BSM Stock: Outlook for 10%-Yielding Energy Play Remains Robust

Reasons to Be Bullish on Black Stone Minerals Stock

What a difference a few months can make. Earlier this year, energy was one of the better performing sectors. Fast forward to the middle of September, and energy has the second worst year-to-date performance (+1.48%) and worst one-year performance (-4.59%).

Near-term and cyclical gyrations aside, the long-term demand for oil and gas is why it’s good to keep energy plays like Black Stone Minerals LP (NYSE:BSM) on your radar.

Why?

Calls for the end of fossil fuels and new oil and gas production are greatly exaggerated.

Firstly, the world still runs on oil, so suspending oil exploration and production would disrupt the entire global economy.

Secondly, the global demand for oil is greater than the current supply. And demand for oil and gas is only going up. World demand for oil is expected to increase from 96.5 million barrels of oil per day (Mb/d) to 97.4 Mb/d by 2050. World demand for natural gas, meanwhile, is expected to increase from 4,159 billion cubic meters (bcm) in 2022 to 4,179 bcm in 2050. (Source: “Oil and gas in the global economy through 2050,” Canadian Energy Centre, March 26, 2024.)

This goes counter to many pessimistic claims. In 2021, the International Energy Agency said that if countries are serious about the climate crisis, there should be no new investments in oil, gas, or coal “from now – from this year.” (Source: “No new oil, gas or coal development if world is to reach net zero by 2050, says world energy body,” The Guardian, May 18, 2023.)

Then of course there’s António Gueterres, the secretary-general of the United Nations, who said that oil-producing countries are “dangerous radicals” for increasing fossil fuel production. (Source: “Antonio Guterres (@antonioguterres), “Climate activists are sometimes depicted as dangerous radicals,” X, April 5, 2022, 4:46 AM.)

On the other side of the aisle is former President Donald Trump, who wants to promote greater domestic energy production and has promised to “drill, baby, drill.” (Source: “‘Drill, baby, drill’ – At the RNC as Trump charmed crowd,” BBC, July 19, 2024.)

The point is, fossil fuels aren’t going away and the pressure on the energy industry over the coming decades will only intensify.

About BSM Stock

Black Stone Minerals is the largest pure-play oil and gas mineral and royalty owner in the U.S. with over 20 million mineral and royalty acres encompassing interests in over 40 states. (Source: “KeyBanc Capital Markets” Black Stone Minerals LP, March 25, 2024.)

The company’s positions are held in 60 productive basins in both established and emerging plays, but its highest-concentration positions are in Permian Basin, Haynesville Shale, and Bakken Formation.

As a minerals company, Black Stone Minerals has exposure to oil and gas, but without the hassle of operating costs or capital spending requirements. And thanks to its scale, the company has opportunities to partner with operators to initiate or accelerate drilling and directly benefits from their technology advancements, which helps increase recovery and well economics.

There are plenty of oil and gas reserves to keep its customers happy though. Black Stone Minerals’ estimated proved oil and natural gas reserves at year-end 2023 were 64.5 million barrels of oil equivalent (MMBOE), up one percent from 64.1 MMBOE at the end of 2022 and up 7.8% from 59.8 MMBOE at year-end 2021.

Strong Balance Sheet & Zero Debt

For the second quarter ended June 30, 2024, Black Stone announced mineral and royalty production of 38.2 thousand barrels of oil equivalent per day (MBOE/D), up slightly from $38.1 MBOE/D in the first quarter and up 13.6% over the 33.6 MBOE/D in the second quarter of 2023. (Source: “Black Stone Minerals, L.P. Reports Second Quarter Results,” Black Stone Minerals LP, August 5, 2024.)

Total reported production averaged 40.4 MBOE/D, compared to 40.3 MBOE/D for the first quarter of 2024 and 36.2 MBOE/D for the second quarter of 2023.

The company’s average realized price per barrel of oil equivalent (BOE) was $30.01 for the second quarter of 2024, down three percent from $30.87 per BOE in the first quarter of 2024 and a four-percent decrease from $31.35 in the second quarter of 2023.

Black Stone reported second-quarter net income of $68.63 million, compared to $63.9 million in the first quarter and $78.3 million in the second quarter of 2023.

Distributable cash flow was $92.5 million. In the first quarter of 2024, the company reported distributable cash flow of $96.4 million and $103.6 million in the same prior year period.

Black Stone ended the quarter with zero debt and $26.7 million in cash. At the beginning of August, when it reported its second quarter financial results, it had $61.0 million in cash and zero debt.

Commenting on the results, Thomas L. Carter, Jr., Black Stone’s chairman, chief executive officer, and president, commented, “Throughout the second quarter we continued to add strategic, targeted mineral and royalty interest acquisitions that further enhance our existing assets and provide a long runway for development in combination with our organic growth strategy.”

BSM Stock: Second-Quarter Distribution of $0.375 Per Share

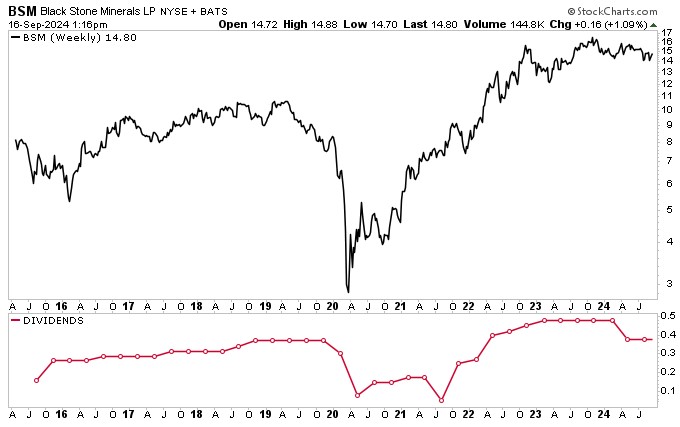

If you look at the chart below, you’ll see that Black Stone’s quarterly distribution fluctuates based on price and supply and demand metrics. But BSM stock’s payouts have been especially robust over the last three years.

In 2023, the company raised its cash distribution by nine percent to $1.90 per unit from $1.745 per share in 2022.

BSM stock currently provides a quarterly distribution of $0.375 per unit, or $1.50 on an annual basis, for a forward yield of 10.25%.

Black Stone has a long history of returning cash to equity holders. Over the last 25 years, BSM stock has returned around $4.7 billion to investors through distributions. It also didn’t miss a payout during the 2020 health crisis.

The BSM share price is a different matter right now. Its oil and gas production remains strong, but oil and gas prices are down, which is impacting the company’s earnings and dividend payout. And that’s not something shareholders are rewarding right now.

As of this writing (September 16), BSM stock is up just 0.6% year to date and is down 4.8% over the last year. The outlook for BSM stock isn’t exactly bullish, with analysts calling for shares to hit $15.00 over the next 12 months. That’s just $0.20 above current levels.

The bearish call is a result of a lowered global oil price forecast of $80.00 per barrel for the rest of 2024. Though, as history shows, those forecasts can change overnight. In February of this year, analysts had a 12-month share price forecast of $20.00 per share.

While shareholders wait to see how things play out in the energy sector, they can sit back and enjoy the company’s reliable, high-yield quarterly distribution.

Chart courtesy of StockCharts.com

The Lowdown on BSM Stock

Black Stone Minerals is the largest pure-play oil and gas mineral and royalty owner in the U.S. Because of its massive geographic diversity, it’s been able to generate serious cash flow, report strong financial results, and provide shareholders with a reliable quarterly distribution.

Thanks to its strong cash flow, the company has been able to reduce its outstanding debt from $394.0 million in the fourth quarter of 2019 to zero at the start of 2023. Even during the 2020 health crisis, Black Stone was able to reduce its outstanding debt from $388.0 in the first quarter of 2020 to $121.0 million by the end of the year.

It’s gone from strength to strength since then.