BW LPG Stock: 20.6%-Yielder Announces Blockbuster Acquisition

BW LPG Stock Up 47% Year Over Year

The global shipping industry continues to do well in 2024 thanks in large part to industry tailwinds, challenges in the Red Sea and Panama Canal, and even weather-related issues. This has resulted in strong daily time charter equivalent (TCE) rates. All of which has been a boon for BW LPG stock.

The year started out strong for BW LPG Ltd (NYSE:BWLP) and its freight rates, with some spot rates topping $120,000 per day. Cold weather, which curtailed production and exports of liquified petroleum gas (LPG), saw spot rates retreat from those levels at the end of the second quarter. (Source: “Financial Results for Q2 2024,” BW LPG Ltd, August 22, 2024.)

Since then, the company’s earnings have recovered alongside LPG production here in the U.S., with spot cargoes at rates above the seasonal average level. In early July, Hurricane Beryl made landfall in Texas, causing widespread damage. This included the number of LPG vessels available for export, which juiced spot rates.

Spot rates are currently hovering near $45,000 per day, with strong fundamentals supporting that level. As is often the case, the spot market is expected to fluctuate on the heels of weather changes, geopolitical issues, and other factors that drive the Very Large Gas Carrier (VLGC) market.

Longer term, the outlook for the LPG market remains solid as businesses in China and the rest of Asia switch from coal to gas to support their economic growth. Demand for North American LPG export is expected to grow in the high single digits over the next three years.

Middle East LPG exports are expected to grow in the mid-single digits over the coming years fueled by higher gas production from new projects in Qatar, United Arab Emirates (UAE), and other countries in the region.

About BW LPG Ltd

Most people aren’t familiar with BW LPG, but that’s only because it began trading on the New York Stock Exchange in late April 2024. It’s been listed on the Oso Stock Exchange since 2013 though. (Source: “BW LPG Limited – Commencement of trading and admission to trading on NYSE,” BW LPD Ltd, April 26, 2024.)

BW LPG is the world’s leading owner and operator of LPG vessels, with a fleet of 41 VLGCs, including eight vessels that are owned and operated by its subsidiary operating in India. It is actually India’s largest owner and operator of VLGC vessels, responsible for carrying more than 20% of LPG into India.

The VLGCs have a total carrying capacity of over three million cubic meters (CBM) of chargeable weight. One CBM is equal to 167 kilograms or 368 pounds. Three million CBM then is equal to 1.1 billion pounds. (Source: “Our VLGC Fleet,” BW LPG Ltd, last accessed September 3, 2024.)

In August, BW LPG announced plans to acquire 12 VLGCs from Avance Gas Holding Ltd for $1.05 billion. The transaction will see BW LPG’s fleet grow significantly, from 41 VLGCs to 53. (Source: “BW LPG Acquires 12 Very Large Gas Carriers from Avance Gas,” BW LPG Ltd, August 15, 2024.)

The acquisition also comes at a time when VLGC newbuild deliveries are falling and there’s continued growth in global LPG export volumes. This points to strong market demand over the coming years, which should also help juice BW LPG’s earnings and dividends.

The closing of the transaction, which will take place on a vessel-by-vessel basis, should be completed by the end of 2024.

Another Strong Quarter

For the second quarter ended June 30, BW LPG reported another strong quarter, with daily TCE rates of $49,660 per available day and $48,030 per calendar day, with 95% fleet utilization. (Source: “Interim Financial Report, Q2 2024 and H1 2024,” BW LPG Ltd, August 15, 2024.)

This resulted in second-quarter TCE income of $148.6 million, with its India subsidiary contributing a reliable $30.6 million.

BW LPG reported net profit after tax (NPAT) of $85.0 million, or $0.58 per share. Its second-quarter operating profit was $89.0 million, or $0.58 per share.

The company ended the quarter with total cash of $264.3 million.

As noted above, during the quarter, BW LPG announced it was acquiring 12 VLGCs for $1.05 billion. Announcing an acquisition wasn’t a total surprise. The company ended the first quarter with $661.0 million in liquidity, including $340.0 million in cash. Excluding its Indian subsidiary, BW LPG was debt-free.

At the time, management said that its balance sheet was actually “too robust” and it was finding it tough to find places to invest its money in profitable ways. It has since remedied this.

BW LPG Stock: Quarterly Dividend of $0.58 Per Share

Returning capital to investors through its reliable dividend and share repurchases is a big part of BW LPG’s business plan. And it can do that because it makes a lot of money.

In the first half of 2024, the company generated $458.4 million in free cash flow (FCF). It’s been using that money to pay dividends and pay down debt.

In the first half of 2024, BW LPG repaid $98.3 million in bank borrowing and $250.1 million in dividend payments.

Since its IPO in 2013, the company has paid out more than 71% of its earnings as dividends. In 2023 alone, it paid out 98% of earnings. (Source: “Why invest in BW LPG,” BW LPG Ltd, last accessed September 3, 2024.)

Most recently, in August, BW LPG declared a second-quarter dividend of $0.58 per share, or $2.38 on an annual basis, for a frothy forward dividend yield of 20.69%. (Source: “Key information relating to the cash dividend for Q1 2024,” BW LPG Ltd, May 30, 2024.)

Because the company aims for an annual payout ratio of at least 50% of NPAT, the dividend payout will fluctuate. The payout could jump to 75% to 100% of NPAT should certain net leverage ratio targets be met. (Source: “Key information relating to the cash dividend for Q2 2024,” BW LPG Ltd, last accessed September 3, 2024.)

In the first quarter, BW LPG paid out $1.00 per share; in the fourth quarter of 2023, it paid out $0.90 per share.

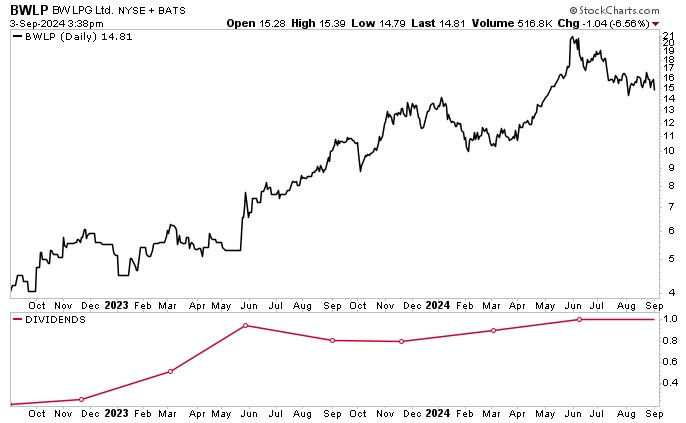

BW LPG Stock Up 47% Year Over Year

BWLP stock has been having a good year. Back in May, it hit a new record high of $21.23. The stock has retreated from that level, but continues to perform well. As of September 3, BW LPG stock is up:

- 42% over the last six months

- 12% year to date

- 47% over the last year

Chart courtesy of StockCharts.com

The Lowdown on BW LPG Stock

BW LPG Ltd is the world’s leading owner and operator of LPG vessels. It has a strong balance sheet, reported another strong quarter, and announced the acquisition of 12 VLGCs. It generated strong FCF in the first half of 2024 of $458.4 million, which it used to pay down debt and continue to pay a reliable, high-yield dividend.

Thanks to near- and long-term industry demand for LPG, which plays a critical role in the energy transition, the outlook for the company, BW LPG stock, and its dividend payouts remains excellent.