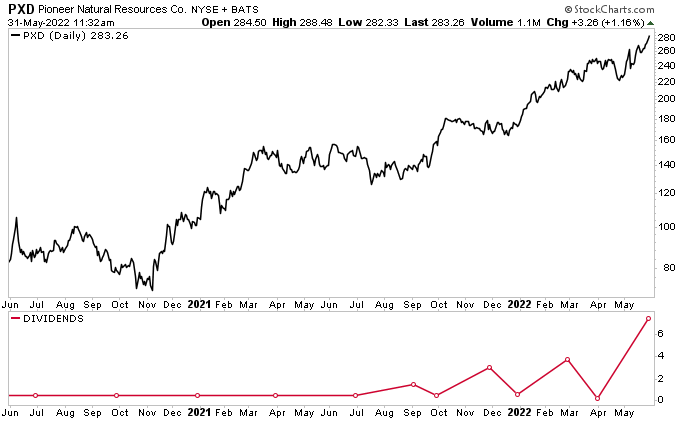

4.4%-Yielding Pioneer Natural Resources Stock Up 101% YOY

Pioneer Natural Resources Co Hikes Dividend 95%

When it comes to safe, high-yield dividends, one of the most important things to consider is the company’s free cash flow. The more money a company has, the more it can pay out to investors.

One company that pays safe, high-yield dividends is Pioneer Natural Resources Co (NYSE:PXD), the largest pure-play independent oil and natural gas company in the Midland Basin of West Texas.

The company holds approximately 976,000 gross acres, of which 961,000 are in the Spraberry/Wolfcamp field in the Midland Basin. The oil produced from the Spraberry/Wolfcamp field is West Texas Intermediate sweet oil. The natural gas produced from that field is casinghead gas, with an average energy content of 1,400 British thermal units (Btus). (Source: “Pioneer Natural Resources Co,” Reuters, last accessed June 1, 2022.)

The oil and natural gas are produced primarily from six formations: Spraberry, Jo Mill, Dean, Wolfcamp, Strawn, and Atoka. The company’s subsidiaries include Pioneer Natural Resources USA, Inc., Pioneer Sands LLC, and Pioneer Uravan, Inc.

Wonderful Q1 Results

As the leading oil and gas producer in one of the most venerable Permian basins in the U.S., Pioneer Natural Resources Co earns bucketloads of cash.

For the first quarter of 2022, the company reported net income of $2.0 billion, or $7.85 per share. Its first-quarter revenue went up by 115% year-over-year to $3.9 billion. (Source: “Pioneer Natural resources Reports First Quarter 2022 Financial and Operating Results,” Pioneer Natural Resources Co, May 4, 2022.)

In the first quarter of 2022, the company’s average realized price for oil was $94.60 per barrel. Its average realized price for natural gas liquid (NGL) was $41.37 per barrel. Its average realized price for gas was $4.81 per thousand cubic feet. Pioneer Natural Resources Co’s production costs, including taxes, averaged $11.14 per barrel of oil equivalent (BOE).

The company continues to maintain a solid balance sheet, with unrestricted cash on hand at the end of the first quarter of $2.4 billion and net debt of $3.3 billion. It had $4.4 billion of liquidity as of March 31.

For dividend hogs, the company generated first-quarter free cash flow of $2.3 billion.

PXD Stock Returns 88% of Free Cash Flow to Shareholders

Pioneer Natural Resources Co was an early adopter of a dividend strategy to pay a base quarterly dividend that the company tops up with a much higher-variable dividend that’s dependent on its cash flow and other metrics.

Through this strategy, the company can provide investors with larger payouts during the fat years without (hopefully) needing to cut its payouts during the lean years. This, coupled with its aggressive share-repurchase program, creates significant long-term value for Pioneer Natural Resources stockholders.

For the second quarter of 2022, Pioneer Natural Resources Co’s board of directors declared a quarterly base-plus-variable dividend of $7.38 per share, made up of a $0.78 base dividend and a $6.60 variable dividend. This works out to a yield of 4.4%. It also represents a 95% increase over the first-quarter 2022 payout of $3.78 per share.

The company’s payout ratio is just 32.9%, which is way below the 90% threshold I like to see. This gives management more than enough financial wiggle room to boost its base-plus-variable dividend in the coming quarters.

As for the aforementioned share-repurchase program, during the first quarter of 2022, the company repurchased $250.0 million common shares of PXD stock at an average price of $237.00 per share.

The combination of the second-quarter dividends and first-quarter share repurchases represents a total annual stockholder return of approximately 15%.

2022 Business Outlook

Pioneer Natural Resources Co expects its 2022 total capital budget (which is fully funded from its 2022 operating cash flow) to range from $3.3 to $3.6 billion. The company expects its 2022 operating cash flow to be greater than $12.5 billion.

In 2022, the company plans to operate an average of 22 to 24 horizontal drilling rigs in the Midland Basin. Pioneer Natural Resources also expects to produce 350,000 to 365,000 barrels of oil per day and 623,000 to 648,000 BOE per day.

Wall Street analysts are increasingly bullish on Pioneer Natural Resources stock, as evidenced by the number of upward revisions they’ve provided on the company’s earnings.

Over the last 90 days, analysts’ estimates for the company’s earnings per share (EPS) for the current quarter, next quarter, current year, and 2023 have all climbed significantly. Three months ago, analysts’ consensus estimate for the company’s 2022 EPS was $21.65, and now it’s $30.93. Meanwhile, their estimate for the company’s 2023 EPS jumped from $20.49 to $27.02. (Source: “Pioneer Natural Resources Company (PXD)” Yahoo! Finance, last accessed June 1, 2022.)

Recent Share-Price Performance

Pioneer Natural Resources Co’s strong outlook—which includes drilling longer laterals, reducing drilling days per well, completing more feet per day, and improving operational efficiencies—continues to enhance the company’s capital efficiency and mitigate inflationary pressures that are being felt by the broader industry.

The company’s excellent financial results and analyst estimates have been helping propel PXD stock significantly higher. As of this writing, Pioneer Natural Resources stock is up by:

- 25% over the last month

- 21% over the last three months

- 66% over the last six months

- 62% year-to-date

- 101% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on Pioneer Natural Resources Stock

Pioneer Natural Resources Co is a top-tier independent exploration and production company with a proven track record of returning value to shareholders in the form of high-yield dividends and opportunistic share repurchases.

The company’s returns-focused investment framework, which prioritizes free cash flow and allows for disciplined oil growth of up to five percent, is anchored by its deep inventory of high-return well locations in low-risk, predictable basins in the U.S.

The company says this enviable combination should allow PXD stock to deliver sustainable and durable long-term value to shareholders for decades.