This 7% Yield Is Just What the Doctor Ordered

A High-Yield Healthcare Stock

If you want to earn more dividend income from the stock market, then you need to start investing in healthcare.

Analysts project that the number of Americans 65 and older will double by 2060. That means more prescriptions, more checkups, and more doctor appointments.

One of the big winners from this boom is Omega Healthcare Investors Inc (NYSE:OHI). Over the years, the partnership has built an empire of elder care facilities nationwide. And with the ranks of seniors growing by the day, these properties have become money machines.

But can you trust any business that pays a seven-percent dividend? Savvy readers will ask this question before pulling the trigger on any high-yield stock.

Can You Trust Omega Healthcare Investors Inc’s 7% Yield?

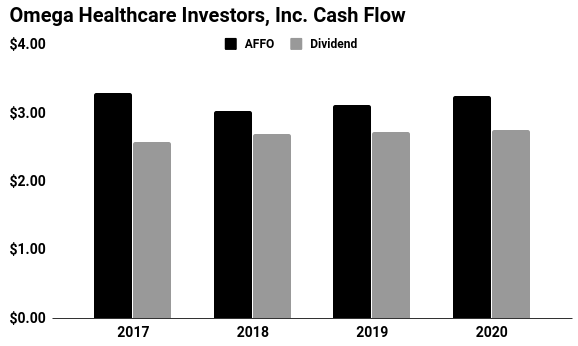

In the real estate business, performance is measured through a metric called “adjusted fund flows from operations” (AFFO). This metric is better than regular profits at providing insight into how much cash a company can return to investors.

In 2019, Omega Healthcare Investors Inc is projected to generate $3.12 per share in AFFO. Over the same period, the company is expected to pay out $2.64 per share in distributions. That comes out to a payout ratio of 85%. (Source: “Omega Healthcare Investors, Inc. Supplemental Information Q4 2018,” Omega Healthcare Investors Inc, last accessed May 6, 2019.)

Generally, I like to see companies pay out 90% or less of their cash flow as dividends, leaving themselves a little financial wiggle room. So in the case of Omega Healthcare, investors can sleep well at night.

Growth in Omega’s income stream is likely. The company’s lease agreements come with 2.5% annual rent hikes baked into most contracts. That provides an easy avenue to increase cash flows year after year. (Source: “Barclays Global Healthcare Conference Investor Presentation March 2019,” Omega Healthcare Investors Inc, last accessed May 6, 2019.)

Omega can pad that income stream further through acquisitions. Aging baby boomers will drive a multi-decade increase in demand for senior care facilities. That will fuel plenty of demand to build new facilities and raise rents at existing properties.

How fast can Omega grow? Over the next five years, Wall Street projects that the partnership’s cash flows will grow at a high single-digit annual clip. Most of that extra income will likely get passed on to unitholders through distributions.

(Source: “Cash Flow,” Omega Healthcare Investors Inc, last accessed May 6, 2019.)

The Bottom Line on OHI Stock

The big risk here is interest rates. Omega Healthcare Investors Inc funds most of its business through variable interest rate debt. If yields rise, that could bite into the partnership’s cash flows.

That, however, likely won’t be a problem anytime soon. With the economy slowing, the Federal Reserve will likely hold off on any more rate hikes. Still, it’s a risk worth keeping an eye on.

Omega’s seven-percent dividend yield is just what the doctor ordered. With ample cash flow and a growing stream of rental income, OHI stock’s distribution will likely soar in the coming years. That makes this real estate investment trust a name worth investigating further.