PermRock Royalty Trust: BlackRock’s Bullish on This 12%-Yielder

PRT Stock’s Monthly Distribution on the Rise

The outlook for beaten-down energy plays like PermRock Royalty Trust (NYSE:PRT) remains solid.

Weaker-than-expected demand for West Texas Intermediate has seen prices of crude fall to around $67.00 per barrel, the lowest level since November 2021. But it’s all relative.

World oil demand is still expected to increase by more than two million barrels of oil per day to around 104.2 million barrels per day in 2024, rising by an additional 1.7 million barrels per day in 2025. (Source: “Crude Oil Prices Fall to Lowest level of 2024 as OPEC Cuts Demand Outlook,” Investopedia, September 10, 2024.)

While oil prices remain muted, demand is still greater than it was before the 2020 health crisis historical average of 1.4 million barrels per day.

Keep this in mind, too: the U.S. is the world’s largest market for gasoline, but, because of regional challenges, some parts of the country import gas from other regions. However, this trend is largely ebbing as the U.S. breaks its dependence on gasoline imports. Gasoline imports fell to just 320,000 barrels per day in October, the lowest monthly number in almost a decade. (Source: “US Breaks Dependence on Gasoline Imports,” Oilprice.com, November 16, 2024.)

The fact is, demand for gasoline in the U.S. has held up despite demand for electric vehicles, with daily consumption unchanged from last year at around nine million barrels per day.

So, while demand from China may be down, the U.S. economy remains strong, which bodes well for energy companies like PermRock Royalty Trust.

PermRock Royalty Trust owns a perpetual interest in oil- and natural-gas-producing properties located in the Permian Basin in Texas. It received an 80% net profit interest from the sale of production from certain properties owned by Boaz Energy, rather than a specific portion of production. (Source: “Form 10K,” U.S. Securities and Exchange Commission, August 9, 2024.)

The underlying properties consist of four operating areas in the Permian Basin in Texas, totaling approximately 31,354 gross (22,394 net) acres.

Founded in 2017, the trust has produced over 30 billion barrels (Bbls) of oil and more than 75 trillion cubic feet (Tcf) of natural gas.

Because it declares a monthly dividend, PermRock announces its financial results on a monthly basis, too. For the production month of September, the company reported oil cash receipts of $1.55 million, a $320,000 decrease from the prior month.

The trust sold 22,464 barrels per oil at $68.87 per barrel compared with 24,944 barrels at $74.92 per barrel in the prior month. (Source: “PermRock Royalty Trust Declares Monthly Cash Distribution,” November 18, 2024.)

Natural gas cash receipts for the properties underlying the trust totaled $0.05 million, down from $0.04 million in the prior month. In September, natural gas averaged $1.66 per thousand cubic feet (Mcf) as compared to $2.00 per Mcf in the prior month.

PermRock Increases Monthly Distribution

This resulted in a cash distribution of $368,269.34, or $0.030271 per unit, up slightly from $0.030219 per unit in October. This works out to $0.48 on an annual basis for a forward yield of 12.34%. (Source: “Cash Distributions,” PermRock Royalty Trust, last accessed November 18, 2024.)

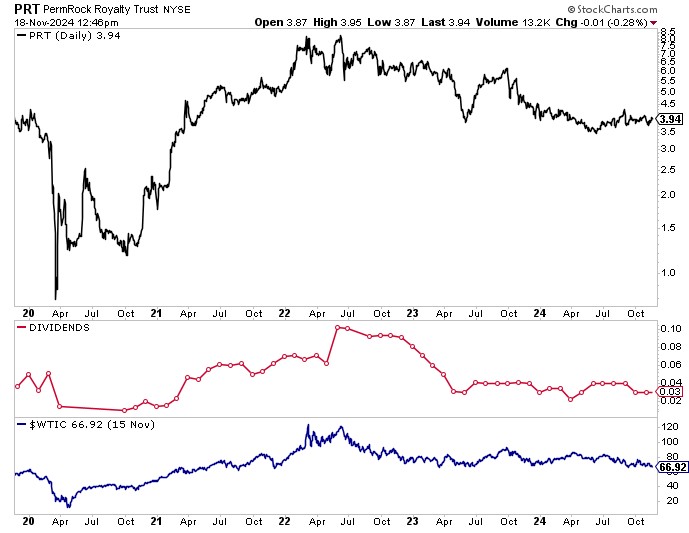

PermRock paid out its first monthly dividend in May 2018. As expected, the monthly payout fluctuates based on the price of oil and gas and sales volumes. The red line in the chart below represents PRT stock’s dividend payout and the blue line is the price of West Texas Intermediate.

Chart courtesy of StockCharts.com

Some months are more prosperous than others. During the 2020 health crisis, PermRock suspended its payout for five months.

Keeping up to date on commodity prices and the opinions of the Federal Reserve and other economic indicators can also give you an idea on where PRT stock is going.

Oil prices are down from their March 2022 high of $130.00 per barrel, now trading at around $67.00 per barrel. Lower oil prices have been putting pressure on oil and gas stocks. And PermRock is no exception, with units down 13.6% on an annual basis and down 3.2% in 2024.

Again, the outlook for crude remains solid. The U.S. Energy Information Administration (EIA) expects the Brent crude oil spot price to increase from its current level of around $71.00 per barrel to an average $78.00 per barrel in the first quarter of 2025 and an average $76.00 per barrel for the full year. (Source: “Short-Term Energy Outlook,” EIA, November 13, 2024.)

The Lowdown on PermRock Royalty Trust

PermRock Royalty Trust is a great oil and gas exploration and production company that rewards shareholders with a monthly dividend. The company has a big footprint in the Permian Basin and, thanks to historically strong demand for oil and gas, it has been able to provide its shareholders with an inflation-crushing monthly dividend.

This fact is not lost on Wall Street. BlackRock Inc is the biggest holder of PRT stock, followed by Certuity, LLC and Royal Bank of Canada.

Insider interest in PermRock is also high at 40.22%, which can often entice insiders to deliver better results.