Battered Universal Health Realty Stock Is Yielding 9%

UHT Stock Is a Contrarian REIT Play

When interest rates begin to decline later this year, income-seekers who are currently investing in U.S. Treasuries will need to look for alternative higher-yielding assets.

A viable option is real estate investment trusts (REITs), which generally provide above-average dividend yields. Moreover, the expected decline in interest rates should help REITs reduce their financing costs and expand their margins and free cash flow (FCF).

On the smaller end, consider Universal Health Realty Income Trust (NYSE:UHT), which has a market valuation of $453.6 million. (Source: “Corporate Information,” Universal Health Realty Income Trust, last accessed April 17, 2024.)

The company has been around since 1986 as a REIT that focuses on health-care and human services-related facilities.

It has 26 investments in 21 states. The investments comprise acute care hospitals, childcare centers, emergency departments, medical office buildings, rehabilitation hospitals, and subacute care facilities.

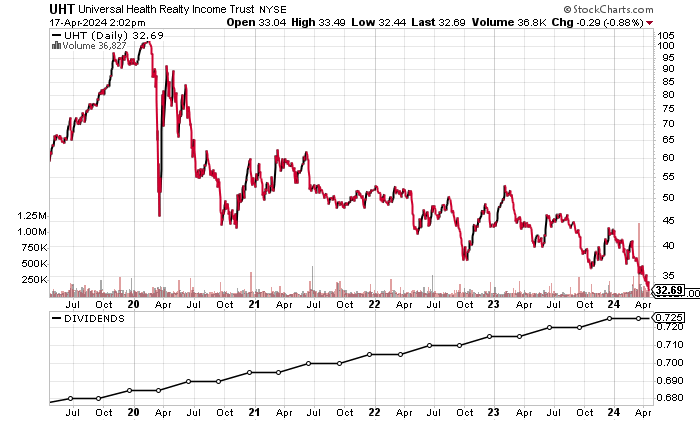

Although Universal Health Realty is small, I like its current risk/reward trade-off. As of April 17, its share price was down by 24.5% this year, and its new 52-week low was $32.44. Going back to February 2020, Universal Health Realty stock was trading 76% higher than it is now, at $132.41.

In my view, the stock’s price weakness provides an aggressive contrarian opportunity to be rewarded with above-average price appreciation while collecting dividends, which have continued to rise.

Chart courtesy of StockCharts.com

History of Profits & Positive FCF

Universal Health Realty Income Trust has reported higher revenues for the past four consecutive years, up to a record high in 2023.

Despite this, UHT stock’s share price is well below its record high, which was set in 2020.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $77.2 | N/A |

| 2020 | $78.0 | 1.1% |

| 2021 | $84.2 | 7.9% |

| 2022 | $90.6 | 7.6% |

| 2023 | $95.6 | 5.5% |

(Source: “Universal Health Realty Income Trust,” MarketWatch, last accessed April 17, 2024.)

Universal Health Realty has also consistently produced gross margins above 90%.

| Fiscal Year | Gross Margin |

| 2019 | 95.0% |

| 2020 | 94.8% |

| 2021 | 94.9% |

| 2022 | 94.4% |

| 2023 | 94.5% |

On the bottom line, Universal Health Realty Income Trust has consistently generated generally accepted accounting principles (GAAP) earnings-per-share (EPS) profits, but it needs to generate consistent EPS growth.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.38 | N/A |

| 2020 | $1.41 | 2.5% |

| 2021 | $7.92 | 460.8% |

| 2022 | $1.53 | -80.7% |

| 2023 | $1.11 | -27.1% |

(Source: MarketWatch, op. cit.)

Universal Health Realty Income Trust’s funds statement shows consistent positive FCF. This allows the REIT to continue paying for dividends and capital spending.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $42.9 | N/A |

| 2020 | $50.3 | 17.1% |

| 2021 | $46.3 | -7.9% |

| 2022 | $47.7 | 2.9% |

| 2023 | $43.5 | -8.8% |

(Source: MarketWatch, op. cit.)

Universal Health Realty’s balance sheet is manageable, despite carrying $370.4 million in total debt. (Source: “Universal Health Realty Income Trust (UHT),” Yahoo! Finance, last accessed April 17, 2024.)

The company’s cash on hand is $15.5 million, and its current ratio is a strong 8.73, indicating that its current assets are well above its current liabilities.

The REIT has managed to easily cover its annual interest expenses with higher earnings before interest and taxes (EBIT). The company’s 2023 interest coverage ratio of 1.7 could improve, but it’s acceptable for now.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $27.7 | $8.3 |

| 2021 | $118.0 | $8.8 |

| 2022 | $32.2 | $11.1 |

| 2023 | $37.4 | $22.0 |

(Source: Yahoo! Finance, op. cit.)

Universal Health Realty Income Trust’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a reasonable 5.0. This is just above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Universal Health Realty Stock’s Dividend Yield Above 5-Year Average

Universal Health Realty Income Trust’s forward dividend yield of 8.79% (as of this writing) is attractive and well above its five-year average dividend yield of 4.78%. UHT stock’s high yield is due to its lower share price. (Source: Yahoo! Finance, op. cit.)

I don’t see any reason why Universal Health Realty stock won’t continue paying dividends. I also expect it to extend its dividend growth streak.

| Metric | Value |

| Dividend Growth Streak | 37 Years |

| Dividend Streak | 38 Years |

| 7-Year Dividend Compound Annual Growth Rate | 1.5% |

| 10-Year Average Dividend Yield | 5.3% |

| Dividend Coverage Ratio | 1.1 |

The Lowdown on Universal Health Realty Income Trust

Universal Health Realty Income Trust could provide healthy returns to its shareholders if the company can improve its operations. In the meantime, income investors can collect nice regular dividends from UHT stock for assuming risk.

Note that Universal Health Realty stock has moderate institutional ownership, with 243 institutions holding 68.8% of its outstanding shares. The top two institutional investors are BlackRock Inc (NYSE:BLK), with 17.21% of the outstanding shares, and The Vanguard Group, Inc., with 16.23% of the outstanding shares. (Source: Yahoo! Finance, op. cit.)