Why Hersha Hospitality Is a Top Stock: A Near-6% Dividend Yield

High-dividend-yield stocks that provide safety are difficult to find. Of course, there’s a simple reason for this: stocks that have high dividend yields generally do so because their safety is in question.

In other words, there’s usually “no free lunch” to be had when it comes to investing. Now, that can be a discouraging thing to hear for beginning investors. But there’s no need to fret.

While stable high-yield stocks aren’t easy to find, they are not impossible to find either. Every now and then, the market presents us with an opportunity to purchase a high-yield stock with low risk. And as regular readers know, I dedicate all of my time to scoping out these opportunities.

So where do I typically start my search? Well, in addition to screening stocks for a high dividend yield, I look for solid cash flow, a simple business model that most anyone can understand, and strong long-term growth prospects.

This week, I’ll highlight another high-yield stock that checks off all of those boxes: hotel real estate investment trust (REIT) Hersha Hospitality Trust (NYSE:HT).

Diving into Hersha

If you haven’t heard of Hersha before, don’t feel too badly; it’s a relatively small company and pales in size to more well-known hotel stocks.

In fact, Hersha has a market capitalization of only about $800.0 million. For perspective, hotel giants Marriott International Inc (NASDAQ:MAR) and Hilton Hotels Corporation (NYSE:HLT) boast market caps in the tens of billions.

Another big difference between Hersha and those hotel gorillas is that Hersha is a REIT. This means that the company is required to pay out at least 90% of its taxable income to shareholders in the form of dividends.

So Hersha’s objective is simple enough: purchase and operate hotels, and then pass on the cash flow to shareholders. Rinse and repeat.

Specifically, Hersha chooses to focus on the upscale end of the hotel sector within major East Coast markets. In total, the company owns 53 hotels (roughly 7,900 rooms) located mainly in New York, D.C., Boston, Philadelphia, and Miami.

As you can tell, these locations nicely lend themselves to an upscale strategy for several reasons. They are all major urban markets with high growth, are all markets with heavy corporate travel, and are all popular spots for international travelers.

Of course, attractive geographic markets aren’t all that Hersha has going for it. The company also has a strong management team that has been together since its initial public offering in 1999. In today’s corporate world of management musical chairs, there is something to be said for continuity.

But how has management performed of late? Well, gauging from recent results, very well.

Solid Results

In Q1, Hersha posted net income of $18.7 million, or $0.44 per share. That compares to a net loss of $11.3 million in the year-ago period. More importantly, the company’s comparable revenue per available room (RevPAR) grew 3.1%. RevPAR is an important stat for hotel companies because it measures how well a company fills its rooms and how much it is able to charge.

Business was especially strong in the company’s DC Urban, Philadelphia, and Boston portfolios, which posted RevPAR growth of 15.4%, 11.1%, and 8.2%, respectively. That strength helped offset weakness in the company’s South Florida portfolio, which continues to be pressured by several headwinds.

During the quarter, management also completed the sales of two DC properties for $62.0 million. Additionally, it entered the high-growth market of Seattle.

“During the first quarter, Hersha remained very active with its capital recycling strategy, continuing to improve the Company’s high-quality, transient-focused portfolio and positioning it for strong growth,” said Chief Executive Officer Jay Shah. (Source: “Hersha Hospitality Trust Announces First Quarter 2017 Results,” Hersha Hospitality Trust, April 25, 2017.)

Well-Funded Dividends

Of course, strong RevPAR means nothing to us income investors if it doesn’t translate into one thing: cash flow. After all, a company can only pay consistent dividends to shareholders if cash flow is also consistent. This is definitely the case with Hersha.

In Q1, Hersha’s adjusted funds from operations (AFFO)–the best measure of cash flow for REITs–clocked in at $13.5 million. That is a 7.1% increase over the year-ago period.

The strong cash flow helped management pay a dividend of $0.28 in Q1, representing the company’s 72nd straight quarterly distribution.

Given the company’s growth prospects, I don’t expect that streak to end anytime soon.

“Looking ahead, we will focus our portfolio strategy on hotels that generate consistent cash flows and provide attractive asset value growth in the country’s highest demand urban gateway and destination markets,” Shah said. (Source: Ibid.)

High Dividend Yield at a Bargain

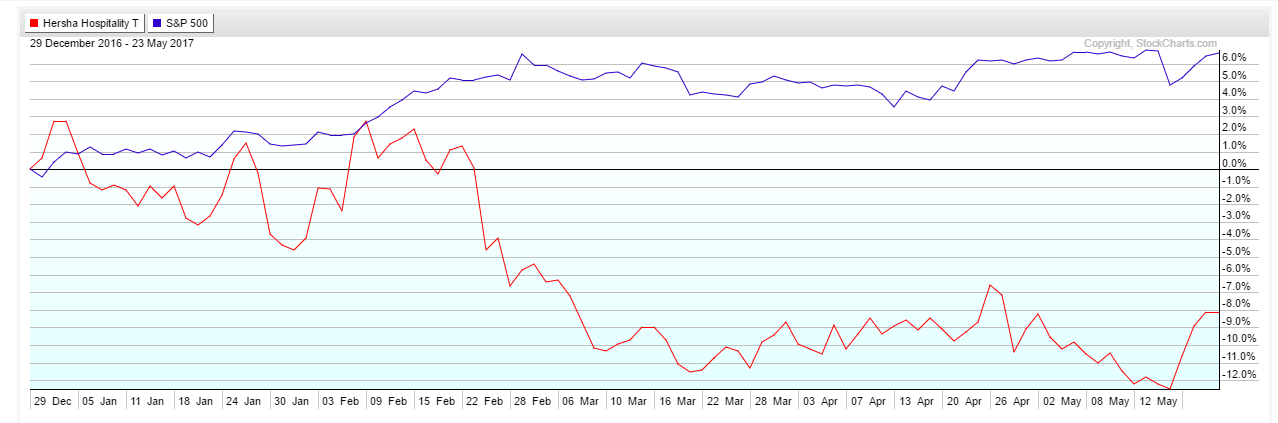

And that brings us back to Hersha’s stock price, which has been sliding as of late:

So what is worrying Wall Street?

Well, in addition to general market malaise, the prospect of rising interest rates is weighing on the shares. Remember, Hersha uses plenty of debt to finance its hotels, thus rising rates will certainly increase its borrowing costs.

Still, I’m convinced that Hersha’s dividend yield of 5.9% already factors in the interest rate risk. After all, that yield is still higher than the real estate industry average (5.3%), as well as the S&P 500 (2.1%). And given the strength of Hersha’s fundamentals, that spread should only narrow over time.

The Bottom Line on Hersha Hospitality

There it is, my dear readers: a few reasons why I think Hersha provides both a juicy dividend yield and safety.

As is always the case, don’t view this article as a formal recommendation. Instead, see it as a jump-off point for more research. Hersha’s usage of debt and interest rate exposure are very real risks to consider.

But as an idea with plenty of potential, Hersha is definitely worth looking into.