Bullish 5.9%-Yielding Gaming and Leisure Properties Stock Pays Special Dividends

GLPI stock Rises Again

The COVID-19 pandemic was brutal for most businesses. Locked-up people wanted to get out, but with flights canceled and quarantine orders in place, they were forced to hunker down at home. Suffice it to say, tourism businesses took a huge hit, including Gaming and Leisure Properties Inc (NASDAQ:GLPI), the first gambling-focused real estate investment trust (REIT) in the U.S.

The company’s property portfolio consists of 57 gaming facilities in 17 U.S. states. Those facilities’ amenities include more than 5,600 hotel rooms on almost 6,000 acres. (Source: “Overview,” Gaming and Leisure Properties Inc, last accessed September 19, 2022.)

During the second quarter of this year, the company completed its acquisition of three casino properties in Black Hawk, CO plus a casino and Hotel in Rock Island, IL from Bally’s Corp (NYSE:BALY) for $150.0 million. Bally’s Corp will be leasing back these properties, with the rents increasing by $12.0 million annually. (Source: “Bally’s Transaction & Company Overview: July 2022,” Gaming and Leisure Properties Inc, last accessed September 19, 2022.)

In June, the REIT expanded its relationship with Bally’s Corp, acquiring two Rhode Island casino properties for $1.0 billion. Both properties are expected to be added to the existing Bally’s Corp master lease and bring in an additional annual rental stream of $76.3 million.

Three of Gaming and Leisure Properties Inc’s other tenants are PENN Entertainment Inc (NASDAQ:PENN), Caesars Entertainment Inc (NASDAQ:CZR), and Boyd Gaming Corporation (NYSE:BYD).

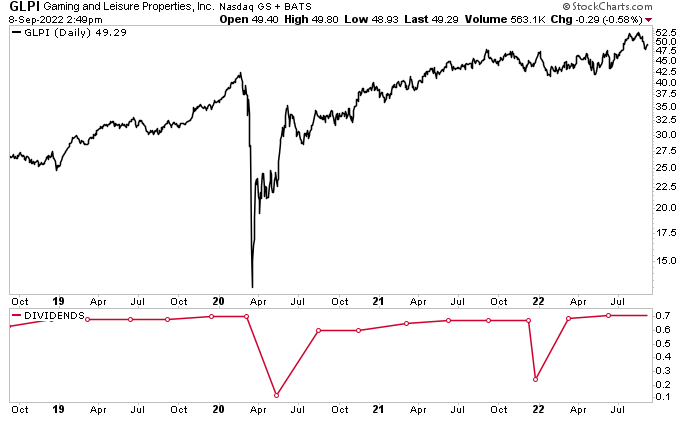

Gaming and Leisure stock was trading at record levels at the end of 2019. That momentum was abruptly upended in February 2020 by COVID-19. Over just a few weeks, GLPI stock crumbled, losing 70% of its value. After taking a big hit during the early days of the COVID-19 pandemic, gaming stocks rebounded as quarantine orders were lifted and international travel resumed.

It took a while, but Gaming and Leisure Properties stock has clawed its way back up to above its pre-pandemic level. As of this writing, GLPI stock is up by:

- Five percent over the last three months

- 15% over the last six months

- Five percent year-to-date

- Two percent year-over-year

Not massive gains, but gains nonetheless—and far better than the S&P 500 and Nasdaq.

Chart courtesy of StockCharts.com

Gaming and Leisure Properties Inc Increases Quarterly Dividend to $0.705

In addition to share-price appreciation, Gaming and Leisure Properties Inc provides its shareholders with stable dividends. Even during the pandemic, the REIT continued to pay dividends—although it reduced the annual payout from $2.74 per share in 2019 to $2.50 per share in 2020. (Source: “Dividend History,” Gaming and Leisure Properties Inc, last accessed September 19, 2022.)

Thanks to strong financial results, the company has resumed hiking its dividends annually. In full-year 2021, it paid out $2.66 per share. At the end of that year, the company also announced a special dividend of $0.24 per share, boosting Gaming and Leisure Properties stock’s payout to $2.90 per share.

GLPI stock currently pays a quarterly dividend of $0.705 per share, for a yield of 5.9%.

Record Second-Quarter Financial Results

For the second quarter ended June 30, Gaming and Leisure Properties Inc announced that its revenues increased by three percent year-over-year to $326.5 million. Its income from operations went up by 12% year-over-year to $237.1 million. (Source: “Gaming and Leisure Properties, Inc. Reports Second Quarter 2022 Results and Initiates 2022 Full Year AFFO Guidance,” Gaming and Leisure Properties Inc, July 28, 2022.)

The company reported second-quarter net income of $155.8 million, or $0.61 per share, up from $138.2 million, or $0.59 per share, in the same prior-year period. Its funds from operations (FFO) increased by 10% year-over-year to $215.3 million, or $0.84 per share. Its adjusted FFO went up by 13.6% year-over-year to $231.6 million, or $0.91 per share.

Commenting on the results, Peter Carlino, Gaming and Leisure Properties Inc’s chairman and CEO, said, “GLPI’s record second quarter results and our ongoing momentum highlight the value of our strategic, accretive approach to the expansion and diversification of our portfolio of top-performing regional gaming assets managed by leading operators, while carefully managing our capital structure and cost of capital.” (Source: Ibid.)

Carlino continued, “We continue to benefit from new and innovative growth opportunities with existing and new tenants, while driving increased capital returns to shareholders in the form of growing dividends. Given the predictability of our rental revenue streams, we believe the resiliency of our portfolio will be highlighted in the current economic environment.”

The Lowdown on Gaming and Leisure Properties Stock

Gaming and Leisure Properties stock is a high-yield dividend stock that can help investors fight runaway inflation.

Gaming and Leisure Properties Inc has a diverse portfolio of gambling properties across the U.S, a record of high earnings growth, and a history of providing high-yield dividends to its shareholders. Management said the company is well positioned to deliver record results in the second half of this year as it further expands, diversifies its property portfolio, and generates cash from recent transactions and rent escalators.