Buckeye Stock: A 7.7% Yield That’s Going Higher

One Long-Term Dividend Stock to Own Forever

Today’s chart highlights my favorite way to find great income stocks: “forever assets.”

Forever assets have rewarded shareholders for generations. Their entrenched positions have allowed them to crush the market year after year. It’s not crazy to say you can buy these stocks today and hold them for the rest of your life.

Case in point is Buckeye Partners, L.P. (NYSE:BPL). This firm owns thousands of miles of pipelines across the country, shipping millions of barrels of refined energy products each day.

The partnership’s status as a forever asset comes down to a few points, the first being that it’s a dull business.

Our lives depend on Buckeye. That might sound like an odd point, given that most people have never heard of them. But, without the commodities that this firm ships through its network each day, the economy would literally grind to a halt.

The business serves as the toll road of the oil patch. Buckeye ships energy products from refineries where they’re produced to consumers across the country. In exchange, the partnership collects a small fee on each barrel.

This results in a steady income stream. Energy prices can swing wildly from year to year, creating sleepless nights for investors. The total volume of crude going through pipelines, however, is fairly consistent over time. For this reason, I’ve often compared these profits to bond coupons.

Better still, Buckeye has a lucrative operation. A new pipeline costs billions of dollars to construct but, once you have one up and running, they’re not that expensive to maintain. Because pipeline firms don’t have to plow all of their profits back into operations, they have a lot of cash left over to pay shareholders.

Furthermore, it’s tough to compete. In most sectors, big profits bring competition. Few rivals, though, can pony up the billions of dollars needed to compete against Buckeye or secure the rights-of-way from landowners.

For this reason, Buckeye represents a kind of de facto monopoly. And, like your telephone or cable provider, this gives the company the power to pass on big price hikes each year. Needless to say, you have a powerful wealth-building formula here.

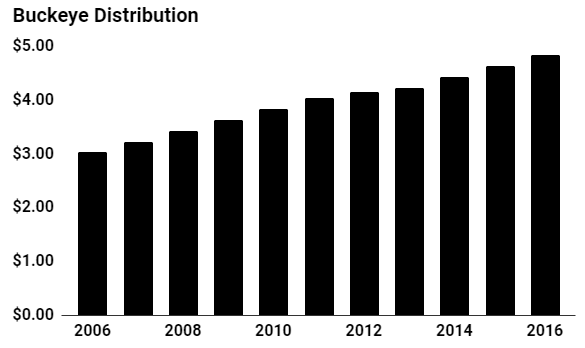

For owners, this has also translated into a tidy income stream. Since 1986, Buckeye has paid a distribution to unitholders each quarter. Over the past decade, this payout has more than doubled. Even through the financial crisis, executives managed to hike the distribution for owners.

Today, Buckeye Partners stock pays a quarterly payout of $1.25 per unit. This comes out to an annual yield of 7.7%.

(Source: “Distribution History,” Buckeye Partners, L.P., last accessed July 3, 2017.)

That payout will likely keep growing. New technologies have unlocked billions of barrels of oil and gas across the country. This will mean more energy flowing through Buckeye’s network and more dividends paid out to unitholders.

The Bottom Line on BPL Stock

Forever assets won’t impress your colleagues around the water cooler. These firms tend to have the excitement of a Victorian woman’s novel, and probably won’t invent the next gee-wiz tech gadget. But, if you’re willing to trade fast profits (or losses) for reliable income, you’ll like these names just fine.

Buckeye tops this list. Thanks to its entrenched market position, this little-known company should crank out oversized profits for decades to come. This is one top long-term dividend stock to own for the next 100 years and beyond.