ABR), a mid-cap REIT established just over two decades ago. The company has grown into a nationwide REIT that is focused on multifamily and single-family rental portfolios and commercial real estate assets. (Source: “Profile,” Arbor Realty Trust Inc, last accessed November 20, 2024.)

And with rents across the country surging, Arbor Realty finds itself in a sweet spot to benefit from the higher rents coupled with lower interest rates. If you ever wanted to become a landlord and enjoy the higher rental rates, ABR stock may be ideal for you.

As an income investor, you’ll be interested to hear that Arbor Realty Trust Inc is on a 13-year dividend streak; better yet, ABR stock currently provides a tasty forward dividend yield of 11.66%.

Moreover, investors would’ve seen their positions rise 12.2% over the past three months and 21.2% over the past year (to November 19).

If you were fortunate enough to buy Arbor Realty Trust stock at $3.54 during the pandemic in March 2020, your position would be up 316.7%. This is based on the price of $14.75 at the time of writing. And this doesn’t include the dividends you are collecting every quarter.

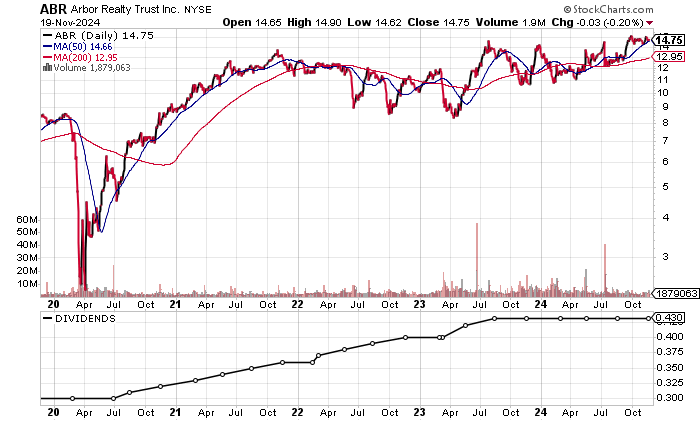

ABR stock is presently trading above its 200-day moving average (MA) of $13.75 and just below its 50-day MA of $15.00. The chart is flashing a golden cross, a bullish technical crossover when the 50-day MA is above the 200-day MA. This crossover suggests that additional gains may be coming.

Chart courtesy of StockCharts.com

Third-Quarter Beat for This Free-Cash-Flow Machine

In the third quarter ended September 30, 2024, Arbor Realty Trust reported distributable earnings of $88.2 million, or $0.43 per diluted share. This was a penny above the consensus estimate and represented the fourth straight quarter that the REIT beat the consensus. (Source: “Arbor Realty Trust Reports Third Quarter 2024 Results and Declares Dividend of $0.43 per Share,” Arbor Realty Trust Inc, November 1, 2024.)

Analysts estimate that Arbor Realty Trust will report distributable earnings of $1.64 per diluted share in 2024 and $1.57 per diluted share in 2025. There is a high estimate of $1.77 per diluted share in 2025. (Source: “Arbor Realty Trust, Inc (ABR),” Yahoo! Finance, last accessed November 20, 2024.)

At the same time. Arbor Realty Trust paid back $2.45 billion in debt and issued $2.1 billion in new debt. (Source: Yahoo! Finance, op. cit.)

With the debt reduction, the company managed to improve its debt to equity ratio from 4:1 in 2023 to 3:1 in the third quarter.

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a decent reading of 6.0 for Arbor Realty Trust, which is above the midpoint of the 1.0 to 9.0 range.

And with financing costs set to decline, I expect Arbor to generate improving margins and distributable earnings. This will be important given the $10.4 billion in total debt on the balance sheet that is typical of asset-acquiring REITs. (Source: Yahoo! Finance, op. cit.)

There is no issue when it comes to short-term expenses, as working capital is strong and there’s $689.5 million in cash.

Arbor Realty Trust is a free cash flow (FCF) machine, hitting $1.1 billion in 2022 before declining to $235.9 million in 2023. A plus is that the FCF is rebounding in 2024 after a combined $414.8 million in the first nine months of 2024.

| Fiscal Year | FCF | Growth |

| 2020 | $55.2 million | N/A |

| 2021 | $216.8 million | 292.8% |

| 2022 | $1.1 billion | 407.2% |

| 2023 | $235.9 million | -78.5% |

(Source: Yahoo! Finance, op. cit.)

ABR Stock: Steady & Safe Dividends

ABR stock’s current annual dividend is $1.72 per share, representing a forward yield of 11.66%. This is above the five-year-average dividend yield of 10.53%. (Source: Yahoo! Finance, op. cit.)

Given the profitability and FCF, I expect the dividends with ABR stock to be safe and rise a bit.

| Metric | Value |

| Dividend Growth Streak | 12 years |

| Dividend Streak | 13 years |

| Dividend 7-Year CAGR | 15.2% |

| 10-Year Average Dividend Yield | 15.3% |

The Lowdown on ABR Stock

Institutional ownership in ABR stock is decent; it has been rising, with 412 institutions now holding a 60.9% stake in the outstanding shares. (Source: Yahoo! Finance, op. cit.)

There is a large short position on ABR stock of 59.37 million shares as of October 31, representing 43.4% of the float. If Arbor Realty stock rallies, I would expect to see short-covering and support for the stock. (Source: Yahoo! Finance, op. cit.)

Based on the current price of $14.75, ABR stock trades at a reasonable forward price-earnings multiple of 9.5 times the consensus 2025 distributable earnings estimate. This is below the average five-year price-earnings of 10.7 times.