Dorchester Minerals Stock Yielding 10.58%

DMLP Stock Up 80.2% Over Last 5 Years

Domestic oil prices broke above $70.00 a barrel on the escalation in the Middle East. Add in the hurricane impact on Florida’s gulf coast and you have supportive factors.

The spot price of West Texas Intermediate oil took out $81.00 a barrel in mid-August before retrenching back down to the $70.00-handle.

For the energy sector, strong oil prices are generally bullish for the upstream segment, including companies like Dorchester Minerals LP (NASDAQ:DMLP).

The company was formed in January 2003 with the combination of Dorchester Hugoton, Ltd., Republic Royalty Company, L.P., and Spinnaker Royalty Company, L.P.

Dorchester Minerals owns producing and non-producing crude oil and natural gas mineral, royalty, overriding royalty, net profits, and leasehold interests across 28 states. (Source: “Investor Relations,” Dorchester Minerals LP, last accessed October 10, 2024.)

The company also recently closed two previously announced acquisitions of mineral, royalty, and overriding royalty interests. (Source: “Dorchester Minerals, L.P. Announces Two Acquisitions of Mineral, Royalty and Overriding Royalty Interests,” Dorchester Minerals LP, September 30, 2024.)

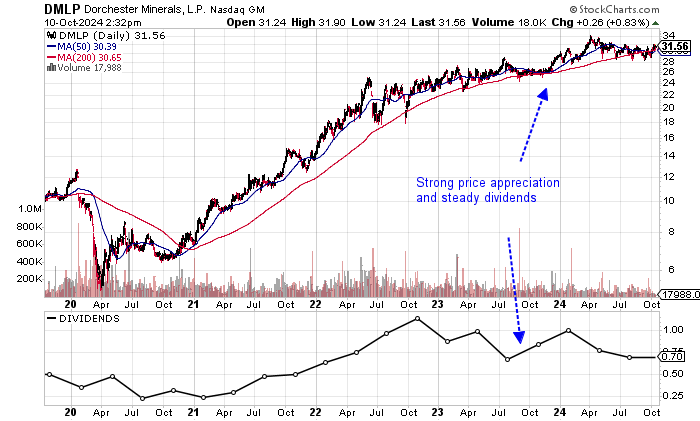

Looking at the chart, you’ll see that Dorchester Minerals stock is flat this year. However, if we add in the dividends, the return is seven percent based on a share price of $31.56, which is just below DMLP stock’s 52-week high of $35.74.

Technically, Dorchester Minerals stock is hovering around its 200-day moving average (MA) of $31.58 and sitting comfortably above its 50-day MA of $30.36.

Watch for DMLP’s 50-day MA to take a run at its 200-day MA. If this happens, Dorchester Minerals stock would move into a bullish golden cross, potentially creating additional gains.

Chart courtesy of StockCharts.com

Revenues Up 108% Since 2019

Dorchester Minerals LP delivered exceptional revenue growth in 2021 and 2022 coming out of the 2020 pandemic. Revenues in 2022 were helped by the higher energy prices before slightly stalling in 2023 as oil and natural gas prices fell.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $78.8 | N/A |

| 2020 | $46.9 | -49.5% |

| 2021 | $93.4 | 93.4% |

| 2022 | $170.8 | 82.8% |

| 2023 | $163.8 | -4.1% |

(Source: “Dorchester Minerals, L.P.,” MarketWatch, last accessed October 10, 2024.)

Dorchester Minerals produced strong gross margins of over 90% in the last five years.

| Fiscal Year | Gross Margins |

| 2019 | 95.2% |

| 2020 | 91.4% |

| 2021 | 95.6% |

| 2022 | 96.2% |

| 2023 | 95.9% |

The bottom line shows a profitable company. Generally accepted accounting principles (GAAP) profits jumped in 2021 and 2022 on higher energy prices and economic recovery. Dorchester’s profits slipped in 2023, but $2.85 per diluted share was its second highest on record.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.50 | -7.1% |

| 2020 | $0.61 | -59.2% |

| 2021 | $1.94 | 217.1% |

| 2022 | $3.35 | 73.2% |

| 2023 | $2.85 | -15.1% |

(Source: MarketWatch, op. cit.)

Dorchester Minerals has also been consistent in delivering positive free cash flow (FCF), including the two highest on record in 2022 and 2023. The strong FCF allows for dividends and capital expenditures.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $66.1 | 5.8% |

| 2020 | $39.4 | -40.4% |

| 2021 | $70.3 | 78.4% |

| 2022 | $147.1 | 109.2% |

| 2023 | $139.8 | -5.0% |

(Source: MarketWatch, op. cit.)

The balance sheet is healthy, with only $1.2 million in total debt and $35.2 million in cash along with strong working capital. (Source: “Dorchester Minerals, L.P. (DMLP),” Yahoo! Finance, last accessed October 10, 2024.)

The low debt level means minimal interest obligations that are easily covered by high earnings before interest and taxes (EBIT).

| Fiscal Year | EBIT (Millions) |

| 2020 | $21.9 |

| 2021 | $70.2 |

| 2022 | $130.6 |

| 2023 | $114.1 |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a reasonable reading of 5.0, which is just above the midpoint of the 1.0 to 9.0 range.

Dorchester Minerals Stock: Dividends Are Safe

Dorchester Minerals has paid dividends in 22 consecutive years, albeit what it pays out has not been consistent.

For example, the trailing four quarterly dividend payments totaled $3.34 per share, representing a trailing dividend yield of 10.58% based on a share price of $31.56.

The most recent dividend was $0.702 per share, paid in July 2024. Prior to this, the quarterly dividend was $0.782 per share in April 2024, $1.00 per share in January 2024, and $0.845 per share in October 2023. (Source: Yahoo! Finance, op. cit.)

While Dorchester Minerals stock’s quarterly dividends vary, income investors have received a regular high-yielding quarterly dividend. Over the past 10 years, the average dividend yield was 15.1%. This means an investor in Dorchester Minerals stock has received a really nice dividend return for each dollar invested.

| Metric | Value |

| Dividend Streak | 22 years |

| Dividend 7-Year CAGR | 18.9% |

| 3-Year Average Dividend Yield | 13.4% |

| 10-Year Average Dividend Yield | 15.1% |

The Lowdown on Dorchester Minerals Stock

For income investors, the high dividend yield has been attractive. Plus, income investors have also seen their shares appreciate 80.2% over the past five years.

Dorchester Minerals stock’s strong return on equity of 68.4% shows a well-managed company that you can count on for dividends.