Dunkin Brands Group Inc: This Dividend Stock Is Quietly Beating the Market

Dunkin Brands Group Inc Keeps Paying Out More

If you understand the two most important numbers in business, then you can make a lot of money in the stock market: 80/20.

The “80/20 rule” states that 80% of an industry’s profits comes from 20% of the work. Savvy executives exploit this principle by zeroing in on the most profitable activities in their business, leaving the grunt work to others. If you look at top dividend stocks like Nike Inc (NYSE:NKE), Microsoft Corporation (NASDAQ:MSFT), and Coca-Cola Co (NYSE:KO), they all follow this rule to make massive profits for shareholders.

Case in point: Dunkin Brands Group Inc (NASDAQ:DNKN), owner of the popular “Dunkin Donuts” chain. Now, most people would assume this company earns its money from the sale of coffee, donuts, and other fast foods. The real story, however, is more interesting.

Dunkin Brands, in fact, doesn’t own a single restaurant. Instead, the company collects royalties from franchisees that actually manage the day-to-day operations of the stores. And this small distinction has resulted in big returns for shareholders.

At first glance, the strategy doesn’t make sense. By contracting out operations, management has to cut franchisees in on the company’s profits. That leaves less money left over to pay Dunkin Brands stock investors.

But by going down this route, executives still exploit the rule of 80/20. Running a restaurant represents the hardest, least-profitable part of the fast-food business. By outsourcing operations, the franchisees have to front the cost of starting new stores, training workers, and handling customers. Dunkin Brands, meanwhile, can kick up its feet and collect a royalty on each sale. This allows the company to collect 80% of the industry’s profits while putting up only 20% of the capital.

This model has turned the company into a money machine. In the restaurant industry, the typical business earns about $0.05 in profit on every dollar of debt and equity invested in operations. Dunkin Brands Group Inc, by comparison, earned over $0.18 on the dollar last year.

This type of return puts the company in the same league of elite dividend stocks like PepsiCo, Inc. (NASDAQ:PEP), and Colgate-Palmolive Company (NYSE:CL).

For DNKN stock holders, this has created quite the income stream. Executives have boosted the distribution on seven occasions since 2011, raising the yield on shares to almost 1.9%. (Source: “Dividend History,” Dunkin Brands Group Inc, last accessed September 11, 2019.)

In addition to dividends, management also returns an enormous amount of cash to shareholders through stock buybacks—which totaled $585.0 million last year alone. If you factor this into your yield calculation, it boosts the payout on shares to almost 10%.

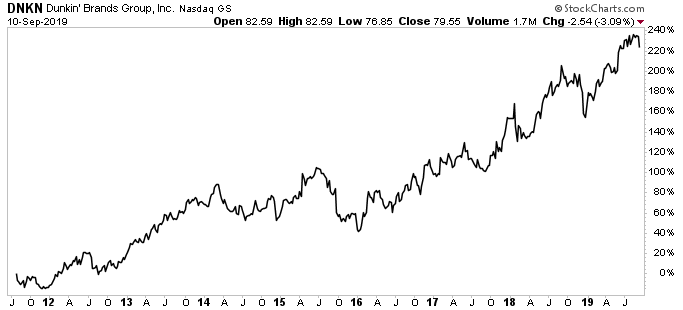

Wall Street, it seems, has taken notice. Since Dunkin Brands stock’s initial public offering (IPO) in mid-2011, its shares have delivered a total return, including dividends, of 227%. That beats the pants off of the broader S&P 500, which gained only 135% over the same period.

Chart courtesy of StockCharts.com

Dunkin Brands Group Inc’s expansion plans should allow those returns to keep rolling in. Outside of the Northeast, the company has relatively little presence across most of the United States. Dunkin has also enjoyed success rolling out new stores in international markets like Asia and Europe. That implies the business has a long growth runway ahead of it.

That growth could pay off for DNKN stock owners. With each new store, the company increases its stream of royalty income. But because franchises shoulder all of the costs for this expansion, Dunkin’s expenses stay fairly flat. This could result in explosive profit (and dividend) growth, even if revenues increase at only a modest clip.

That’s the benefit of exploiting the 80/20 rule.