Community Healthcare Stock Has Raised Payout Every Quarter Since 2015

Undervalued CHCT Stock Has 37% Upside

Real estate investment trusts (REITs) have been having a rough go within the high-interest-rate environment. Higher interest rates translate into higher borrowing costs and lower profit margins, which can impact both the share price and dividends. But with the Federal Reserve finally starting to cut interest rates, the outlook for REITs is looking up.

Then there are REITs like Community Healthcare Trust Inc (NYSE:CHCT). Health-care REITs have been dealing with both the high-interest rate environment and the fallout from the 2020 health crisis.

During the pandemic, health-care facilities were forced to deal with lower occupancy rates and higher costs associated with evolving protocols to limit the spread of COVID-19. Even health-care REITs that weathered the health crisis were negatively impacted, simply by association.

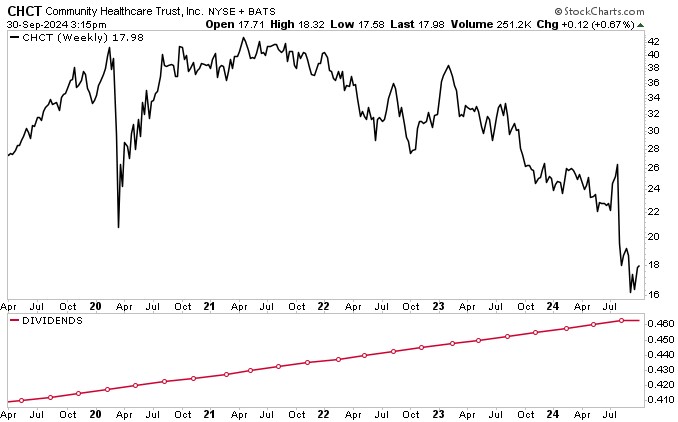

Community Healthcare Trust saw its stock take a big hit during the opening days of the pandemic, cratering more than 50%. But Community Healthcare stock rebounded fairly quickly, erasing those losses by October 2020. In May 2021, CHCT stock hit a new all-time-record intraday high of $43.57.

Since then, though, Community Healthcare stock has been trending steadily lower; it’s currently hovering near its April 2020 pandemic lows at $18.28.

Despite the big 27% year-to-date decline in its share price, the outlook remains bright for Community Healthcare stock. Wall Street analysts expect the stock to rally anywhere from 14% to 37% over the next 12 months. The high 12-month share price projection would put Community Healthcare stock at $25.00 per share, which is still well below its $43.57 record high.

For patient, contrarian investors, Community Healthcare stock is currently trading in an attractive range. For income investors, the low share price and volatility haven’t impacted the stock’s dividend at all. In fact, Community Healthcare Trust has raised its payout every quarter since its inception in 2015.

Chart courtesy of StockCharts.com

About Community Healthcare Trust Inc

Community Healthcare Trust is a health-care REIT that owns and acquires real estate property that is leased to hospital, doctors, health-care systems, or other health-care service providers. (Source: “Portfolio Overview,” Community Healthcare Trust Inc, last accessed September 30, 2024.)

The REIT’s $1.1-billion portfolio consists of 198 properties across 35 states, covering 4.46 million square feet. Its biggest holdings are in Texas, which accounts for 17% of its portfolio, followed by Illinois (10.9%), Ohio (10.3%), and Pennsylvania (5.6%).

Community Healthcare’s properties are 92.6% occupied, with lease expirations ranging from 2024 through 2044. By property type, medical office buildings account for 39.1% of the portfolio, followed by the inpatient rehabilitation facility (19.2%), acute inpatient behavioral (12.9%), and specialty center (10.2%) categories.

No single tenant accounts for more than 10.7% of total annualized rent.

Earnings Outlook Improving

For the second quarter ended June 30, 2024, Community Healthcare reported a net loss of $10.4 million, or a loss of $0.42 per share. That’s down from second-quarter 2023 earnings of $6.5 million, or $0.24 per share. (Source: “Community Healthcare Trust Announces Results for the Three Months Ended June 30, 2024,” Community Healthcare Trust Inc, July 30, 2024.)

The REIT’s second-quarter revenue was $27.51 million, down slightly from $27.81 million in the same period last year. Year-to-date revenue was up 3.3% at $56.8 million.

Its funds from operations (FFO) came in at $11.6 million, or $0.43 per share, down from $15.8 million, or $0.62 per share in the same prior year period. Adjusted FFO (AFFO) was $0.53 per share, down from $0.63 per share last year.

According to Community Healthcare, the decline in FFO and AFFO was largely a result of one client with six leases that had trouble keeping up with its payments. This resulted in a reduction in FFO per share of $0.12 and AFFO per share of $0.09.

One troubled client does not define Community Healthcare.

For example, during the quarter, the REIT acquired one inpatient rehabilitation facility for $23.5 million. The 38,000-square-foot property is 100% leased to a tenant with a lease expiration in 2039.

Subsequent to the end of the second quarter, Community Healthcare Trust acquired a medical office building for $6.2 million. The property is 100% leased with a lease expiration in 2027.

Community Healthcare also has seven properties under definitive purchase agreements, to be acquired after completion and occupancy for an aggregate purchase price of approximately $169.5 million.

The REIT anticipates closing on one of these properties in the fourth quarter of 2024, with the remainder closing throughout 2025, 2026 and 2027.

Management didn’t provide any guidance. However, after Community Healthcare reported 2023 earnings of $0.02 per share, Wall Street analysts expect it to report a loss of $0.11 in 2024, followed by earnings of $0.45 per share in 2025. (Source: “Community Healthcare Trust Incorporated (CHCT),” Yahoo! Finance, last accessed September 30, 2024.)

The REIT’s revenue is expected to rise 4.2% from $112.8 million in 2023 to $117.57 in 2024 and a further 9.4% in 2025 to $128.6 million.

Community Healthcare Stock: Quarterly Dividend Payout Hiked Again

Returning value to shareholders is an important part of Community Healthcare Trust’s business. And not just because it legally has to distribute at least 90% of its taxable earnings to shareholders in the form of a dividend. (Source: “Consistent Dividend Growth,” Community Healthcare Trust Inc, last accessed September 30, 2024.)

In addition to paying a reliable dividend, the REIT has actually increased its payout every quarter since its inception in 2015. Even when Community Healthcare stock was decimated during the 2020 health crisis, it gave its shareholders a raise every quarter.

Most recently, in July, Community Healthcare’s board declared a quarterly cash dividend of $0.4625 per share, or $1.85 per share, for an annual forward dividend yield of 10.37%.

The $0.4625 payout represents a slight increase over the $0.46 per share paid out in the first quarter of 2024 and a 2.2% increase over the $0.4525 paid out in the same period last year. If history is any indicator, Community Healthcare stock’s third-quarter dividend payout will be $0.465 per share.

The Lowdown on Community Healthcare Stock

Community Healthcare Trust Inc is a REIT with a growing, diversified portfolio of health-care properties across 35 states. For the most part, its share price has been held back by higher interest rates.

The fact is, the company’s annual revenue has grown 132% over the last five years (2018-2023), net income has increased for three of the past five years, and free cash flow has grown in four of the last five years.

This is probably why institutional ownership stands at a whopping 92.3%, with BlackRock, Inc. being the largest holder at 16.63%.

Community Healthcare stock may be down 34.5% over the last 12 months, but over that period of time, BlackRock’s 4.67 million shares allowed it to collect $8.63 million in dividends.

Most individual investors can’t build up that kind of position, but they can certainly take advantage of Community Healthcare stock’s reliably growing quarterly dividend while they wait for CHCT to rebound.