Permian Basin Royalty Trust: Little-Known Firm Yields 7%

Quiet Business Pays 7% Yield

A five-hour drive from Dallas sits a small town in the middle of the West Texas plains.

A picture of the high school football team hangs in almost every shop window. As the sole community for miles, it contains the only post office in the county.

Welcome to Crane, population 3,400. Outside of town, dry weeds and flare stacks dot the terrain. A few workers head out for their shift each morning, taking their dust-covered pickup trucks over the access roads.

Nearby sits the Waddel Ranch. Years ago, these fields produced more oil than any other place in the country. Today, the owners have painted “NOT IN USE” across the panels of some rusted-out pump jacks.

In other words, the field’s best days have long passed. These wells, however, still product a sizable amount of oil. And, for you and me, it’s one of the best income sources on the market today.

The current owners set up a partnership to fund operations: the Permian Basin Royalty Trust (NYSE:PBT). This simple vehicle collects oil from nearby wells and passes on the income to investors. PBT collects around two-fifths of the barrels produced on the ranch, in addition to ownership rights on a few nearby tracts of land.

It’s a dull business, especially by the standards of the oil patch. Most drillers bet the farm on exploration, hoping to strike it rich on the next gusher. PBT, in contast, has decided to sit back and milk its existing wells for easy profits.

The Waddel Ranch started producing crude in the 1920s, so operators pretty much know where all of the oil sits beneath the property. Workers have also drilled all of the wells and constructed the needed infrastructure. It’s akin to sucking the last drops of milkshake out of the glass.

The business, though, is surprisingly lucrative. Ongoing costs come in at only around $30.00 per barrel. Buyers also prize the royalty trust’s particular blend of crude, given the sweet, light chemistry makes it easy to refine.

The numbers look like this: with oil prices at around $55.00 per barrel, PBT made a $3.2-million operating profit in February. The more units you own, the larger your slice of this income stream.

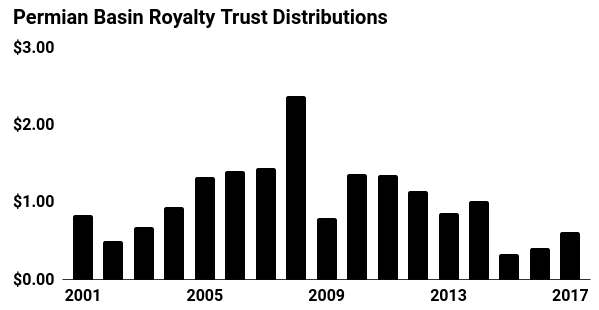

That number changes, of course, depending on the energy market. With the recovery in oil prices, owners have seen their distributions surge over the past few years. Higher natural gas prices have also padded the bottom line.

Most of these profits get paid out to owners. In the energy sector, drillers usually plow their earnings back into operations to find more oil wells. PBT, on the other hand, pays out every dollar of profit.

That has resulted in some eye-popping yields. Last month, for instance, management announced a $0.07 distribution. On an annual basis, that comes out to a trailing yield of nearly seven percent.

Source: “Permian Basin Royalty Trust (PBT),” Yahoo! Finance, last accessed February 23, 2018.

Of course, you can probably imagine the downsides of this business model. Oil wells represent depleting assets, which will eventually run dry. Profits also vary with energy prices, resulting in a volatile income stream.

In the case of PBT, analysts expect the business will wind down in another decade or so. If oil prices increase or new technologies emerge, management could extend operations for another few years. At some point, though, this income stream will end.

That doesn’t make oil wells a bad idea, per se. You just need to understand the characteristics of the investment ahead of time. And for yield hunters looking to supplement their portfolio income, Permian Basin Royalty Trust looks like an idea to investigate further.