Vale Stock: Contrarian Metals Play Yielding 14.22%

Dividend Cut But Sell-Off Presents Opportunity

Why am I reviewing Vale stock today?

When looking at dividend stocks, I generally do not like companies that cut their dividend, but there are special situations when dividend cuts are needed in order to improve operations.

That’s the case with leading metals and mining play, Vale SA (NYSE:VALE). The company has a behemoth market cap of $44.5 billion as of August 21, in spite of the shares declining 34.7% in 2024.

Based out of Brazil, Vale is one of the world’s biggest miners of iron ore, nickel, and copper. These are used to produce steel and lithium batteries and for other widely used applications. Other metals mined include gold, silver, and cobalt. The company has extensive operations in Brazil, Oman, Canada, China, and Indonesia. (Source: “What we do,” Vale S.A., last accessed August 22, 2024.)

Key reasons for the price deterioration in Vale stock were its dividend cut and inconsistencies in its dividends over the last few years.

Vale SA cut its quarterly dividend to $0.37 per share effective the upcoming September payment, compared to $0.55 per share in March. Based on its September payment, Vale stock currently has an expected forward yield of 14.22%. Although, as you can see from the recent dividend history, this could easily change and thereby impact the yield. (Source: “Dividend History,” Nasdaq, last accessed August 22, 2024.)

| Dividend Payment Date | Amount of Dividend |

| December 2023 | $0.15 |

| September 2022 | $0.39 |

| March 2022 | $0.72 |

| October 2021 | $1.51 |

| July 2021 | $0.44 |

| March 2021 | $0.61 |

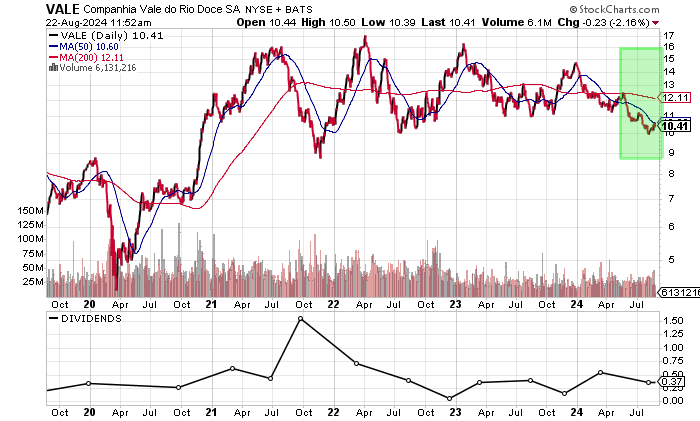

The stock chart shows the volatile trading history. Vale stock is currently hovering around its key long-term support/resistance level dating back to 2005.

VALE stock is currently just below its 50-day moving average (MA) of $10.94. A break above could drive the stock towards the 200-day MA of $12.88. The 10-year high was $23.18 in June 2021, so there’s massive upside if the company can improve its operations.

Chart courtesy of StockCharts.com

Vale Stock: A Work in Progress

Vale SA increased its revenues significantly from the pandemic in 2020 to a record $54.5 billion in 2021. But revenues failed to hold, and they have declined in the last two years. In spite of this, revenues in 2023 were still the third highest in the last 10 years.

| Fiscal Year | Revenues (Billions) | Growth |

| 2020 | $39.55 | N/A |

| 2021 | $54.50 | 37.8% |

| 2022 | $43.84 | -19.6% |

| 2023 | $41.78 | -4.7% |

(Source: “Vale S.A. (VALE),” Yahoo! Finance, last accessed August 22, 2024.)

The outlook is mixed, depending on the state of the global economy. At this point, analysts estimate that Vale will report lower revenues of $39.95 billion in 2024, followed by $41.03 billion to as high as $44.34 billion in 2025. The forward multiple of 1.1 times the consensus 2025 revenue estimate could provide some downside cushioning. (Source: “Vale S.A. (VALE),” Yahoo! Finance, last accessed August 22, 2024.)

Over the last five years, Vale generated its highest gross margins since 2014.

| Fiscal Year | Gross Margins |

| 2019 | 47.2% |

| 2020 | 55.9% |

| 2021 | 60.0% |

| 2022 | 45.2% |

| 2023 | 42.3% |

On the bottom line, the company has been inconsistent despite its ability to deliver generally accepted accounting principles (GAAP) profits in nine of the last 10 years. The high profits in 2021 and 2022 were more an aberration, while 2023 was more representative. Profits in 2023 were the third highest since 2014.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2020 | $0.95 | N/A |

| 2021 | $4.47 | 370.5% |

| 2022 | $4.05 | -9.4% |

| 2023 | $1.83 | -54.8% |

(Source: Yahoo! Finance, op. cit.)

Analysts expects Vale SA to report higher profits of $2.19 per diluted share in 2024 and $2.23 per diluted share in 2025. There is high estimate of $3.37 and $3.64 per diluted share for 2024 and 2025, respectively. Should the company reach these estimates, I would expect a dividend increase. (Source: Yahoo! Finance, op. cit.)

A look at the funds statement shows consistent free cash flow (FCF). This allows the company to pay dividends and reduce its debt. Vale bought back $2.7 billion of common stock in 2023, $6.0 billon in 2022, and $5.5 billion in 2021. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Billions) | Growth |

| 2020 | $10.10 | N/A |

| 2021 | $20.65 | 104.5% |

| 2022 | $6.04 | -70.8% |

| 2023 | $7.25 | 20.0% |

(Source: Yahoo! Finance, op. cit.)

On the balance sheet, Vale SA held $97.7 billion of total debt and $36.4 billion in cash at the end of June. I don’t expect any issues given the profitability and FCF. (Source: Yahoo! Finance, op. cit.)

Vale has also easily covered its interest expense with higher earnings before interest and taxes (EBIT) in four straight years.

| Fiscal Year | EBIT (Billions) | Interest Expense (Billions) | Interest Coverage Ratio |

| 2020 | $9.35 | $2.36 | 4.0X |

| 2021 | $31.09 | $1.55 | 20.1X |

| 2022 | $20.73 | $0.95 | 21.8X |

| 2023 | $12.49 | $1.34 | 9.3X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a reasonable reading of 5.0, which is above the midpoint of the 1.0 to 9.0 range.

Dividends Could Rise if Estimates Pan Out

While the dividend cuts and inconsistency present some risk, I’m cautiously optimistic that Vale stock will continue to pay dividends near the current amount. Based on the dividend of $0.37 in September, the payout ratio is roughly 67.6% of the 2024 earnings estimate.

| Metric | Value |

| Dividend Streak | 24 years |

| Dividend 7-Year CAGR | 68.3% |

| 10-Year Average Dividend Yield | 8.3% |

| Dividend Coverage Ratio | 2.1X |

The Lowdown on Vale Stock

Vale stock is worth a look for contrarian income investors who are willing to assume some risk and wait for the situation to improve.

The expected higher profitability and FCF could allow the company to consider higher dividends once again.