Realty Income Corp Stock Has Paid 630 Consecutive Monthly Dividends

Why O Stock Is Compelling in 2023

What’s better than reliable, growing, quarterly dividends? Monthly ones. That’s what sets Realty Income Corp (NYSE:O) apart from its peers.

At a time when inflation, rising interest rates, and a looming recession have been leading some companies to cut or suspend their dividends, Realty Income Corp has been living up to its nickname as “The Monthly Dividend Company.” Realty Income Corp stock has paid dividends for more than 600 consecutive months, and management has raised O stock’s dividends for more than 100 consecutive months.

Realty Income is the largest triple-net real estate investment trust (REIT) in the U.S. and the fourth-largest REIT globally. The company owns more than 11,700 real estate properties in all 50 U.S. states, Puerto Rico, the U.K., and Spain. (Source: “Investor Presentation: December 2022,” Realty Income Corp, last accessed January 10, 2023.)

The REIT’s properties are under long-term net lease agreements with about 1,150 tenants in about 80 industries. The REIT currently gets 84% of its rent from retail tenants. Thanks to the company’s diverse tenants, about 90% of its total rent is resilient during economic downturns and/or is isolated from e-commerce pressures.

As of the end of September 2022, Realty Income Corp’s properties had an occupancy rate of 98.9%, with 131 properties available for lease or sale. That’s compared to 98.9% as of June 30, 2022 and 98.8% as of September 30, 2021. (Source: “Realty Income Announces Operating Results for the Three and Nine Months Ended September 30, 2022,” Realty Income Corp, November 2, 2022.)

Some of the company’s top clients are 7-Eleven, Dollar General Corp (NYSE:DG), FedEx Corporation (NYSE:FDX), and Walgreens Boots Alliance Inc (NASDAQ:WBA).

Recent Property Acquisitions

To maintain its status as one of the largest global REITs, Realty Income needs to continually expand and diversify its property portfolio. The company was busy doing that in 2022.

In February 2022, Realty Income signed a definitive agreement to acquire the Encore Boston Harbor Resort and Casino property for $1.7 billion in a long-term net lease agreement with Wynn Resorts, Limited (NASDAQ:WYNN). (Source: “Realty Income Announces $1.7 Billion Sale-Leaseback of Encore Boston Harbor Through Partnership With Wynn Resorts,” Realty Income Corp, February 15, 2022.)

The sale-leaseback transaction with Wynn Resorts is expected to be executed at a 5.9% initial cash cap rate on a 30-year lease that increases the rent at the rate of the consumer price index, with a floor of 1.75% and a ceiling of 2.5%.

Realty Income Corp’s acquisition of the Encore Boston Harbor Resort and Casino is the REIT’s first foray into the gaming sector. It will make the company less sensitive to downturns in retail spending.

On December 30, 2022, Realty Income announced that it had signed a definitive agreement to acquire up to 185 single-tenant retail and industrial properties from subsidiaries of CIM Real Estate Finance Trust, Inc., for approximately $894.0 million in cash. This transaction is expected to close in the first quarter of 2023. (Source: “Realty Income to Acquire Properties from CIM Real Estate Finance Trust, Inc. for $894 Million, 7.1% Cash Cap Rate,” Realty Income Corp, December 30, 2022.)

The properties from CIM Real Estate Finance Trust, which cover up to 4.6 million square feet, are leased to 55 retail clients (95% of the properties) and four industrial clients (five percent of the properties).

Drug stores, home improvement retailers, and grocery stores are expected to be the top three sectors in terms of the properties’ total annualized contractual rent—at 12.1%, 12.1%, and 11.9%, respectively. Lowe’s Companies Inc (NYSE:LOW) and Walgreens are expected to be the top two clients in terms of total annualized contractual rent—at 11.9% and 7.6%, respectively.

Strong Third-Quarter Financials

For the third quarter of 2022, which ended September 30, Realty Income announced that its net income jumped to $837.3 million, or $0.36 per share, from $489.9 million, or $0.34 per share, in the same period of 2021. (Source: Realty Income Corp, November 2, 2022, op. cit.)

The REIT’s normalized funds from operations (FFO) increased in the third quarter of 2022 by nine percent year-over-year to $0.97, while its adjusted FFO went up by 7.7% year-over-year to $0.98.

During the third quarter of 2022, the company invested $1.9 billion in 375 properties, including properties under development or expansion. Of that amount, $613.0 million was invested in Europe.

Sumit Roy, Realty Income Corp’s president and CEO, noted, “…the operating fundamentals of our business remain healthy as we finished the quarter with occupancy of 98.9% while registering a rent recapture rate of 108.5% on properties re-leased. We are fortunate to manage a consistent business model that provides dependable results, and believe we are well-positioned to continue generating long-term value for shareholders.” (Source: Realty Income Corp, November 2, 2022, op. cit.)

Realty Income Corp Stock’s Payout Increased for 118th Consecutive Quarter

Realty Income Corp’s growing, diverse property portfolio brings in reliable cash flow, which management returns to investors in the form of reliable, high-yield dividends.

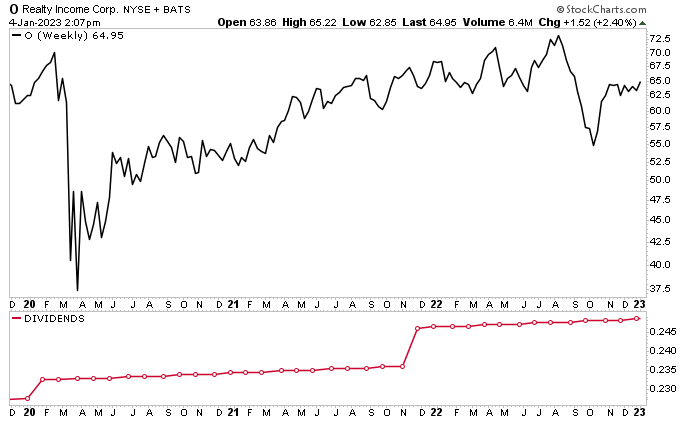

On December 12, the REIT increased its monthly cash dividend to $0.2485 per share, for a yield of 4.7% (more than double the yield of the S&P 500). This was the company’s 118th dividend increase since O stock got listed on the New York Stock Exchange in 1994. (Source: “118th Common Stock Monthly Dividend Increase Declared by Realty Income,” Realty Income Corp, December 13, 2022.)

The REIT continuing to raise its monthly dividends, no matter how large or small the increases were, is a testament to the strength of the company, as well as management’s optimism.

In 2020, during the COVID-19 pandemic, Realty Income achieved 3.1% dividend growth. That year, the company was one of seven retail REITs, eight retail net lease REITs, and 15 S&P 500 REITs to increase their dividends. Also in 2022, Realty Income was one of four retail net lease REITs, four retail REITs, and seven S&P 500 REITs to have positive earnings growth.

Realty Income Corp stock’s reliable, growing dividends—coupled with superb long-term stock market gains—have resulted in a compound annual total shareholder return of 14.4% since the company went public in 1994. The stock hasn’t yet fully recovered from the COVID-19 stock market crash of 2020; it needs to climb by 15% to do that.

O stock has still outperformed the broader market, rising by about seven percent over the last three months and only falling by about 6.5% in 2022. Being in the red is nothing to get excited about, but the S&P 500 is flat over the last three months, and it went down by approximately 20% in 2022.

Chart courtesy of StockCharts.com

The Lowdown on Realty Income Corp

At a time when stocks are deep in the red, with many companies cutting or suspending their dividends, it’s nice to see Realty Income Corp stock bucking the trend.

As mentioned earlier, Realty Income Corp has paid 630 consecutive monthly dividends throughout its 53-year history, and it has raised its dividends 118 times since going public in 1994. Since then, O stock has achieved an inflation-crushing total return of 14.4%, with its dividends growing at an annual compound rate of 4.4%.

This bodes well for Realty Income Corp’s share price and future dividends.