Delek Logistics Stock: Dividend Grower Yielding 10.9%

Steady Dividends & Compelling Risk/Reward Trade-off With DKL Stock

Small-cap stocks have been lagging the broader market, but that doesn’t mean they aren’t worth a look. In reality, smaller companies tend to be more flexible in their strategies.

Finding small-cap, high-yield dividend payers with growing revenues, consistent profitability, and positive free cash flow (FCF) is rare. One such company is Delek Logistics Partners LP (NYSE:DKL), a midstream energy master limited partnership (MLP) with a market valuation around $1.84 billion.

To be classified as an MLP, a company must generate a minimum of 90% of its earnings from minerals and natural resources.

Delek Logistics acquires, constructs, and operates crude oil and refined product logistics and marketing assets. The company owns the assets via joint ventures. Key areas of interest include the Permian Basin, the Delaware Basin, and other regions in the Gulf Coast area. This includes Texas, Tennessee, and Arkansas. (Source: “Investor Presentation: December 2023,” Delek Logistics Partners LP, last accessed May 15, 2024.)

The partnership operates through four major business segments: Gathering & Processing, Wholesale Marketing and Terminalling, Storage & Transportation, and Pipeline Joint Ventures.

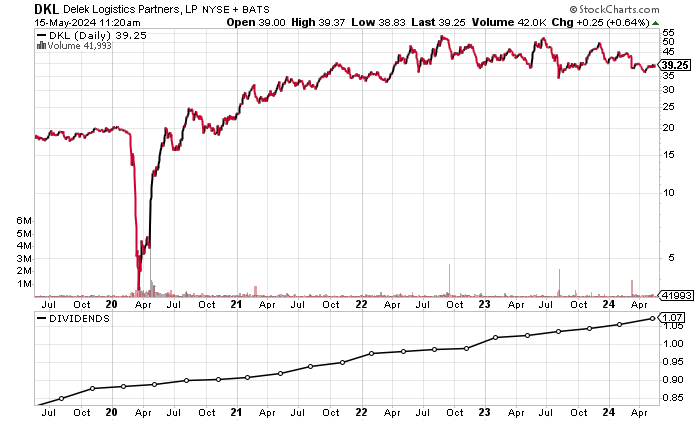

As of May 15, Delek Logistics stock is up by 0.3% over the past year and well below its record high of $64.47 in September 2022. This presents an opportunity to benefit from share-price appreciation while collecting steady dividends.

Chart courtesy of StockCharts.com

More Than $1 Billion in Annual Revenues in 2022 & 2023

Delek Logistics Partners LP’s revenues have risen by more than 70% from 2019 through 2023.

The partnership achieved double-digit revenue growth in 2021 and 2022. Moreover, due to acquisitions, it generated record-high revenues of more than $1.0 billion annually in the last two years. The company’s revenue compound annual growth rate (CAGR) for the 2019–2023 period was a healthy 14.6%.

Analysts predict that Delek Logistics will report revenue growth of 1.8% to $1.04 billion in 2024 and 2.1% to $1.06 billion in 2025. (Source: “Delek Logistics Partners, LP (DKL),” Yahoo! Finance, last accessed May 15, 2024.)

| Fiscal Year | Revenues | Growth |

| 2019 | $591.2 Million | N/A |

| 2020 | $570.6 Million | -3.5% |

| 2021 | $708.1 Million | 24.1% |

| 2022 | $1.04 Billion | 47.4% |

| 2023 | $1.02 Billion | -2.2% |

(Source: “Delek Logistics Partners L.P.” MarketWatch, last accessed May 15, 2024.)

Delek Logistics’ gross margins have held steady around the 30% level for the last five years. The company managed to expand its gross margin in 2023 following a drop in 2022.

| Fiscal Year | Gross Margin |

| 2019 | 30.2% |

| 2020 | 42.7% |

| 2021 | 36.7% |

| 2022 | 29.9% |

| 2023 | 36.5% |

On the bottom line, Delek Logistics Partners LP has consistently generated profits in terms of generally accepted accounting principles (GAAP)-diluted earnings per share (EPS). There have been inconsistencies, but overall, the results have been good. This means the company should have no problem continuing to pay dividends.

Analysts expect Delek Logistics Partners to report an earnings rebound to $3.45 per diluted share in 2024, followed by $4.04 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

That translates into a forward price-to-earnings (P/E) ratio of about 9.7 times the company’s consensus 2025 EPS estimate, which should provide some cushioning for the company.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $2.61 | N/A |

| 2020 | $4.18 | 60.4% |

| 2021 | $3.79 | -9.3% |

| 2022 | $3.66 | -3.6% |

| 2023 | $2.89 | -20.8% |

(Source: MarketWatch, op. cit.)

Delek Logistics Partners LP’s funds statement shows consistent positive FCF, with strong growth in three of the last four years. The company’s FCF rebounded in 2023 following a decline in 2022. The positive FCF allows Delek Logistics to pay dividends and other corporate expenses.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $122.1 | N/A |

| 2020 | $182.5 | 49.4% |

| 2021 | $259.9 | 42.4% |

| 2022 | $52.8 | -79.7% |

| 2023 | $138.2 | 161.8% |

(Source: MarketWatch, op. cit.)

A risk with Delek Logistics Partners LP is its debt of $1.7 billion, which is due to acquisitions. (Source: Yahoo! Finance, op. cit.)

Energy companies generally carry higher debt loads than other companies, so I’m not that concerned at this time.

Moreover, the following table shows that the company has been easily covering its interest expenses via significantly higher earnings before interest and taxes (EBIT), so no worries for now. The company had a reasonable interest coverage ratio of 1.9 times in 2023.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $202.4 | $42.9 |

| 2021 | $215.2 | $50.2 |

| 2022 | $241.7 | $82.3 |

| 2023 | $270.7 | $143.2 |

(Source: Yahoo! Finance, op. cit.)

Delek Logistics Partners LP’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—was an acceptable 6.0 in 2023. This is well above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Dividend Growth Streak of 11 Years From Delek Logistics Stock

DKL stock’s dividend has risen for 11 years straight. The stock’s dividend in May was $1.07 per share. (Source: “Delek Logistics Partners, L.P. Common Units Representing Limited Partner Interests (DKL) Dividend History,” Nasdaq, last accessed May 15, 2024.)

That represents a forward yield of 10.89% (as of this writing). Delek Logistics stock’s five-year average dividend yield was in line with that, at 10.08%. The company’s payout ratio of 142.7% appears to be high, but MLPs’ payout ratios tend to be much higher than those of other companies. (Source: Yahoo! Finance, op. cit.)

Given Delek Logistics Partners LP’s expected earnings growth, DKL stock’s dividends will likely continue rising.

| Metric | Value |

| Dividend Growth Streak | 11 Years |

| Dividend Streak | 12 Years |

| 7-Year Dividend CAGR | 6.9% |

| 10-Year Average Dividend Yield | 14.7% |

| Dividend Coverage Ratio | 1.3 |

The Lowdown on Delek Logistics Partners LP

Delek Logistics stock could be ideal for aggressive income investors who seek high-yield dividends and the potential for big capital gains.

DKL stock’s price weakness may be of interest to contrarian dividend investors, given Delek Logistics Partners LP’s history of steady dividend increases.