Synovus Financial Corp. Hikes Dividend During COVID-19

Synovus Stock Is a Rock-Solid Dividend Stock

If the recent, irrational stock-buying frenzy in GameStop Corp. (NYSE:GME), BlackBerry Ltd (NYSE:BB), and BB Liquidating Inc (OTCMKTS:BLIAQ) has you scratching your head, wondering why inexperienced day traders are happy to lose money, I suggest you take a look at Synovus Financial Corp. (NYSE:SNV) instead.

A rock-solid dividend stock, SNV stock has raised its annual dividend for the last seven consecutive years. And it looks like the company is going to announce another dividend hike in March.

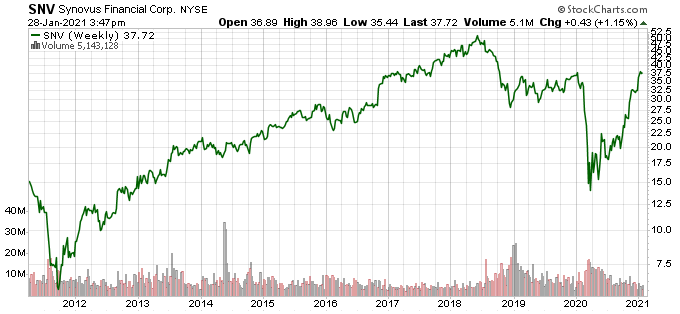

Synovus stock also has a history (save for the odd hiccup, which creates a great entry price) of providing investors with strong capital appreciation.

Moreover, Synovus Financial Corp. recently announced strong fourth-quarter financial results that topped earnings and revenue estimates. In fact, the company has topped the consensus earnings estimates for three of the last four quarters.

Bank stocks might not be as exciting as tech stocks or the various stocks pumped by social media sites, but there’s something to be said for a reliable, inflation-trouncing dividend yield from a company with strong operations.

Chart courtesy of StockCharts.com

Synovus Financial Corp. is the holding company for Synovus Bank, which provides various financial products and services. Based in Columbus, GA, the company has approximately $53.0 billion in assets. (Source: “Company Profile,” Synovus Financial Corp., last accessed January 29, 2021.)

Synovus provides commercial and retail banking, investment services, and mortgage services through 289 branches in Georgia, Alabama, South Carolina, Florida, and Tennessee.

The company’s commercial banking services include treasury management, asset management, capital market, and institutional trust services—as well as commercial, financial, and real estate loans.

Synovus Financial Corp.’s retail banking segment accepts deposits, provides mortgages and other consumer loans, investment services, brokerage services, safe deposit services, automated banking services, credit cards, and debit cards.

Synovus also offers other financial services, including portfolio management for fixed-income securities, investment banking, asset management, and financial planning.

7 Consecutive Years of Dividend Growth

SNV stock probably isn’t on a lot of investors’ radar because it’s not a so-called Dividend Champion (a company with 25+ years of raising its annual dividend), nor a Dividend Contender (a company that has increased its dividend for 10-25 years).

It’s close, though. Synovus Financial Corp. has increased its annual dividend for the last seven consecutive years—and some of the increases have been pretty substantial.

|

Year |

Annual Dividend |

Year-Over-Year Increase |

|

2020 |

$1.32 |

10% |

|

2019 |

$1.20 |

20% |

|

2018 |

$1.00 |

66% |

|

2017 |

$0.60 |

25% |

|

2016 |

$0.48 |

14% |

|

2015 |

$0.42 |

35% |

|

2014 |

$0.31 |

N/A |

(Source: “SNV Dividend History,” Nasdaq, last accessed January 29, 2021.)

Synovus stock currently pays an annual dividend rate of $1.32 and has a 3.6% yield. As you can see from the above chart, since 2014, the company has raised its annual dividend by 322%. It even increased the dividend by 10% in 2020, the year that COVID-19 wreaked havoc on the global economy.

Chances are good that Synovus Financial Corp. will raise its dividend again in 2021. Since 2017, the company has increased its dividend in March.

While some income hogs might balk at SNV stock’s dividend yield of 3.6%, that’s one of the highest dividend yields in the financial sector.

And you can be certain it’s safe. In 2020, when Synovus stock paid out $1.32 in dividends, its full-year net income was $340.5 million, or $2.30 per share. As of this writing, the company’s payout ratio is just 57.3%, which is far below the 90% threshold I like to see. The company also has an earnings yield of 6.1%.

Q4 Earnings and Revenue Beat

On January 26, Synovus announced its financial results for the fourth quarter ended December 31, 2020. The company reported net income of $142.1 million, or $0.96 per diluted share. That’s compared to $83.3 million ($0.56 per share) in the third quarter of 2020 and $143.3 million ($0.97 per share) in the fourth quarter of 2019. (Source: “Synovus Announces Earnings for the Fourth Quarter 2020,” Synovus Financial Corp., January 26, 2021.)

The company’s fourth-quarter adjusted net income was $160.6 million ($1.08 per share), compared to $131.3 million ($0.89 per share) in the third quarter of 2020 and $140.0 million ($0.94 per share) in the fourth quarter of 2019.

Its fourth-quarter revenue was $501.5 million, compared to $492.3 million in the third quarter of 2020 and $497.9 million in the fourth quarter of 2019.

Synovus Financial Corp.’s full-year 2020 net income was $340.5 million ($2.30 per share), compared to $540.9 million ($3.47 per share) in full-year 2019. Its adjusted earnings per share were $2.41 in 2020, compared to $3.90 in 2019.

The company’s full-year 2020 revenue was $2.02 billion, versus $1.95 billion in 2019.

“During 2020, we delivered approximately 19,000 PPP loans totaling $2.9 billion to small business customers throughout the Southeast and grew core transaction deposits $8.6 billion,” said Kessel Stelling, chairman and CEO. (Source: Ibid.)

“In the year ahead, we expect our Synovus Forward initiatives to produce additional revenue opportunities, expense savings, and efficiencies that will further strengthen our bank.”

The Bottom Line on Synovus Financial Corp.

Synovus Financial Corp. does what it’s supposed to: make a lot of money.

Despite the coronavirus pandemic, the banking company reported a fourth-quarter earnings and revenue beat. Synovus ended 2020 with higher capital levels, improved liquidity, and strong credit quality. That furthered the strength and resiliency of the company’s balance sheet in a challenging economic environment.

All of which bodes well for Synovus stock in 2021 and the coming years.