Orion Office REIT Stock: 10.28%-Yielder with High Risk/Reward

Return to Office Provides Tailwind

Today’s focus pick is Orion Office REIT stock.

When the COVID-19 pandemic first emerged in 2020, it led to a massive shift of workers from the corporate office to the home. Now, while there are still hybrid work models that split a worker’s time between the home and office, we are seeing more companies moving their employees back to the office.

This reversion back to the office has resulted in a significant improvement in office occupancy rates, helping to drive major gains in office-focused real estate investment trust (REIT) units.

But there are still some office REITs that have largely missed the boat, which may interest contrarian income investors.

Take the case of Orion Office REIT Inc (NYSE:ONL), a small REIT that’s valued at a mere $217.6 million in market cap as of October 29. The company has some operational issues, but it could bounce back and reward investors with above-average returns.

Orion Office REIT stock only started trading in November 2021 after it was spun off from Realty Income Corp (NYSE:O).

Orion Office REIT invests in a diversified portfolio of high-quality office buildings located in suburban markets in the U.S. At the end of June, the portfolio comprised 69 property leases mainly to single tenants. (Source: “Investor Presentation August 2024,” Orion Office REIT Inc, last accessed October 29, 2024.)

The concern is the relatively low occupancy rate of 79.7%, which will need to be strengthened. To address this, Orion sold one vacant property for a gross sales price of $2.1 million in the second quarter. In addition, the REIT has agreements to divest one operating property and six non-operating properties for $39.0 million. I like these moves by Orion to rid itself of lower-quality buildings. (Source: “Orion Office REIT Inc. Announces Second Quarter 2024 Results, “ Orion Office REIT Inc, August 8, 2024.)

The uncertainty in the business is reflected in the share price. Orion Office REIT stock is trading just north of its historical low of $3.01 and well off its 52-week high of $6.22.

ONL stock traded as high as $32.25 in November 2021 following its initial public offering (IPO). My view is that, if the company can improve its metrics, we could see a corresponding jump in Orion Office REIT stock.

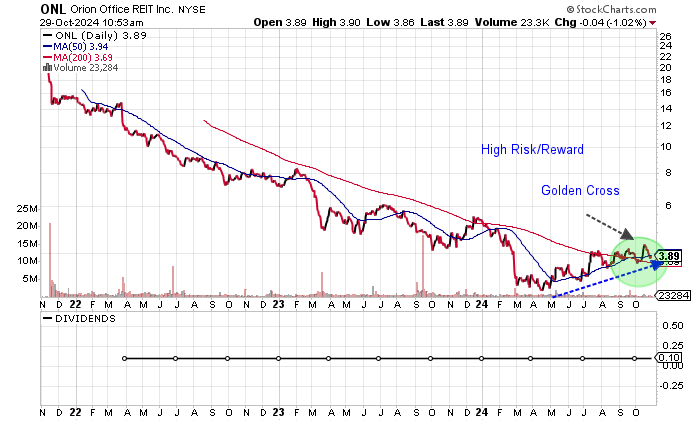

The chart shows an encouraging technical signal, with the 50-day moving average (MA) of $3.99 above the 200-day MA of $3.87. If Orion Office REIT stock can hold, we could see an upside breakout on this bullish golden cross formation.

Chart courtesy of StockCharts.com

A Work-in-Progress That Could Pay Off

Orion’s revenues jumped in 2021, followed by a record $208.1 million in 2022 as workers began to return to the office. In 2023, the REIT reported a 6.3% dip that drove Orion Office REIT stock down.

| Fiscal Year | Revenues (Millions) | Growth |

| 2020 | $53.5 | N/A |

| 2021 | $79.7 | 49.0% |

| 2022 | $208.1 | 161.1% |

| 2023 | $195.0 | -6.3% |

(Source: “Orion Office REIT Inc (ONL),” Yahoo! Finance, last accessed October 29, 2024.)

To be successful, Orion Office REIT will need to address the revenue decline that looks to continue into 2024.

The company’s revenues fell to $40.1 million in the second quarter versus $52.0 million for the second quarter in 2023. Its first-half revenues of $87.0 million were down 14.7% year over year. Clearly, Orion Office REIT continues to face issues with its occupancy rate. (Source: Yahoo! Finance, op. cit.)

The company is also struggling with contracting gross margins, so this will need to be addressed.

| Fiscal Year | Gross Margins |

| 2020 | 89.2% |

| 2021 | 73.2% |

| 2022 | 69.6% |

| 2023 | 68.5% |

On the bottom line, Orion has yet to deliver generally accepted accounting principles (GAAP) income. A bright spot was that the GAAP loss narrowed in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2020 | -$0.03 | -112.4% |

| 2021 | -$0.84 | -2,400.3% |

| 2022 | -$1.72 | -105.3% |

| 2023 | -$1.02 | 41.0% |

(Source: Yahoo! Finance, op. cit.)

The REIT reported a GAAP loss of $0.60 per diluted share in the second quarter, which was worse than the comparative loss of $0.28 per diluted share in the year-earlier second quarter.

While there are GAAP losses, a REIT looks at funds from operations (FFO) as a measure of its performance, rather than the GAAP result. In the case of Orion Office REIT, its core FFO were $0.25 per share in the second quarter versus $0.48 per share a year earlier.

While the results were down versus 2023, this helps the company to pay out dividends.

The funds statement points to four straight years of positive free cash flow (FCF).

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | $41.9 | N/A |

| 2021 | $46.2 | 10.3% |

| 2022 | $102.6 | 122.1% |

| 2023 | $70.6 | -31.2% |

(Source: Yahoo! Finance, op. cit.)

In 2023, the FCF helped support Orion Office REIT stock’s dividend payments, as did the company buying back $5.1 million in common stock and paying down a net $59.0 million in debt. (Source: Yahoo! Finance, op. cit.)

At the end of June. Orion held cash of $24.2 million and total debt of $471.0 million. The working capital is strong, and the total debt to equity of 57.6% is manageable. (Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a reasonable reading of 5.0 for Orion Office REIT, which is just above the midpoint of the 1.0 to 9.0 range.

Dividend Looks Manageable

Orion Office REIT stock currently pays a steady $0.10-per-share quarterly dividend in March, June, September, and December. This has been the case since the initial $0.10-per-share dividend in March 2022 following the IPO in November 2021.

Based on the second-quarter core FFO of $0.25 per share, the REIT’s $0.10 dividend implies an easily manageable payout ratio of 40%. Moreover, the dividend coverage ratio of 3.3 times supports continued dividend payments.

The Lowdown on Orion Office REIT Stock

Institutional ownership is relatively strong for such a small company. Around 309 institutions hold a 63.4% stake of the outstanding shares. (Source: Yahoo! Finance, op. cit.)

Orion Office REIT Inc is clearly a work-in-progress that needs to drive the occupancy rate in order to lift revenues, FFO, and FCF. This would help support the current dividend and the potential for higher dividends along with share price appreciation potential.