International Seaways Stock: A 11.7%-Yielder with Good Upside

A Juicy Yield for This Maritime Shipper

Today’s focus pick is International Seaways stock.

Countries around the world are always on the prowl for energy and chemicals. The transport of these key commodities is carried out via pipes, railways, and roads.

Let’s not forget ships; often the product has to be moved across vast stretches of water, so this mode of transportation will continue to be critical.

A mid-cap player in the maritime transport space is International Seaways Inc (NYSE:INSW). It currently owns and operates a fleet of 82 vessels that transport crude, product, and chemicals to ports around the world. (Source: “Company Profile,” International Seaways Inc, last accessed September 24, 2024.)

International Seaways stock has rewarded income investors with a 12.7% gain so far this year, which edges out the 12.1% move by the Dow Jones Industrial Average. Better yet, the stock pays out a nice forward dividend yield of 11.7%.

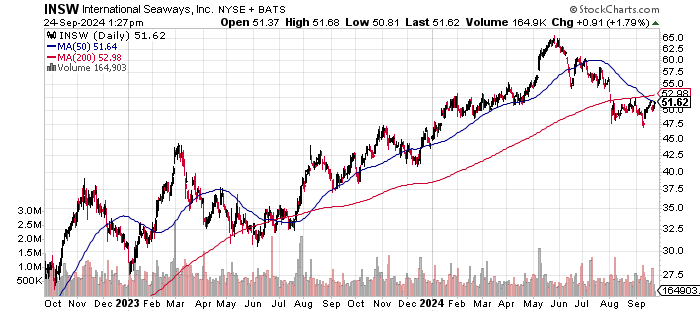

A look at the chart shows INSW stock huddling just below its 50-day moving average (MA) of $51.80 and 200-day MA of $53.50. A break above could see the stock move towards the 13-week high of $60.99 and 52-week high of $65.94.

Chart courtesy of StockCharts.

Flat Second Quarter But Fundamentals Remain Strong

International Seaways Inc reached a milestone in 2023 after breaking above the $1.0-billion threshold in revenues.

Revenues increased 192.9% from 2019 to the record $1.07 billion in 2023. From the five-year low in 2021, revenues surged 289.8%. International Seaways stock advanced around 240% during the same period.

| Fiscal Year | Revenues | Growth |

| 2019 | $366.18 million | N/A |

| 2020 | $421.65 million | 15.1% |

| 2021 | $274.97 million | -34.8% |

| 2022 | $865.51 million | 214.8% |

| 2023 | $1.1 billion | 23.8% |

(Source: “International Seaways, Inc.,” MarketWatch, last accessed September 24, 2024.)

But after a strong revenue ramp-up, a company’s growth tends to slow and become more uncertain when there’s a potential global slowdown brewing.

Analysts estimate that International Seaways’ revenues will drop 1.4% to $1.06 billion in 2024, followed by a 3.0% decline to $1.02 billion in 2025. There is a high estimate of $1.3 billion for 2025. My view is that the actual results will largely be contingent on the global economy. (Source: “International Seaways, Inc. (INSW),” Yahoo! Finance, last accessed September 24, 2024.)

So far in 2024, the situation is playing out as expected. In the second quarter, revenues were $257.4 million versus $292.2 million for the comparative quarter in 2023. The revenue breakout consisted of revenues from crude transport at $125.4 million and product transport at $132.0 million. (Source: “International Seaways Reports Second Quarter 2024 Results,” International Seaways Inc, August 7, 2024.)

In the first half of 2024, International Seaways generated revenues of $531.8 million versus $579.3 million for the same period in 2023.

Moving to the bottom line, you’ll notice that there was a return to generally accepted accounting principles (GAAP) profitability in 2022 and 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.03 | N/A |

| 2020 | -$0.19 | 578.6% |

| 2021 | -$3.48 | -1,731.6% |

| 2022 | $7.78 | 323.6% |

| 2023 | $11.26 | 44.7% |

(Source: MarketWatch, op. cit.)

Adjusting for non-recurring expenses, International Seaways reported an adjusted $10.62 per diluted share in 2023. Analysts predict that this will fall slightly to $10.27 per diluted share in 2024, but rebound to $10.67 per diluted share in 2025. There are high estimates of $12.24 and $18.37, respectively, for 2024 and 2025. (Source: Yahoo! Finance, op. cit.)

For the second quarter, GAAP profits came in at $2.91 per diluted share versus $3.11 per diluted share in the second quarter of 2023. In the first half, the company’s GAAP profits of $5.83 per diluted share were below the comparative $6.59 per diluted share. (Source: International Seaways Inc, op. cit.)

On an adjusted basis, International Seaways reported $2.37 per diluted share, which was 5.6% below the consensus $2.51 per diluted share. It was the first miss in four quarters.

A big plus is that International Seaways continues to be a free cash flow (FCF) machine. FCF came in at a record $481.8 million in 2023, up 181.6% versus 2022. The strong FCF allows for steady dividends along with funds for capital expenditures, debt reduction, and share buybacks.

So far in 2024, International Seaways’ FCF was $129.3 million in the first quarter and -$8.6 million in the second quarter.

“We maintained strong momentum in the second quarter, drawing on Seaway’s substantial cash flows to continue to execute the Company’s balanced capital allocation strategy for the benefit of shareholders,” commented Lois K. Zabrocky, the company’s president and chief executive officer. (Source: International Seaways Inc, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $50.3 | N/A |

| 2020 | $165.6 | 229.2% |

| 2021 | -$155.2 | -193.7% |

| 2022 | $171.1 | 210.3% |

| 2023 | $481.8 | 181.6% |

(Source: MarketWatch, op. cit.)

International Seaways Stock: Reasonable Payout Ratio Supports Dividend Increase

International Seaways stock has an attractive forward dividend yield of 11.7% based on the $1.50 paid out in September. The payout ratio is roughly 53.3% based on GAAP profits in 2023. This is reasonable and allows for further increases.

The company has paid out regular and special dividends over the last three years. So far in 2024, International Seaways stock has paid $4.57 per share in dividends. Over the last 12 months, dividends amounted to $5.82 per share. This is well up from the $4.31 in total dividends in 2023, $1.42 per share in 2022, and $1.36 per share in 2021. (Source: Yahoo! Finance, op. cit.)

Based on the profitability and FCF, I expect the company to continue to raise its dividend.

| Metric | Value |

| Dividend Growth Streak | 4 years |

| Dividend Streak | 5 years |

| Dividend 3-Year CAGR | 197% |

| 3-Year Average Dividend Yield | 6.5% |

| Dividend Coverage Ratio | 2.0X |

The Lowdown on International Seaways Stock

Institutional ownership in International Seaways stock is relatively strong and rising, with 394 institutions holding 71.9% of the outstanding shares. Insider interest is high at 23% of the shares. This incentivizes company insiders to deliver strong results. (Source: Yahoo! Finance, op. cit.)

For income investors, International Seaways stock has provided an ideal combination of high dividend yields and capital appreciation.