Global Net Lease Stock: 12.76%-Yielder for Contrarian Investors

Lower-Rate Environment to Aid GNL Stock

Today’s pick in the spotlight is Global Net Lease stock.

Real estate investment trust (REIT) structures have been negatively impacted by the rising interest rate environment over the last several years. It has been a tough time to hold REITs, but now it may be time to look at these high-yielding instruments as interest rates begin to decline.

A small-cap REIT that is worth a look is Global Net Lease Inc (NYSE:GNL), a REIT focused on commercial properties. The company acquires commercial properties that it then leases back to the occupants. These properties are situated in the U.S. as well as in Western and Northern Europe. (Source: “Corporate Overview,” Global Net Lease Inc, last accessed September 12, 2024.)

Global Net Lease currently owns approximately 1,277 properties covering 66.9 million square feet. An impressive 93% of the properties are leased, with a weighted average remaining lease term of 6.5 years. This translates into steady cash flow for years. (Source: “Portfolio Overview,” Global Net Lease Inc, last accessed September 12, 2024.)

For investors, the risks are the recent streak of losses and the significant debt obligations that will need to be addressed. In the meantime, income investors can be patient as Global Net Lease stock yields 12.76% and has paid dividends in 10 consecutive years.

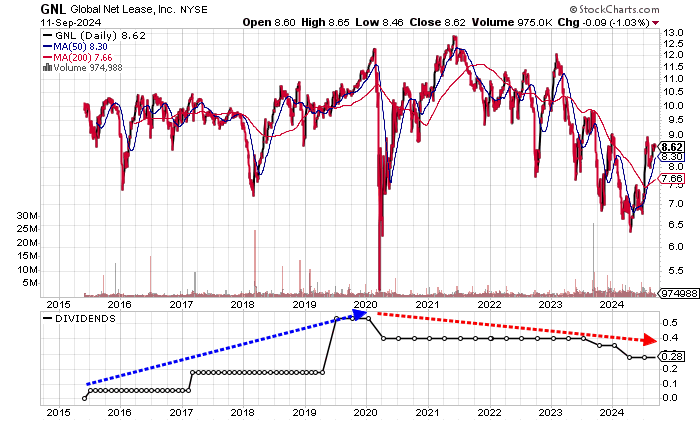

GNL stock is down 14.6% in 2024, but it has rallied 16.4% over the last three months to September 11. Global Net Lease stock is well below its 52-week highs of $11.45 in September 2023 and $30.21 in June 2015, so the upside could be massive.

Chart courtesy of StockCharts.com

Significant Second-Quarter Revenue Growth

Global Net Lease Inc grew its revenues by 70.2% from 2019 to the record $518.6 million in 2023, up an impressive 36.6% over 2022. Going back to 2014, revenues have grown in nine of the 10 years. This coincides with the 10-year dividend history.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $305.4 | N/A |

| 2020 | $330.1 | 8.1% |

| 2021 | $392.3 | 18.9% |

| 2022 | $379.6 | -3.3% |

| 2023 | $518.6 | 36.6% |

(Source: “Global Net Lease, Inc.,” MarketWatch, last accessed September 12, 2024.)

As we move forward, the revenue outlook is extremely optimistic.

Analysts estimate that Global Net Lease will grow revenues by a whopping 57% to $808.5 million in 2024, followed by a slight decline to $794.9 million in 2025. (Source: “Global Net Lease, Inc. (GNL),” Yahoo! Finance, last accessed September 12, 2024.)

So far, the REIT appears set to reach close to its consensus revenue estimate for 2024. The first half of 2024 saw revenues of $409.3 million, up 115.2% versus the same six months in 2023. The second-quarter revenues of $203.3 million represented a 112.1% year-over-year increase.

Global Net Lease Inc generates strong gross margins, including over 80% in 2021 and 2022. However, this was followed by a contraction in 2023.

| Fiscal Year | Gross Margins |

| 2019 | 79.5% |

| 2020 | 79.1% |

| 2021 | 81.6% |

| 2022 | 80.7% |

| 2023 | 70.8% |

A concern for investors is the recent inconsistency in delivering generally accepted accounting principles (GAAP) profitability. GAAP losses have occurred in four straight years, including a loss of $1.71 per diluted share in 2023, the biggest drop since 2014. This will need to be addressed by the company.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.39 | N/A |

| 2020 | -$0.09 | -123.5% |

| 2021 | -$0.20 | -121.5% |

| 2022 | -$0.09 | 55.0% |

| 2023 | -$1.71 | -1,801.8% |

(Source: MarketWatch, op. cit.)

But there is an encouraging outlook. Analysts expect Global Net Lease to narrow its GAAP loss to $0.12 per diluted share in 2024. This will be followed by -$0.09 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

The loss estimate doesn’t look positive at this time, as Global Net Lease reported a loss of $0.35 per diluted share in the first half of 2024. While this suggests a shortfall, it also represents a 68.8% improvement over the same period in 2023.

While the REIT is in a loss position, its ability to deliver consistent positive free cash flow (FCF) since 2015 has been a big benefit. The FCF supports Global Net Lease’s ability to pay dividends and deal with its debt.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $128.7 | N/A |

| 2020 | $170.5 | 32.5% |

| 2021 | $184.6 | 8.3% |

| 2022 | $154.3 | -16.4% |

| 2023 | $99.2 | -35.7% |

(Source: MarketWatch, op. cit.)

The company’s total debt stood at $4.95 billion at the end of June, in addition to it having $132.4 million in cash and strong working capital. Liquidity shouldn’t be an issue at this time. (Source: Yahoo! Finance, op. cit.)

Global Net Lease has managed to just cover its interest expense with higher earnings before interest and taxes (EBIT) in three straight years prior to the weakness in 2023. The EBIT move back to positive territory at $115.3 million in the first half of 2024 is a positive sign.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $87.6 | $71.8 | 1.22X |

| 2021 | $117.9 | $94.3 | 1.25X |

| 2022 | $120.6 | $97.5 | 1.24X |

| 2023 | -$18.0 | $179.4 | N/A |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a weak reading of 3.0 for Global Net Lease. This is near the bottom of the 1.0 to 9.0 range. Prior to 2023, the Piotroski score had averaged a better 5.0.

Global Net Lease Stock: Dividend Increases Around the Corner?

Global Net Lease stock’s forward yield of 12.76% is in line with the five-year average yield of 12.6%. The negative has been the declining dividends since 2020. Prior to this, the REIT raised its dividends between 2015 and 2019.

The dividend coverage ratio of 0.7 times is on the weak side, so there could be another dividend cut.

I generally like to see higher dividends over time, but the strong expected increase in revenues and narrowing losses could lead to higher dividends down the road.

| Metric | Value |

| Dividend Streak | 10 years |

| Dividend 7-Year CAGR | -5.7% |

| 10-Year Average Dividend Yield | 18.1% |

| Dividend Coverage Ratio | 0.7X |

The Lowdown on Global Net Lease Stock

Global Net Lease stock is not the typical dividend stock you would seek for your portfolio given the dividend cuts. But, if things play out as hoped, higher dividends could be in store.

For patient contrarian income investors, Global Net Lease stock provides a strong risk/reward opportunity for major price appreciation while shareholders collect dividends.