United Maritime Stock: 11.5%-Yielder Has 132% Upside Potential

Outlook for United Maritime Corp Bullish on Industry Tailwinds

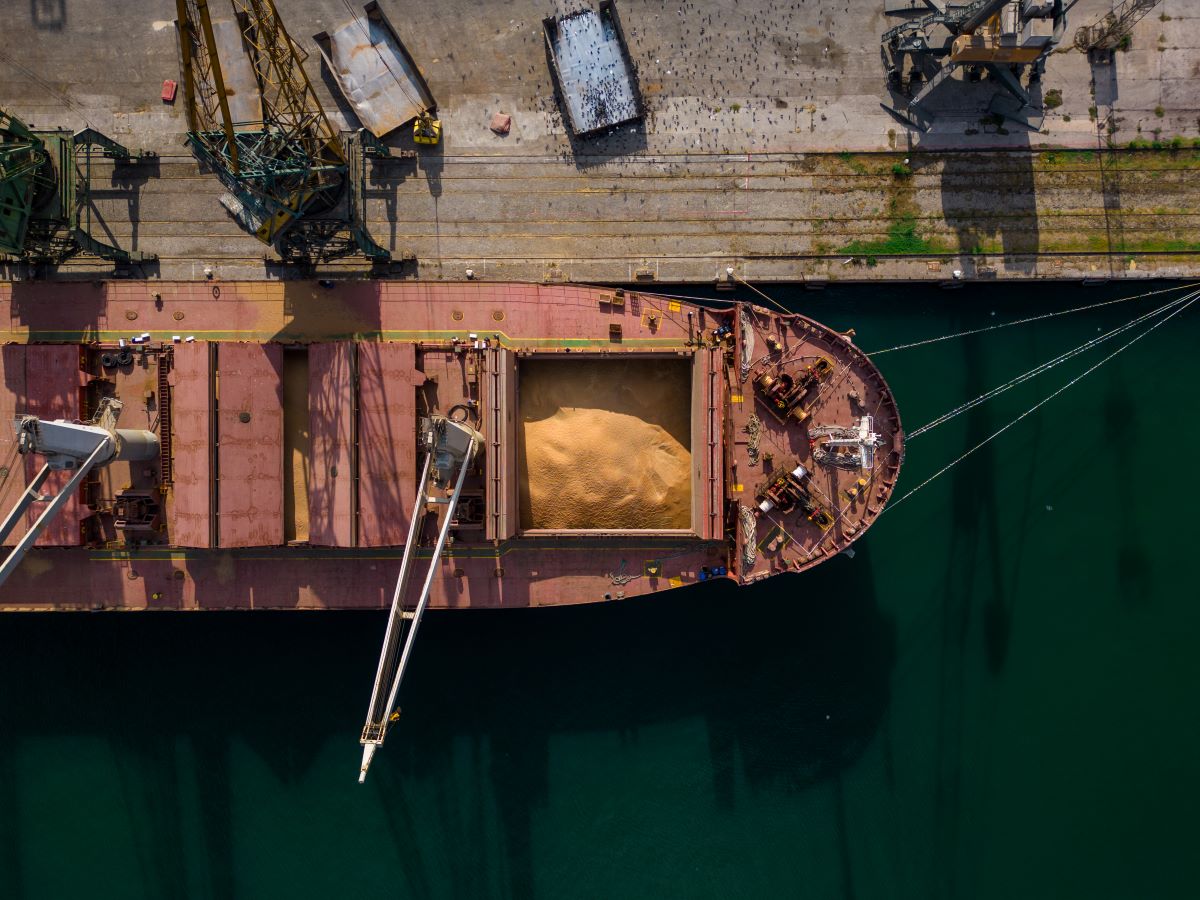

There’s a dry bulk shipping stock I think you should take a look at: United Maritime stock.

The broader shipping industry has been on fire in 2024, energized by tensions in the Red Sea and Suez Canal that have increased demand for vessels with extended trade routes adding one to two weeks of transit time at an added cost of $1.0 million in fuel charges. (Source: “Houthi Attacks Placing Pressure on International Trade,” Defense Intelligence Agency, April 5, 2024.)

These continued geopolitical concerns are responsible for overall rising ocean freight rates, which could surpass $20,000 per day. They could even hit the peak of $30,000, hit in the pre-pandemic era. (Source: “Fears are rising ocean freight rates may surpass $20,000 with no relief for global trade into 2025,” CNBC, June 13, 2024.)

Ultimately, these industry tailwinds will subside. And that’s why it’s important to consider the long-term outlook for the global shipping and dry bulk industry. And for dry bulk carriers like United Maritime Corp (NASDAQ:USEA), the longer-term outlook remains bright.

In 2023, the dry bulk shipping market was valued at $162.6 billion. Between 2024 and 2032, the market size is projected to expand at a compound annual growth rate (CAGR) of four percent.

That strong growth is expected to come from rapid urbanization, with cities needing vast quantities of construction materials such as steel and cement. Other examples of dry bulk goods include coal, grain, bauxite, phosphate, and fertilizers.

To support the need for massive infrastructure development, cities will need to rely on increased shipments from specialized dry bulk vessels. The exact kind that you can find in United Maritime’s fleet.

Based in Greece, United Maritime Corp is a diversified international shipping company with a fleet of eight vessels: three Capesize, two Kamsarmax, and four Panamax dry bulk vessels, with an aggregate cargo-carrying capacity of 922,054 deadweight tonnage (DWT). That’s the total amount a ship can carry, including cargo, crew, provisions, fuel, and water. (Source: “Corporate Presentation June 2023,” United Maritime Corp, last accessed July 2, 2024.)

The company’s goal is to grow its fleet to meet industry demand. In July 2022, United Maritime acquired four tankers before the market run and sold four tankers for a combined profit of approximately $40.0 million.

In early 2023, the dry bulk carrier acquired two Japanese Kamsarmax vessels and one Japanese Panamax vessel. It also sold one of its Long Range 2 vessels at a premium of over 85% of the vessel’s acquisition price.

Q1 Revenue More Than Doubles

For the first quarter ended March 31, 2024, United Maritime announced that net revenue increased 278% year over year to $10.6 million. (Source: “United Maritime Reports First Quarter 2024 Financial Results and Declares Quarterly Cash Dividend of $0.075 Per Share,” United Maritime Corp, May 24, 2024.)

Net loss improved to $1.3 million, or a loss of $0.15 per share, from a loss of $4.9 million, or a per-share loss of $0.64. Adjusted net loss improved to $1.1 million, or a loss of $0.13 per share, from a loss of $3.7 million, or -$0.48 per share.

The company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $3.7 million, compared to negative adjusted EBITDA of $1.5 million in the same period last year.

The all-important time charter equivalent (TCE) rate (the average daily revenue performance) was $15,165 per day, up 47% from $10,294 in the first quarter of 2023.

Commenting on the results, Stamatis Tsantanis, United Maritime’s chairman and chief executive officer, said, “In the first quarter of the year, we witnessed a strong start for the dry bulk market, reflecting positively on the Capesize segment of our fleet, while our smaller vessels recorded a moderate performance. The strong market conditions are paving the way for high returns on capital for our shareholders, mainly through the appreciation of our Capesize and Panamax acquisitions concluded in 2023.”

Looking ahead, Tsantanis said that the company had fixed approximately 95% of its second-quarter days at an average rate of $17,300, with expected daily TCE rates for the full quarter to be at similar levels.

6th Consecutive Quarterly Dividend of $0.075 Per Share

As one would hope, one of United Maritime’s goals is to reward shareholders. Since its inception in November 2022, United Maritime stock has returned total cash dividends of $11.4 million, or $1.45 per share, representing approximately 46% of the company’s total market capitalization.

In the first quarter of 2024, United Maritime stock declared its six consecutive quarterly cash dividend of $0.075 per share, or $0.30 on an annual basis, for a forward, annualized yield of 11.5%.

Management remains optimistic that the positive market conditions will allow it to consistently reward its shareholders in the next quarters.

Will it be able to raise those payouts?

TCE rates are up, which should help juice United Maritime’s profitability. Moreover, the current payout ratio is just 58.8%. So, a dividend increase for United Maritime stockholders is not out of the question.

USEA Shares Have 132% Upside Potential

USEA shares have traded in a relatively tight range since the start of 2023, but they are still trading up 13% year to date and up 8.5% over the last 12 months.

Currently trading at $2.57, United Maritime stock needs to climb almost 60% to get to its July 2022 record high of $4.09. Despite the big gap, Wall Street thinks USEA shares will do more than that over the coming quarters, with an analyst rating of $6.00 per share. This points to potential upside of 132.5% on United Maritime stock.

Chart courtesy of StockCharts.com

The Lowdown on United Maritime Stock

United Maritime Corp is a dry bulk shipping company with a fleet of eight vessels. It reported strong revenue and TCE growth and improved its net loss and has fixed roughly 95% of its second-quarter days with a TCE rate well above the first quarter.

Consistent with its practice of returning capital to shareholders, United Maritime stock declared its six consecutive quarterly dividend of $0.075 per share.

The outlook for United Maritime stock remains solid, based on limited new deliveries of vessels and continued strong dry bulk commodity demand, with its mixed fleet of vessels well positioned to take advantage of these developments.

A scenario that management says will put United Maritime Corp in a “position to handsomely reward our shareholders.”