Saul Centers Stock: 6.6%-Yielder on 32-Year Dividend Streak

BFS Stock Is a Retail REIT Play With Good Upside

The U.S. economy is clearly being negatively affected by the current high interest rates, which increase the cost of financing for American consumers.

We’re beginning to see softer economic growth, and I expect the Federal Reserve to take note. This should translate to lower interest rates on the horizon. That would likely help drive consumer spending and economic growth.

For income investors, it makes sense to consider interest-rate-sensitive investments like real estate investment trusts (REITs) before interest rates begin to fall.

A small-cap retail REIT that’s currently offering a decent risk/reward opportunity is Saul Centers Inc (NYSE:BFS), which had a market cap of $1.2 billion as of May 29.

The company, which operates as a self-managed, self-administered equity REIT, operates and manages 61 properties, which are predominantly located in the metropolitan Washington, D.C./Baltimore region. (Source: “Corporate Profile,” Saul Centers Inc, last accessed May 29, 2024.)

The REIT’s real estate network comprises 50 community and neighborhood shopping centers, along with seven mixed-use properties totaling about 9.8 million square feet of leasable area. Saul Centers also owns four land and development properties.

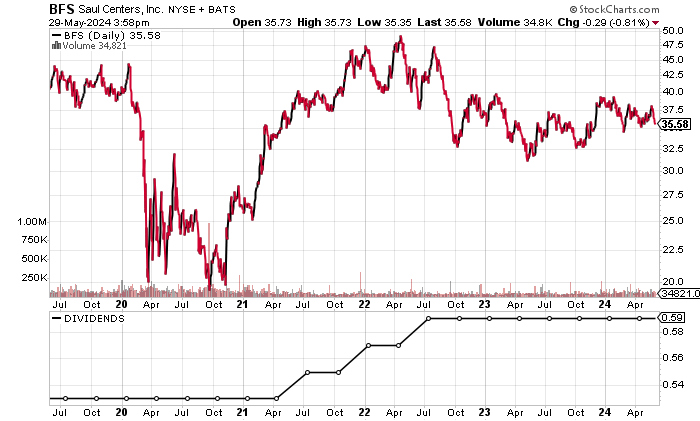

As of this writing, Saul Centers stock is hovering just above its 52-week low of $33.48 and 13.6% below its 52-week high of $41.04. On September 7, 2016, the stock was trading about 94.0% higher than it is now, at $68.75. (Source: “Saul Centers, Inc (BFS),” Yahoo! Finance, last accessed May 29, 2024.)

This presents a compelling risk/reward opportunity while BFS stock pays out high-yield dividends.

Chart courtesy of StockCharts.com

Steady Revenue Growth & Free Cash Flow

Saul Centers Inc doesn’t generate the kind of revenue growth that leaves you speechless, but it does deliver consistency. The company’s revenues have increased in each of the last three years to a record-high $257.7 million in 2023.

The REIT’s revenue growth is expected to continue. The sole analyst who tracks Saul Centers Inc forecasts that the company will report a small increase in revenues to $264.7 million in 2024, followed by an improved increase of 6.6% to $282.3 million in 2025. (Source: Yahoo! Finance, op. cit.)

In the first quarter of 2024, Saul Centers generated total revenues of $66.7 million, up by 5.8% from $63.0 million in the first quarter of 2023. (Source: “Saul Centers, Inc. Reports First Quarter 2024 Earnings,” Saul Centers Inc, May 29, 2024.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $233.0 | N/A |

| 2020 | $230.6 | -1.1% |

| 2021 | $238.6 | 3.5% |

| 2022 | $245.8 | 3.0% |

| 2023 | $257.7 | 4.9% |

(Source: “Saul Centers Inc.” MarketWatch, last accessed May 29, 2024.)

Saul Centers has been consistently generating gross margins above 70%, as the following table shows.

| Fiscal Year | Gross Margins |

| 2019 | 75.0% |

| 2020 | 74.1% |

| 2021 | 74.2% |

| 2022 | 73.8% |

| 2023 | 73.9% |

Saul Centers Inc’s bottom line shows consistent generally accepted accounting principles (GAAP) profits, highlighted by three consecutive years of GAAP-diluted earnings-per-share (EPS) growth to a five-year best in 2023.

Saul Centers is expected to earn an adjusted $1.59 per diluted share in 2024, followed by $1.24 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.57 | N/A |

| 2020 | $1.25 | -20.5% |

| 2021 | $1.57 | 25.8% |

| 2022 | $1.63 | 3.5% |

| 2023 | $1.73 | 6.0% |

(Source: MarketWatch, op. cit.)

Saul Centers Inc’s funds statement shows consistent generation of positive free cash flow (FCF).

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $115.4 | N/A |

| 2020 | $78.4 | -32.1% |

| 2021 | $118.4 | 51.0% |

| 2022 | $121.2 | 2.3% |

| 2023 | $117.7 | -2.8% |

(Source: MarketWatch, op. cit.)

Saul Centers Inc’s balance sheet held $1.4 billion in total debt at the end of 2023. While the debt is higher than what I’d like to see, I don’t envision any immediate problems, given the company’s consistent profit and FCF generation. (Source: Yahoo! Finance, op. cit.)

Another way to look at the REIT’s debt obligations is by comparing its interest expenses to its earnings before interest and taxes (EBIT).

The following table shows the company’s EBIT easily covering its interest expenses each year. Its interest coverage ratio was a reasonable 2.5 times in 2023.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $95.4 | $45.1 |

| 2021 | $105.4 | $43.7 |

| 2022 | $107.4 | $42.0 |

| 2023 | $116.2 | $47.2 |

(Source: Yahoo! Finance, op. cit.)

Saul Centers Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is currently a soft reading of 3.0, which is below the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Saul Centers Stock’s Dividends to Continue, But Don’t Expect an Increase

BFS stock’s forward yield of 6.57% (as of this writing) is above its five-year average dividend yield of 5.54% due to its current share-price weakness. (Source: Yahoo! Finance, op. cit.)

The stock’s dividends should continue, but I don’t expect them to go higher at this time.

| Metric | Value |

| Dividend Streak | 32 Years |

| 7-Year Dividend Compound Annual Growth Rate | 5.4% |

| 10-Year Average Dividend Yield | 9.2% |

| Dividend Coverage Ratio | 1.7 |

The Lowdown on Saul Centers Inc

Saul Centers stock is worth a look for higher-risk income investors who are looking for regular dividends and the opportunity to attain above-average share-price appreciation.

Institutional ownership of Saul Centers Inc is moderate, with 223 institutions holding 46.7% of the REIT’s outstanding shares (as of this writing). The top two institutional holders of BFS stock are The Vanguard Group, Inc., with an 8.5% stake, and BlackRock Inc (NYSE:BLK), with an 8.3% stake. (Source: Yahoo! Finance, op. cit.)

Insider interest in BFS stock is also significant, with 48.4% of the shares held by company insiders. Over the last six months, insiders acquired a net 69,455 shares of Saul Centers stock. That high stake incentivizes the REIT’s insiders to deliver better business results.