Starwood Property Stock: REIT Paying Out Nearly 10% Yield

Steady Income From 16-Year Dividend-Payer

Starwood Property stock is in the spotlight today!

Real estate investment trust (REIT) units are recovering following a period of selling amid the rising interest rates that negatively impacted the commercial mortgage segment.

High interest rates led to a rise in the cost of capital and contracting margins that ultimately impact profitability and free cash flow (FCF).

But there’s some good news. Interest rates are set to begin on their downward trajectory in September; at least that’s what I think. This should help REITs.

While REITs have been rallying on an improved macro environment, there are still opportunities to enter into these income investments.

Take the case of Starwood Property Trust Inc (NYSE:STWD), a mid-cap real estate finance company that is yielding close to 10% and on a 16-year dividend streak. The company, an affiliate of global private investment firm Starwood Capital Group, is the biggest commercial mortgage REIT in the U.S.

Starwood Property manages a diversified portfolio in excess of $26.0 billion in commercial and residential lending, infrastructure lending, investing & servicing, and property business. (Source: “At a Glance,” Starwood Property Trust Inc, last accessed August 20, 2024.)

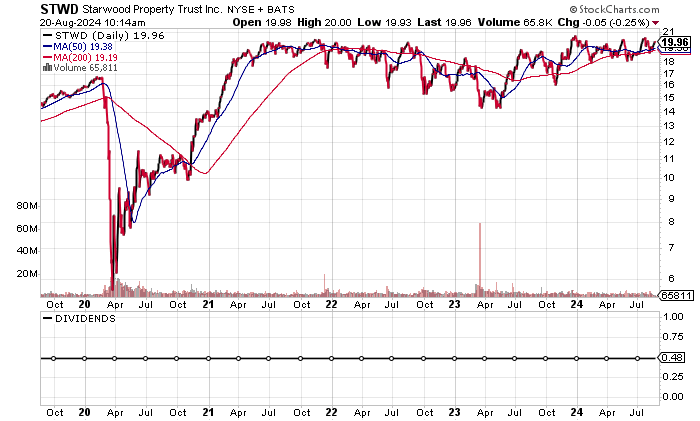

Starwood Property stock is 17.2% above its 52-week low of $17.07 but is down 4.8% in 2024 and 10.2% below its 52-week high. Prior to this, STWD stock traded at $27.01 in June 2021.

The chart shows Starwood Property stock recovering both its 50-day moving average (MA) of $19.48 and 200-day MA of $19.90. And should the 50-day MA break above the 200-day MA, this would generate a golden cross on the chart, a bullish technical crossover that signals higher prices.

Chart courtesy of StockCharts.com

Second Quarter Continues with Steady Results

Revenues have risen in three consecutive years to the record $2.05 billion in 2023 and well above pre-pandemic levels.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $1.32 | N/A |

| 2020 | $1.14 | -13.6% |

| 2021 | $1.19 | 4.4% |

| 2022 | $1.55 | 30.3% |

| 2023 | $2.05 | 32.3% |

(Source: “Starwood Property Trust, Inc,” MarketWatch, last accessed August 20, 2024.)

Analysts estimate that Starwood Property Trust will grow revenues 5.1% to $2.15 billion in 2024 before a flat $2.15 billion in 2025. (Source: “Starwood Property Trust, Inc (STWD), ” Yahoo! Finance, last accessed August 20, 2024.)

The second quarter saw reported revenues of $489.8 million broken down as follows: (Source: “Starwood Property Trust Reports Results for Quarter Ended June 30, 2024,” Starwood Property Trust Inc, August 6, 2024.)

- Commercial and residential lending (74%)

- Infrastructure lending (12%)

- Investing & servicing (10%)

- Property (4%)

Starwood Property has generated consistent 80%-plus gross margins.

| Fiscal Year | Gross Margins |

| 2019 | 81.7% |

| 2020 | 82.0% |

| 2021 | 84.3% |

| 2022 | 92.4% |

| 2023 | 87.6% |

On the bottom line, the company has consistently delivered generally accepted accounting principles (GAAP) profitability, but it needs to deliver consistent growth following the drop in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.79 | N/A |

| 2020 | $1.16 | -35.2% |

| 2021 | $1.52 | 31.0% |

| 2022 | $2.74 | 80.3% |

| 2023 | $1.07 | -60.9% |

(Source: MarketWatch, op. cit.)

Analysts expect Starwood Property to report adjusted distributable earnings of $2.01 per diluted share in 2024, compared to $2.05 per diluted share in 2023. This is expected to be followed by $2.00 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

In the second quarter, Starwood Property reported distributable earnings of $0.48 per diluted share, or a penny below the consensus. Previous to this, the company beat in three straight quarters.

Shifting to the funds statement, you’ll see that there’s consistent positive FCF with growth in two of the last four years.

The positive FCF allows Starwood Property stock to pay dividends and the company to continue to lower its $18.5 billion in total debt on the balance sheet. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $370.8 | N/A |

| 2020 | $321.5 | -13.3% |

| 2021 | $381.5 | 18.7% |

| 2022 | $501.6 | 31.5% |

| 2023 | $339.9 | -32.2% |

(Source: MarketWatch, op. cit.)

I expect the lower interest rate environment to help reduce the carrying costs.

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, was a reasonable 5.0 in 2023. This is just above the midpoint of the 1.0 to 9.0 range.

Delivering Steady Dividends

Starwood Property stock’s forward dividend yield of 9.61% is attractive, on par with the five-year average dividend yield of 9.61%.

The current quarterly dividend is $0.48 per share, which has been in place for the last five years. Unless something dramatic happens, I expect the dividend streak to continue.

| Metric | Value |

| Dividend Streak | 16 years |

| 10-Year Average Dividend Yield | 14.0% |

| Dividend Coverage Ratio | 0.8X |

The Lowdown on Starwood Property Stock

Starwood Property stock has moderate institutional ownership, with 609 institutions holding 50.5% of the outstanding shares. Insiders have been buying to the tune of a net 1,631,622 STWD shares over the last six months. (Source: Yahoo! Finance, op. cit.)

For income investors, my view is that Starwood Property stock provides steady, reliable dividend income and the opportunity for capital appreciation.