Dorchester Minerals LP: This 12% Yielder Is on the Verge of an Upgrade

Partnership Pays a 12% Yield

Readers often ask, “Why do you recommend stocks with shaky dividend histories?” It’s a fair question. Great companies usually have long histories of growing distributions, so it seems odd to skip this criteria when picking a stock.

Usually, it’s because things seem to be improving at the company. Other times, I’m willing to take a high risk to lock in an exceptionally high yield. Sometimes, both of these things are in play.

That’s the situation with Dorchester Minerals LP (NASDAQ:DMLP), a limited partnership that owns hundreds of oil and natural gas wells across the United States. The stock’s 12% dividend yield comes with a lot of risk, and you don’t need an MBA to figure out why.

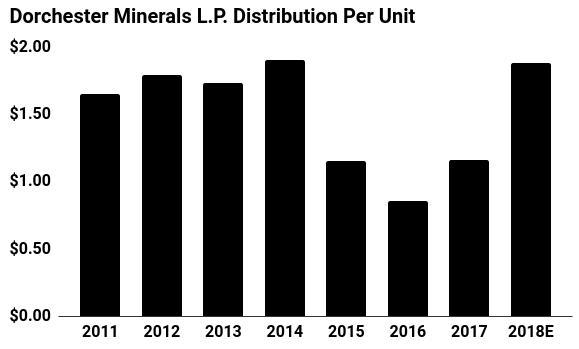

Dorchester Minerals cut its distribution in 2013, 2015, and 2016. When management reduces the payout, it tells shareholders that the dividend is not too valuable to be tampered with. While some firms do whatever it takes to maintain their dividend, others, like Dorchester, will change their payout whenever it suits them.

The moves didn’t surprise analysts, given the big drop in energy prices. Dorchester Minerals earns most of its revenue from the sale of oil and natural gas, so the slowdown in the energy patch hit the partnership’s profits especially hard.

The thing is, analysts now expect Dorchester’s earnings to rebound. Oil prices have surged over the past few months, putting the distribution on a much firmer footing.

(Source: “Distribution History,” Dorchester Minerals LP, last accessed August 1, 2018.)

In 2018, “the street” is expecting the partnership to pay out $1.88 per unit in distributions. That’s significant, because it would mean a 62% increase from last year’s payout.

More importantly, management took advantage of the downturn to add some impressive acreage to their portfolio. Executives scooped up a number of high-quality assets in places like the Balkan, Permian, Fayetteville, and Hugoton. These fields come with low operating costs and generate ample cash flow—exactly what I like to see in any energy company.

I’m willing to give Dorchester a chance. I like that the 2018 consensus estimate is higher, and that investors are being well compensated with a big upfront yield for the risks they’re taking. That will turn the business into a cash machine and could also result in some tidy capital gains for shareholders.

To be clear, Dorchester Minerals LP doesn’t present the safest dividend around. I have no way to cover that up. But with the rebound in the energy market, I like the partnership’s outlook.