FLEX LNG Stock: An 11.27%-Yielder for Contrarians

Maritime LNG Shipper Up 167% Over Last 5 Years

Today’s we’re taking another look at FLEX LNG stock.

Liquefied natural gas (LNG) is natural gas that is cooled down to liquid form for easier transportation. The benefit is that LNG can be transported without the need for complicated and expensive pressurized storage transport solutions.

Given this, I like FLEX LNG Ltd (NYSE:FLNG). The $1.4-billion-market-cap company specializes in the transport of LNG via its fleet of 13 modern vessels.

Moreover there is some revenue certainty, as the company has long-term fixed-rate charter contracts in place for 11 of its vessels. Another vessel is reserved for variable usage. (Source: “Company Profile,” FLEX LNG Ltd, last accessed October 8, 2024.)

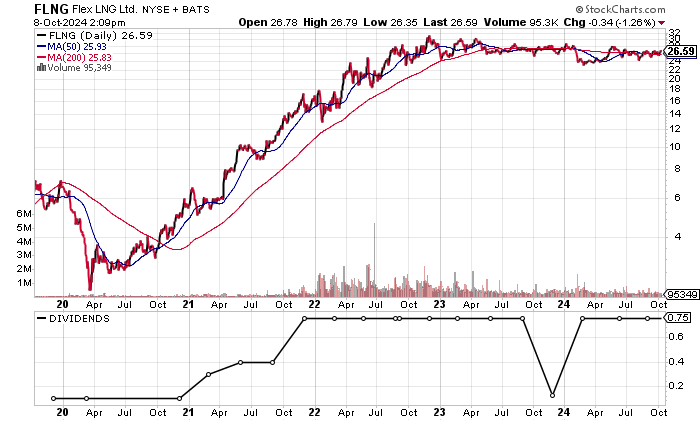

The one-year chart shows indecisive trading in FLNG stock. The stock declined 8.5% this year and 11.9% over the past year to October 8. For longer-term investors, it has been a different story, as FLEX LNG stock has rewarded investors with a 167% gain over the past five years.

Chart courtesy of StockCharts.com

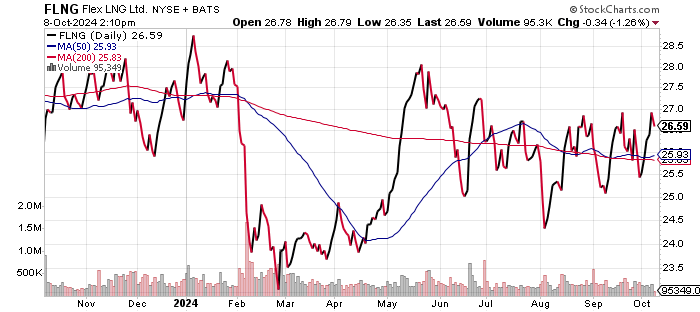

FLEX LNG stock is currently trading just above its 50-day moving average (MA) of $26.25, but is below its 200-day MA of $27.05.

Technically, if FLNG can hold its 50-day MA, we could see a test of the 200-day MA and a breakout above $30.00.

Chart courtesy of StockCharts.com

Steady Revenue & Free Cash Flow

FLEX LNG Ltd grew its revenues 209.2% from 2019 to the record $371.0 million in 2023.

The company’s revenues grew in each of the last five years, resulting in a compound annual growth rate (CAGR) of 27.5% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $120.0 | 55.4% |

| 2020 | $164.5 | 37.1% |

| 2021 | $343.4 | 108.8% |

| 2022 | $347.9 | 1.3% |

| 2023 | $371.0 | 6.6% |

(Source: “FLEX LNG Ltd,” MarketWatch, last accessed October 8, 2024.)

In the first half of 2024, FLEX LNG delivered revenues of $174.9 million, down 2.4% year over year, but up 10.2% for the first half of 2022. Based on the results to date, the company will likely report flat to slightly down revenues for 2024.

To drive growth, FLEX LNG will need to expand its fleet and/or increase the shipping fees. Expansion should not be an issue given the positive free cash flow (FCF) and profitability. The company also recently raised additional financing credit.

FLEX LNG Ltd delivers extremely strong gross margins, with 80%-plus readings over the last three years.

| Fiscal Year | Gross Margins |

| 2019 | 76.1% |

| 2020 | 75.3% |

| 2021 | 81.2% |

| 2022 | 81.0% |

| 2023 | 81.1% |

The gross margin expansion helped FLEX LNG deliver higher generally accepted accounting principles (GAAP) profitability in the post-pandemic years from 2021 to 2023. GAAP earnings of $1.02 per diluted share in the first half are on par with the $1.03 per diluted share in the first half of 2022.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.31 | 6.9% |

| 2020 | $0.15 | -51.7% |

| 2021 | $3.04 | 1,929.2% |

| 2022 | $3.51 | 15.5% |

| 2023 | $2.22 | -36.8% |

(Source: MarketWatch, op. cit.)

On an adjusted basis, analysts expect FLEX LNG Ltd to earn $2.47 per diluted share in 2024 versus $2.52 per diluted share in 2023. Earnings per share are expected to be $2.49 in 2025. (Source: MarketWatch, op. cit.)

The funds statement shows two straight years of positive FCF in 2022 and 2023. FLEX LNG could report higher FCF in 2024 based on the first-half FCF of $82.3 million, compared to $74.6 million for the same period in 2022. This is positive and should allow the company to continue with dividends as well as fleet expansion if desired.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | -$245.0 | N/A |

| 2020 | -$619.6 | 152.9% |

| 2021 | -$54.4 | -91.2% |

| 2022 | $208.9 | -483.7% |

| 2023 | $175.0 | -16.2% |

(Source: MarketWatch, op. cit.)

The company’s balance sheet shows $1.76 billion in total debt and $370.2 million in cash at the end of June. (Source: “FLEX LNG Ltd (FLNG),” Yahoo! Finance, last accessed July 11, 2024.)

The long-term debt to equity ratio improved to 93% in 2023 versus 112.6% in 2022. The five-year average was 85.4% from 2019 to 2023.

FLEX LNG has consistently covered its interest payments via higher earnings before interest and taxes (EBIT). The interest coverage ratio is manageable.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $50.0 | $41.8 | 1.20X |

| 2021 | $218.5 | $56.2 | 3.89X |

| 2022 | $264.7 | $76.6 | 3.46X |

| 2023 | $228.8 | $108.7 | 2.10X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows that FLEX has a reasonable reading of 5.0, which is just above the midpoint of the 1.0 to 9.0 range.

Regular Dividend Boosted with Special Dividends

FLEX LNG stock’s quarterly dividend of $0.75 per share has been in place since December 2021, compared to $0.40 per share in September 2021. (Source: Yahoo! Finance, op. cit.)

Occasionally, the company will boost its regular quarterly payment via a special dividend. This included $0.125 per share in November 2023, $0.25 in February 2023, and $0.50 in September 2022.

FLEX LNG stock’s forward yield of 11.27% is attractive and largely due to the price weakness over the past year. Over the past 10 years, the average dividend yield was 5.1%.

A rally in FLNG stock would result in a lower yield ,but a shareholder would partake in some capital appreciation.

The uncertainty is whether the company’s quarterly dividend is sustainable given the high payout ratio. FLEX LNG Ltd accesses its profits and other surplus cash to make its dividend decision. This is the risk, but there have been no announced changes so far.

| Metric | Value |

| Dividend Streak | 6 years |

| 10-Year Average Dividend Yield | 5.1% |

| Dividend Coverage Ratio | 1.4X |

The Lowdown on FLEX LNG Stock

FLEX LNG is pretty unique in that insiders own more of the company than institutions do.

Institutional ownership accounts for 22.8% of the outstanding shares, while insider interest is extremely high at 43.1%.

This share structure suggests that insiders are more motivated to deliver. (Source: Yahoo! Finance, op. cit.)

In my opinion, income investors who want an above-average dividend yield along with the opportunity for capital appreciation should look at FLEX LNG stock.