Outfront Media Inc: Shares of 8.3%-Yielder Have 20%+ Upside

Outfront Media Inc Outlook Bullish on Strong Results

Many industries took a massive hit during the 2020 health crisis. Some were more obvious than others. Because of quarantine orders, stores were shuttered and the need for billboards and other out-of-home (OOH) and digital advertising platforms evaporated. Since then, though, demand for billboard, transit, and mobile assets has come roaring back…and that has put Outfront Media Inc (NYSE:OUT) back on Wall Street’s radar.

Outfront Media Inc is a specialty real estate investment trust (REIT) that provides advertising space (displays) on OOH marketing structures and sites in the U.S. Its OOH advertising campaigns effectively change the ways advertisers engage with on-the-go audiences.

The company’s inventory consists of LED billboards, traditional print billboards, digital street furniture, transit advertising, massive canvas ads on the side of buildings, specialty place-based media (airports, walls, kiosks, subways, parking garages, etc.), and mobile campaigns that target specific locations and brand stores. (Source: “OUTFRONT,” Outfront Media Inc, last accessed July 9, 2024.)

Creative OOH advertising has emerged as the leading media model, thumping direct mail and traditional media models. It is projected to become the sole traditional media format experiencing growth. It also has some of the highest recall rates among all formats. (Source: “2024 Advertising Trends Report,” Ouftront Media Inc, last accessed March 27, 2024.)

Solid First-Quarter Results

For the first quarter ended March 31, 2024, Outfront Media announced that revenue inched up 3.2% year over year to $408.5 million. Billboard revenues increased by 2.6% to $328.8 million, while transit and other revenues were up six percent at $79.7 million. (Source: “OUTFRONT Media Reports First Quarter 2024 Results,” May 2, 2024.)

The REIT’s first-quarter net loss improved to $27.2 million, or a loss of $0.18 per share. Funds from operations (FFO) increased 30% to $22.3 million, while adjusted FFO jumped 164% to $165.4 million.

Outfront Media’s operating income was up 37% at $14.0 million. Net cash flow provided by operating activities rallied 225% to $30.6 million. Adjusted operating income before depreciation and amortization (OIBDA), which is a metric that shows profitability in a company’s core business, was up 10.5% at $66.5 million.

Commenting on the results, Jeremy Male, Outfront Media Inc’s chairman and chief executive officer, said, “Strong local trends drove solid first quarter financial results, with total revenue up over 3% and Adjusted OIBDA up 10%. It was particularly pleasing to see good growth in transit during the period, and encouragingly this trend has continued into the second quarter.”

Maintains Quarterly Dividend of $0.30

Suffice it to say, the 2020 pandemic was not kind to many companies or their dividends. Outfront Media Inc suspended its $0.38-per-share quarterly dividend at the start of 2020, and then reinstated it at $0.10 per share in the back half of 2021. (Source: “Dividend History,” Outfront Media Inc, last accessed July 9, 2024.)

After tripling the payout in early 2022 to $0.30 per share, the REIT has maintained that payout since. This works out to an annual dividend of $1.20 per share for a forward yield of 8.3%.

OUT Stock Has 20%+ Upside

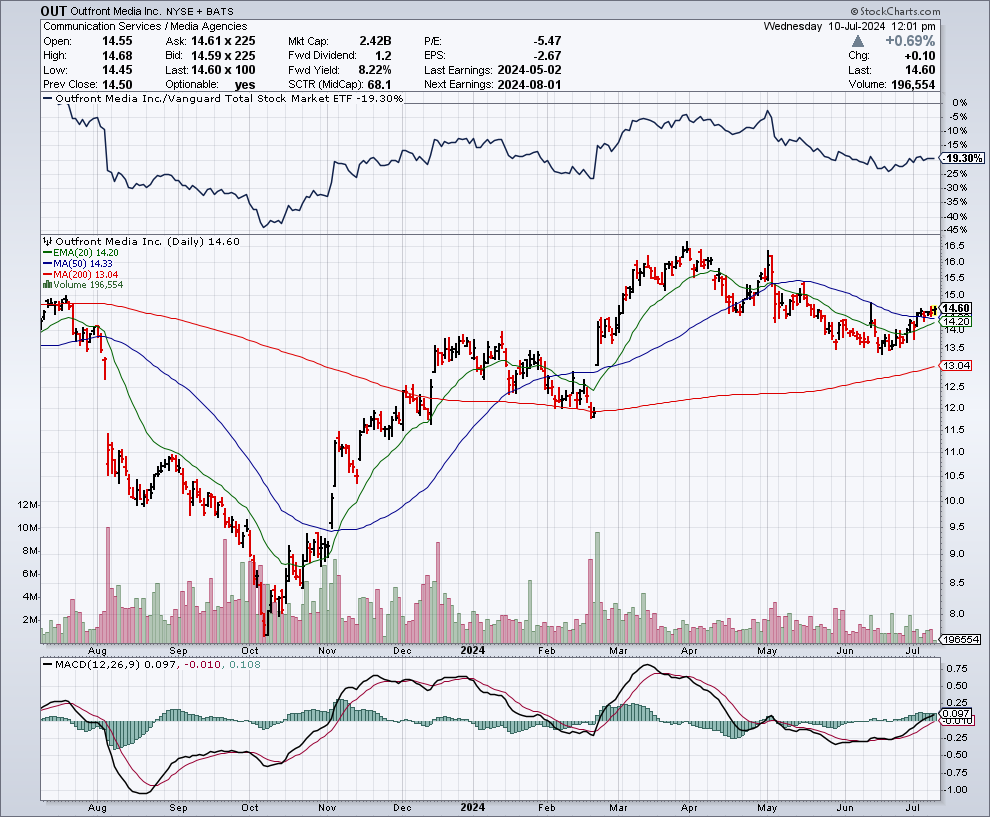

Outfront Media stock has been performing well since early October 2023, advancing more than 80%.

That investor enthusiasm comes on the heels of solid financial results, moderating inflation, robust consumer spending, the fact that the U.S. has avoided a recession, and eventual interest rate cuts.

REITs have faced a lot of pressure with high interest rates; that’s because they borrow a lot of money to grow their portfolios, and higher rates mean more money is going to service that debt.

Even with the big gains since October 2023, the outlook for OUT stock remains solid, with Wall Street analysts providing a 12-month average share price forecast of $14.75 per share with a high estimate of $18.00 per share. This points to potential upside of 16% to 23%.

There’s still plenty of room for growth, of course, Outfront Media stock still needs to climb 74% to get to its February 2020 record high of $25.23.

Why the bullish take?

Management hasn’t provided any guidance, but analysts expect Outfront Media Inc’s earnings to rebound from a loss of $2.66 per share in 2023 to $0.65 per share in earnings in 2024 and $0.80 per share in 2025. (Source: “OUTFRONT Media Inc. (OUT),” Yahoo! Finance, last accessed July 9, 2024.)

Chart courtesy of StockCharts.com

The Lowdown on Outfront Media Inc

As you now know, Outfront Media Inc is a specialty REIT that operates billboards and mobile advertising campaigns across the U.S. While its operations took a hit during the 2020 health crisis, its sales are projected to top pre-pandemic levels this year.

In 2019, Outfront Media reported revenue of $1.7 billion, with analysts looking for the company to report 2024 revenue of $1.86 billion, increasing to $1.91 billion in 2025. This should help Outfront energize its earnings, share price, and, potentially, its dividend payout, too.