Frontline Stock: A 9.65%-Yielder Up 89.6% Over the Past Year

A Dividend Stock Moving Oil Across Oceans

Folks, you don’t have to trade the “Magnificent Seven” mega-cap technology stocks to make money in this market. Frontline stock is a prime example of this.

Frontline plc (NYSE:FRO) is a transporter of crude oil and refined products across oceans. The company is a major player in the space. (Source: “About Frontline plc,” Frontline plc, last accessed June 27, 2024.)

You would think this high-yielding dividend stock would not deliver that much capital growth, but FRO stock has advanced an impressive 29.8% in 2024 and 89.6% over the past year to June 26. You would find it difficult to find comparable returns.

Moreover, despite the strong price appreciation, Frontline stock offers an impressive forward dividend yield of 9.65%.

As an income investor, you’ll find that this combination of dividends and share growth is attractive. Now, I doubt we will see similar returns, but the dividend yield allows shareholders to collect regular income and provides potential for capital appreciation.

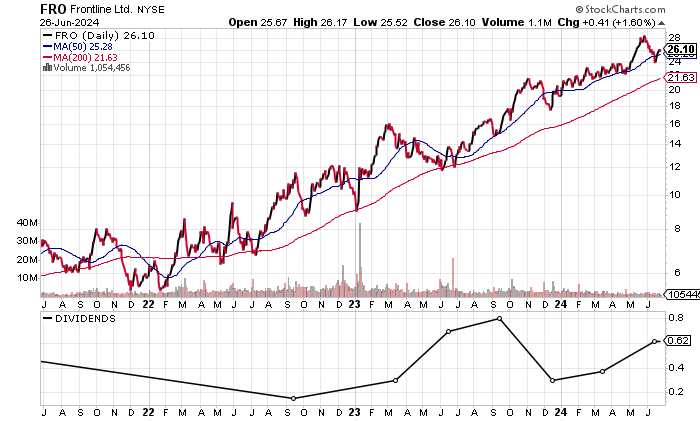

The Frontline stock chart shows FRO trading above both its 50-day moving average (MA) of $25.80 and its 200-day MA of $22.47.

Moreover, Frontline stock is currently trading in a golden cross. This is a bullish technical crossover when the 50-day MA is above the 200-day MA. Should this pattern hold, it may signal further gains.

Chart courtesy of StockCharts

A Near Doubling in Revenues

For a non-technology company, Frontline plc’s five-year revenue history seems impressive.

Its revenues have grown 88%, going from $956.6 million in 2019 to the record $1.8 billion in 2023. This included four years of strong double-digit growth. The compound annual growth rate (CAGR) was 17.1% during this period.

| Fiscal Year | Revenues | Growth |

| 2019 | $956.6 million | 29.1% |

| 2020 | $1.2 billion | 27.7% |

| 2021 | $749.4 million | -38.6% |

| 2022 | $1.4 billion | 90.9% |

| 2023 | $1.8 billion | 26.0% |

(Source: “Frontline plc (FRO), ” Yahoo! Finance, last accessed June 27, 2024.)

As with other companies that have experienced rapid growth, you would expect to see some normalization surface, and that is what’s happening here.

Analysts estimate that Frontline will report revenue contraction of 1.4% to $1.78 billion in 2024, followed by a four-percent rebound to a record $1.85 billion in 2025.

But, given the macro uncertainties, the estimates are broad. There are high estimates of $2.69 billion and $2.62 billion, respectively, for 2024 and 2025. (Source: Yahoo! Finance, op. cit.)

Frontline’s gross margins have been mixed over the past five years, including a low 25.7% in 2021. The company reported two strong years of margin expansion in 2022 and a five-year best in 2023.

| Fiscal Year | Gross Margins |

| 2019 | 41.4% |

| 2020 | 55.3% |

| 2021 | 25.7% |

| 2022 | 45.4% |

| 2023 | 55.9% |

On the bottom line, Frontline plc has largely produced consistent generally accepted accounting principles (GAAP) profitability.

After a disappointing 2021, the company came back with two consecutive high profitability years, including the record $2.95 per diluted share in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.78 | 1,591.6% |

| 2020 | $2.09 | 167.9% |

| 2021 | -$0.08 | -103.6% |

| 2022 | $2.22 | 3,055.1% |

| 2023 | $2.95 | 32.7% |

(Source: Yahoo! Finance, op. cit.)

On an adjusted basis, Frontline earned $2.63 per diluted share in 2023. Analysts expect adjusted earnings to grow to $3.37 per diluted share in 2024, followed by $3.83 and as high as $6.15 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

There’s inconsistency in the company’s free cash flow (FCF). This is not surprising for a capital-intensive business like energy transportation given the high cost of buying new ships and repairs.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $84.2 | N/A |

| 2020 | -$120.3 | -242.9% |

| 2021 | -$388.5 | -222.9% |

| 2022 | $49.5 | 112.7% |

| 2023 | -$775.2 | -1666.1% |

(Source: Yahoo! Finance, op. cit.)

Frontline’s balance sheet points to $4.1 billion in total debt and $303.5 million in cash at the end of March. (Source: Yahoo! Finance, op. cit.)

Don’t be alarmed about the debt. The interest coverage ratio is extremely strong at 30.1 times.

Frontline plc has also managed to easily cover its interest payments via higher earnings before interest and taxes (EBIT), with the exception of 2021.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $485.2 | $72.2 |

| 2021 | $51.2 | $61.5 |

| 2022 | $574.7 | $98.7 |

| 2023 | $835.1 | $178.5 |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score is an indicator of a company’s balance sheet, profitability, and operational efficiency. Frontline has a top-tier reading of 8.0, which is a notch below the peak of the 1.0 to 9.0 range.

Frontline Stock: What’s Supporting Higher Dividends

The forward dividend yield of 9.65% is attractive given the strong price appreciation in Frontline stock. This is below the five-year average dividend yield of 11.48% due to the previous lower share price.

The payout ratio of 75.9% is on the high end, but it should decline as earnings rise. (Source: Yahoo! Finance, op. cit.)

My view is that not only is Frontline stock’s dividend safe, but it’s also likely to rise given the higher expected profits that could lead to greater FCF.

| Metric | Value |

| Dividend Growth Streak | 2 years |

| Dividend Streak | 3 years |

| Dividend 7-Year CAGR | 17.0% |

| 10-Year Average Dividend Yield | 14.3% |

| Dividend Coverage Ratio | 1.6X |

The Lowdown on Frontline Stock

If you’ve owned Frontline stock over the past year, it has been a wonderful ride.

Going forward, I don’t expect the same degree of gains, but the nice dividend yield will make FRO stock attractive for income investors.