Can Kinder Morgan Inc Fund Its 7.4% Dividend Yield?

The Skinny on Kinder Morgan Inc’s Fat 7.4% Dividend Yield

Evaluating a company’s dividend nowadays is quite a challenge. The COVID-19-related recession has forced many companies to withdraw their guidance. And no analyst can accurately forecast the impact of rolling shutdowns, plunging sales, and spiking case counts.

But one company has held up relatively fine: Kinder Morgan Inc (NYSE:KMI).

Kinder Morgan is a master limited partnership (MLP) that owns an extensive network of energy pipelines. These pipelines serve as the “toll roads” of the oil patch, earning steady fees by transporting commodities.

Kinder Morgan Inc.’s portfolio includes:

- A 34% interest in the Gulf Coast Express pipeline, which transports 2.0 billion cubic feet per day of natural gas from the Permian Basin to ports on the Gulf Coast

- The Bear Creek Storage facility in Louisiana, which can hold approximately 59.0 billion cubic feet of natural gas

- A 49% interest in the Elba Island LNG terminal, which has the capacity to export approximately 2.5 million tonnes of liquefied natural gas per year

The MLP’s management expects that these businesses will continue to perform well.

In the pipeline industry, analysts measure performance through a metric called distributable cash flow. This metric provides a better insight into the cash available to pay unitholders than traditional profits.

For full-year 2020, Kinder Morgan executives project that the MLP will generate $5.1 billion in distributable cash flow. That’s down 10% from what the business made in 2019. But it’s more than enough to fund the partnership’s distribution—with enough cash left over to invest in new projects and pay down debt. (Source: “November 2020 Investor Update,” Kinder Morgan Inc, last accessed November 23, 2020.)

Furthermore, management continues to make strides to shore up the partnership’s balance sheet.

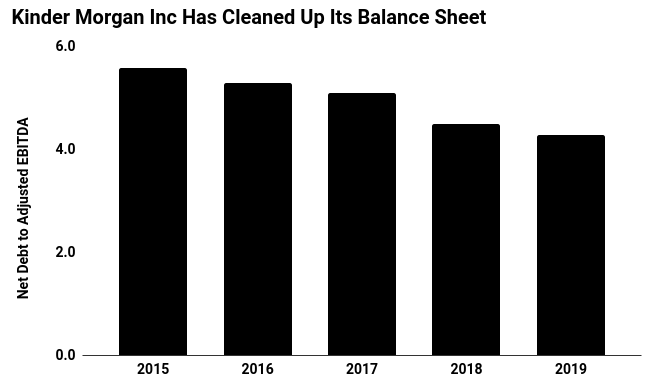

Over the past four years, Kinder Morgan has paid off $10.0 billion in long-term debt. That has reduced the partnership’s ratio of net debt to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from 5.6× in 2015 to 4.3× today.

These efforts have put the business on a much firmer financial foundation, saving it hundreds of millions of dollars in annual interest payments. With fewer creditors to pay, Kinder Morgan Inc. has more funds left over to reward its unitholders.

(Source: Ibid.)

The big risk here? Kinder Morgan’s fortunes are linked to long-term energy prices.

So far, the total volume of commodities flowing through the partnership’s network has remained relatively consistent. But a sustained period of weak energy prices would force drillers upstream to reduce their production. And that would eventually show up in weaker profits for Kinder Morgan.

That said, investors are getting well compensated for the risks they’re taking with KMI stock. Prospective unitholders will probably be content with an upfront yield of seven percent. Any growth that the business can deliver on top of that payout would be a bonus.

Bottom line: Kinder Morgan Inc’s seven percent yield looks safe for now.