MFA Financial Stock: 12.27%-Yielder Up 10.8% Over Past Year

Delivering 27 Straight Years of Dividends

The market is increasingly betting on interest rates to begin to drop at the next Federal Open Market Committee (FOMC) meeting in September.

Supported by cooling inflation and the threat of an economic slowdown, the CME FedWatch Tool is predicting that the federal funds target range could fall by 225 basis points to the target range of 3.0%–3.25% by the September 2025 FOMC meeting. (Source: “CME FedWatch Tool,” CME Group, last accessed August 13, 2024.)

What this means is that the lower interest rates will benefit high-asset-base businesses such as real estate investment trust (REIT) vehicles by reducing debt costs, expanding margins, and improving bottom-line profitability. This could translate into higher dividend payouts.

Rate-sensitive REITs such as MFA Financial Inc (NYSE:MFA) should benefit from the lower interest rates.

MFA Financial is a billion-dollar-market-cap REIT focused on residential mortgage loans, residential mortgage-backed securities, and other real estate assets. (Source: “Overview,” MFA Financial Inc, last accessed August 13, 2024.)

The company looks to drive shareholder value by paying out regular income and some capital appreciation.

MFA Financial has paid dividends in 27 consecutive years and boasts a juicy forward dividend yield of 12.27%. The stock has also advanced 10.8% over the past year to August 13.

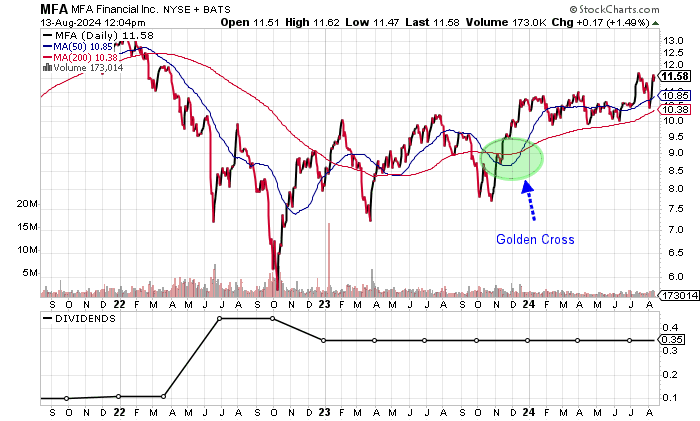

Moreover, MFA Financial stock has moved into a golden cross formation, a bullish technical crossover when the 50-day moving average (MA) breaks above the 200-day MA. This suggests additional moves to the upside to come.

Chart courtesy of StockCharts

Second-Quarter Beat on Top and Bottom Line

A look at the second quarter showed MFA Financial reporting generally accepted accounting principles (GAAP) profits of $33.7 million, or $0.32 per diluted share.

The key adjusted distributable earnings came in at $45.6 million, or $0.44 per share, which beat the Zacks Investment Research consensus estimate of $0.38 per share and is above the comparative $0.40 per share in the year-ago second quarter. (Source: “MFA Financial (MFA) Q2 Earnings and Revenues Surpass Estimates,” Yahoo! Finance, August 8, 2024.)

MFA Financial paid out $0.35 per share after the second-quarter results.

On the revenue side, MFA Financial reported revenues of $53.49 million, beating the Zacks consensus by 12.14% and hitting well above the $44.51 million for the year-ago second quarter. It was the fourth straight quarterly revenue beat. (Source: Yahoo! Finance, op. cit.)

Craig Knutson, MFA Financial’s chief executive officer and president, had this to say: “We are pleased to announce strong results for what was yet another volatile quarter in the fixed income and mortgage markets. We generated Distributable earnings of $0.44 per share and our Economic book value rose to $14.34 per share. We continued to execute our strategy of acquiring residential mortgage assets at attractive levels. During the quarter, we purchased or originated $688 million residential mortgage loans with an average coupon of 9.6%. We also added $176 million of Agency MBS.” (Source: “MFA Financial, Inc. Announces Second Quarter 2024 Financial Results,” MFA Financial Inc, August 8, 2024.)

Looking ahead, analysts expect the company to increase its revenues to $281.8 million in 2024 and $290.7 million in 2025. (Source: Yahoo! Finance, op. cit.)

On the funds statement, MFA Financial has consistently churned out positive free cash flow (FCF) over the last five years. The positive FCF should allow the company to continue with its dividend payment streak.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $213.9 | N/A |

| 2020 | $33.5 | -84.3% |

| 2021 | $108.3 | 222.8% |

| 2022 | $365.8 | 237.9% |

| 2023 | $108.7 | -70.4% |

(Source: “MFA Financial Inc,” MarketWatch, last accessed August 13, 2024.)

The major risk with MFA Financial is the $8.9 billion in total debt on the balance sheet. The company paid down $4.9 billion in debt in 2023 and $5.1 billion in debt in 2022. During this period, it also issued around $12.8 billion in new debt. (Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a decent reading of 6.0 for MFA Financial, which is well above the midpoint of the 1.0–9.0 range.

MFA Financial Stock Dividends to Continue

MFA Financial’s annual dividend of $1.40 per share represents a forward yield of 12.27%. The high yield is due to MFA stock declining to well below its high of $35.16 in September 2019. This provides contrarian income investors with an opportunity to accumulate shares. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Streak | 27 years |

| 10-Year Average Dividend Yield | 20.3% |

| Dividend Coverage Ratio | 1.0X |

The Lowdown on MFA Financial Stock

MFA Financial Inc should benefit from the decline in interest rates over the next two years. The lower interest cost should result in improved profitability and FCF. This could drive a higher share price down the road.

In all, one can collect the nice dividend income and high yield with MFA Financial stock.