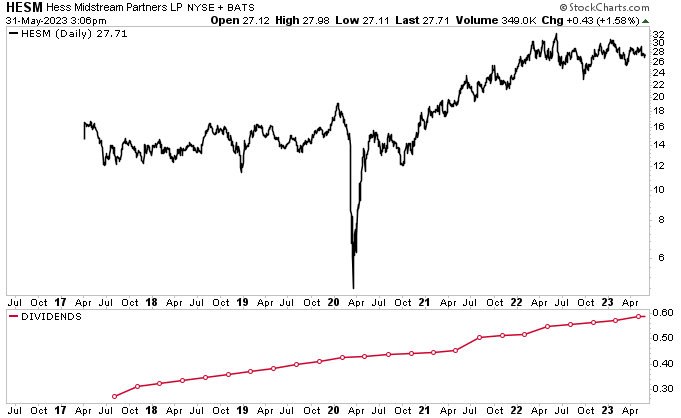

Hess Midstream Stock: 8.3%-Yielder Raises Payout for 26 Straight Quarters

HESM Stock’s Dividend Increased Every Quarter Since Its IPO

Oil prices remain near $70.00 per barrel and continue to face pressure from the U.S. debt ceiling issue and weaker-than-expected economic data from China. On the other hand, oil prices are expected to get a boost if the Organization of the Petroleum Exporting Countries Plus (OPEC+) announces new oil production cuts in early June.

If you like energy stocks but not the volatility and uncertainty of the market, maybe it’s a good time to take a look at Hess Midstream LP (NYSE:HESM).

Why? Despite economic uncertainty, Hess Midstream continues to report strong financial results. The partnership has been making so much money it has raised its quarterly dividends for the last 26 consecutive quarters. The likelihood of additional dividend increases from Hess Midstream stock is excellent, with the company’s management targeting annual dividend growth of at least five percent through 2025.

Why has Hess Midstream LP been doing so well despite industry headwinds? Unlike most energy companies, the partnership is a midstream company that’s on the receiving end of 85% fixed-fee, revenue-based contracts to gather, process, move, store, and export crude oil and natural gas.

The partnership owns, operates, develops, and acquires oil and gas and water midstream assets in the prolific North Dakota Bakken shale region. Hess Midstream provides its strategic infrastructure assets services to Hess Corp. (NYSE:HES) and a number of global third parties. (Source: “About Us,” Hess Midstream LP, last accessed June 1, 2023.)

As a result, the company’s bottom line isn’t susceptible to fluctuations in oil and gas prices. Hess Midstream is like a tollkeeper that collects money whether the company’s clients use its pipelines or not.

Minimum volume commitments provide the partnership with downside protection. Its contracts, which are set on a rolling three-year forward basis (send or pay), cannot be adjusted downward once set, and any shortfall payments are made quarterly.

Hess Midstream LP locks in its customers to long-term contracts; its commercial contracts extend through 2033. Its fees are set annually for all future years in the initial term to achieve contractual returns on capital deployed. On top of that, the partnership’s fees escalate each year based on the Consumer Price Index (CPI).

This provides Hess Midstream with reliable, growing cash flow and opportunities to expand its business and provide accretive financial gains to buy-and-hold HESM stockholders.

Hess Midstream LP Delivered Another “Solid” Quarter of Financials

For the first quarter ended March 31, Hess Midstream reported revenues and other income of $305.0 million, compared to $312.4 million in the same prior-year quarter. (Source: “Hess Midstream LP Reports Estimated Results for the First Quarter of 2023,” Hess Midstream LP, April 26, 2023.)

Its net income in the first quarter of 2023 came in at $142.2 million, compared to $159.6 million in the first quarter of 2022. After deduction for noncontrolling interests, the net income attributable to Hess Midstream in the first quarter was $142.2 million, or $0.47 per share, compared to $159.6 million, or $0.50 per share, in the same period last year.

In the first quarter, Hess Midstream LP’s distributable cash flow (DCF) was $196.6 million and its adjusted free cash flow (FCF) was $142.2 million. The partnership’s first-quarter net cash provided by operating activities was $198.7 million.

John Gatling, Hess Midstream’s president and CEO, commented, “We delivered a solid first quarter marked by execution of two key priorities, operational growth and return of capital to our shareholders.” (Source: Ibid.)

He added, “Our focus on gas capture is expected to drive increased volumes through our business, and we are well-positioned for both this continued throughput growth and the potential to return additional capital to our shareholders on a consistent and ongoing basis.”

Management Reaffirms 2023 Guidance

For full-year 2023, Hess Midstream LP expects to report:

- Net income in the range of $600.0 to $640 million

- Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the range of $900.0 million to $1.0 billion

- DCF in the range of $815.0 to $855.0 million

- Adjusted FCF in the range of $605.0 to $645.0 million

In January, Hess Midstream provided its return-of-capital framework through 2025. (Source: “Hess Midstream LP Announces 2023 Guidance and Return of Capital Framework Through 2025,” Hess Midstream LP, January 25, 2023.)

For 2023, the company expects its capital expenditures—which will be focused on expanding its gas compression capacity and gathering system well connections—to be approximately $225.0 million.

For 2024 and 2025, the partnership expects its net income and adjusted EBITDA to climb by at least 10% per year. The partnership expects that growth to be supported by gas processing and gathering throughput volumes that represent about 75% of its total affiliate revenues, excluding passthrough revenues.

Also for 2024 and 2025, the company expects its adjusted FCF to grow by more than 10% on an annualized basis, which would be more than sufficient to fully fund its targeted distribution increases. Through 2025, Hess Midstream LP has an annual distribution-per-share growth target of five percent, with expected annual distribution coverage of at least 1.4x.

“Hess Midstream is well-positioned, generating growing Adjusted EBITDA, Adjusted Free Cash Flow and distributions, underpinned by expected production growth in the Bakken,” said the company’s president and chief operating officer (COO), John Gatling.

He added, “With our robust balance sheet, unique contract structure, and strong cash flow generation, we have flexibility to deliver ongoing and significant return of capital to our shareholders.”

Hess Midstream Stock’s Payout Hiked For 26th Straight Quarter

Thanks to high cash flow generation, Hess Midstream has been able to raise its quarterly distribution every quarter since it went public in 2017. (Source: “Distribution Payments,” Hess Midstream LP, last accessed June 1, 2023.)

Most recently, in April, Hess Midstream announced it was increasing its first-quarter distribution by 2.7% quarter-over-quarter to $0.5851 per share, for a current inflation-crushing yield of 8.3%. This dividend was paid on May 12. (Source: “Hess Midstream LP Announces Distribution Per Share Level Increase; Increases Quarterly Distribution,” Hess Midstream LP, April 24, 2023.)

Commenting on the increase, Jonathan Stein, the company’s chief financial officer (CFO), said, “We continue to use our financial flexibility to deliver consistent and ongoing return of capital to our shareholders.” (Source: Ibid.)

He added, “We expect to continue to have more than $1 billion of financial flexibility through 2025 that can be used to support our return of capital framework, including potential additional and ongoing unit repurchases that could support further distribution per share level increases.”

Stein said Hess Midstream LP expects to target annual distribution growth per common share of at least five percent through 2025.

HESM stock’s reliably growing distributions can help income hogs weather the current pressure on oil and gas prices.

Share-Price Performance & Forecast

Despite consistently solid financial results, cash flow generation, and guidance, Hess Midstream stock is mostly in the red, down by 3.9% since the start of 2023 and down by 8.3% year-over-year (as of this writing).

That’s a bearish performance for a company that expects to report net income of about $620.0 million for 2023 and increases to its net income and adjusted EBITDA of at least 10% per year for 2024 and 2025.

Chart courtesy of StockCharts.com

Wall Street analysts think HESM stock is trading at a bargain. They’ve provided a 12-month share-price target for Hess Midstream LP in the range of $34.50 to $35.00 per share. This points to potential gains in the range of about 24% to 27%.

That’s far better than the prediction by one analyst that the S&P 500 will tumble by at least 45% in 2023. (Source: “A 31-Year Market Vet Who Called the Current Bear Market Warns an Impending Credit Crunch and Recession Will Sink Stocks by 45% as Valuations Remain Higher Than Dot-Com Bubble Levels,” Business Insider, May 13, 2023.)

The Lowdown on Hess Midstream LP

The energy sector was the biggest winner of the stock market in 2021 and 2022, and it’s expected to outperform the market again in 2023. Chances are high that energy stocks won’t notch up the market’s biggest gains this year (it’s going to be tough to catch up to technology and communication services stocks), but with Hess Midstream LP throwing off so much cash, its dividends will be hard to beat.

As noted above, with 85% of its revenue protected by three-year minimum volume commitments and annual fee increases based on CPI escalations, it doesn’t really matter how the economy does or what the price of oil and gas is; Hess Midstream LP’s cash flow is protected and growing.

This helps explain how the partnership has been able to grow its EBITDA every year since it formed in 2015, even during two oil price downturns. From 2015 to 2023, the company’s adjusted EBITDA has expanded at a compound annual growth rate (CAGR) of 20%.

This also helps explain how the partnership has been able to increase Hess Midstream stock’s distribution for the last 26 consecutive quarters.