10%-Yielding TSLX Stock Ideal for Income Seekers?

Sixth Street Specialty Lending to Benefit From Lower Interest Rates

Dear income-seeking readers, now’s a good time to pay attention to TSLX stock.

Interest rates are heading down, which will help companies that carry significant debt on their respective balance sheets. The Federal Reserve has begun making the cuts that will extend into 2025.

I think a lender like Sixth Street Specialty Lending Inc (NYSE:TSLX) will benefit from the lower interest rates as other companies ramp up their rate of borrowing.

This specialty finance company lends and invests in middle-market companies, which I think is a sweet spot for growth. Companies use the funds to drive organic growth, acquisitions, market or product expansion, and recapitalizations.

At the end of September, Sixth Street Specialty had 98.8% of its debt investments generating interest at floating rates. The interest income is used to pay out dividends.

At the end of September, Sixth Street Specialty Lending’s portfolio was valued at $3.44 billion. The company was invested in 1,121 portfolio companies, up from 1,052 portfolio companies a year earlier. (Source: “Sixth Street Specialty Lending, Inc. Reports Third Quarter 2024 Earnings Results; Declares a Fourth Quarter Base Dividend Per Share of $0.46, and a Third Quarter Supplemental Dividend Per Share of $0.05,” Sixth Street Specialty Lending Inc, November 5, 2024.)

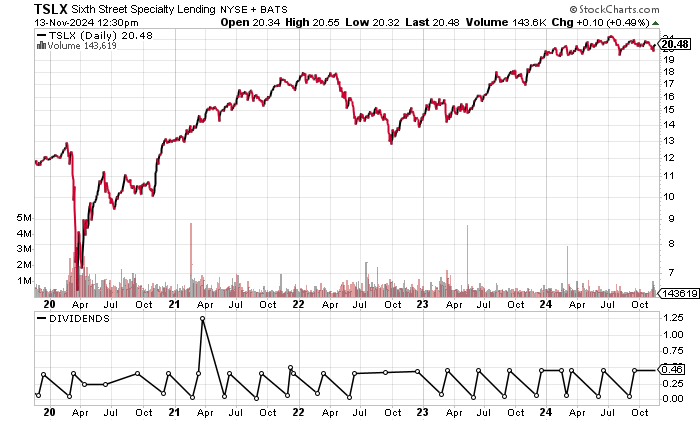

The price chart shows TSLX stock trading in a relatively narrow channel between $19.50 and $22.35 over the past year to November 13.

Currently hovering at $20.48, TSLX stock is just below its 50-day moving average (MA) of $20.61 and 200-day MA of $21.09. Should the 50-day MA move above the 200-day MA, it would signal a golden cross, which is a bullish technical crossover when the 50-day MA is above the 200-day MA. Next up is the record $24.74 achieved by the stock in November 2021.

Chart courtesy of StockCharts.com

Sixth Street Specialty Reports Third-Quarter Beat

The company refers to revenues as total investment income. Sixth Street Specialty Lending Inc grew total investment income by 66.4% from 2019 to the record $421.1 million in 2023.

Sixth Street’s total investment income experienced growth in three of the last four years, including a stellar 36.6% in 2023. It grew at a nice compound annual growth rate (CAGR) of 14.2% during this time period.

Going back to 2014, total investment income grew in nine of the 10 years, with the exception of 2019.

| Fiscal Year | Total Investment Income (Millions) | Growth |

| 2019 | $253.4 | N/A |

| 2020 | $266.9 | 5.3% |

| 2021 | $319.5 | 19.7% |

| 2022 | $323.7 | 1.3% |

| 2023 | $421.1 | 30.1% |

(Source: “Sixth Street Specialty Lending, Inc,” MarketWatch, last accessed November 13, 2024.)

In the third quarter ended September 30, 2024, the company’s total investment income was $119.2 million, up from $114.4 million in the same period in 2023. For the first three quarters of 2024, Sixth Street Specialty reported strong year-over-year growth of 12.6% to $358.8 million.

The total investment income growth rate is expected to slow compared to 2023. Analysts estimate that Sixth Street Specialty Lending will report slightly higher total investment income of $476.4 million in 2024, followed by a decline to $453.4 million in 2025. (Source: “Sixth Street Specialty Lending, Inc. (TSLX),” Yahoo! Finance, last accessed November 13, 2024.)

Its bottom line results are presented as net investment income, This metric has been consistently profitable as highlighted by growth in three of the last four years.

| Fiscal Year | Net Investment Income Per Share | Growth |

| 2019 | $2.34 | N/A |

| 2020 | $2.65 | 13.3% |

| 2021 | $2.79 | 5.4% |

| 2022 | $1.38 | -50.5% |

| 2023 | $2.61 | 88.7% |

(Source: MarketWatch, op. cit.)

In its third quarter, Sixth Street saw net investment income of $0.59 per share, $0.02 above the consensus. According to the company, the results continue to be impacted by the higher interest rates. (Source: Sixth Street Specialty Lending, Inc., op. cit.)

A key risk for Sixth Street Specialty is the $1.87 billion in total debt on the balance sheet and weak working capital at the end of September. (Source: Yahoo! Finance, op. cit.)

While the debt will need to be monitored, I don’t see any immediate issues at this time. The company’s net investment income has easily covered total interest.

TSLX Stock’s Dividend Streak at 11 Years & Counting

TSLX stock’s current forward yield of 10% is above the five-year average yield of 7.38%. While the higher yield is due to the share price weakness, Sixth Street’s dividends have been consistent at these levels for a few years.

Over the past year to the September payment of $0.46 per share, Sixth Street Specialty Lending paid out $2.11 per share in dividends.

TSLX stock’s dividend includes the base quarterly dividend and a smaller dividend paid out roughly two weeks prior. For example, the company paid $0.06 per share in dividends on August 30, followed by $0.46 per share on September 16. Similar payments were also made in May and June, February and March, and November and December in 2023.

Sixth Street Specialty recently announced a base dividend of $0.46 per share to be paid on December 16, followed by a third-quarter supplemental dividend of $0.05 per share payable December 20. The supplemental dividend is not set, so it has fluctuated over time.

The Lowdown on TSLX Stock

TSLX stock is ideal for the income investor who desires a steady dividend and an above-average dividend yield. The stock has a relatively narrow trading range, so the dividend yield should remain at the higher end as long as the dividend stays around the same level.