Utility Stock List: Earn Steady, Reliable Income

Utility Stocks Should Not Be Ignored

Income investors are always looking for investment ideas that will preserve their money and generate a steady income. One group of stocks that should not be ignored by income investors is utility stocks, since they provide a reliable income and are a conservative investment.

Utility stocks have a long track record of generating steady revenue and earnings, which helps preserve capital. Due to this, there are many utility stocks that pay dividends, which are often reviewed regularly for a higher dividend payout per share, adding to investors’ total returns. The utility sector is also where high-yielding investments are often found.

Services from high-yield utility stocks with good dividends are used every day by consumers and include essentials such as water, electricity, heating, and cooling. Since the services are required at all times, the revenue of these companies tends to see no negative effects in a weakening economy. For long-term income investors, this would be the type of company worth considering.

This article will go through the list of all utility stocks worth noting. There are four major segments within the utility sector, so I made it a bit easier by splitting the list of utility stocks up based on these segments. I will also look at how utility stocks have performed in the past compared to a benchmark index and the features of investing in utility stocks.

Features of Utility Stocks

There are four different sub-segments within the utility sector: water utility companies, electric companies, gas distributors, and alternative power generation. But no matter what segment the company is in, it tends to offer investors the same benefits.

1. Steady Revenue and Income

High-dividend utility stocks have steady margins, revenue, and a high payout. That’s because operating in the utility sector requires a large amount of initial capital for the likes of infrastructure and the network. However, such businesses don’t have many ongoing fees beyond those startup costs. As a result, utility stocks generate a lot of cash flow and are able to afford a dividend.

2. Large Market Share

Companies in the utility sector operate either as a monopoly or an oligopoly. A monopoly is a company that has 100% market share, while an oligopoly shares the market with only a few other companies, giving it a large market share. Companies in these environments enjoy steady, predictable revenue, hence the dividend.

3. Inflation-Protected Earnings

Inflation is a concern for everyone, from investors to management. The great thing about utility stocks, however, is that inflation is not a big issue. You see, as a business sees inflation due to costs, those costs get passed to the end user of its products and services. This keeps the margins of the business steady and the dividend up.

4. Outperforms the Market in a Recession

In a recession, many investors will go over their investments and either invest in safe assets or move to cash. Since a company’s earnings are expected to be lower in a recession, it will reflect in a lower stock price as a result. One of the asset classes that is considered in these instances is utilities stocks because earnings see no impact during a recession. This is notable for both retail investors and large institutional investors, since they are faced with mandates on the capital to ensure it’s preserved. Also, with institutional investors, a certain percentage of capital must be invested, so they can’t move 100% of the cash within their accounts.

How Has the S&P 500 Utility Index Performed?

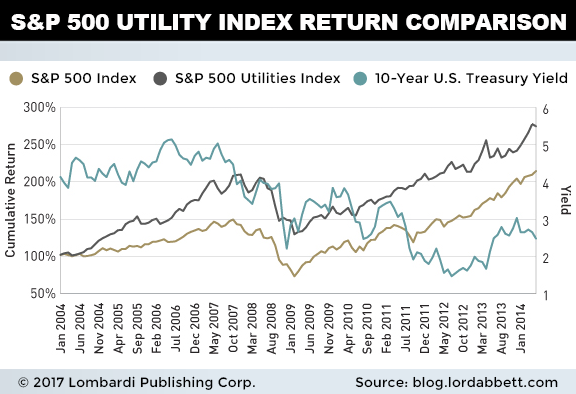

Below is a chart comparing the S&P 500 Utilities Index, the S&P 500 Index, and the 10-year U.S. Treasury note yield. The S&P 500 Index is used because it is considered the broadest index based on the sectors represented within, which include the largest in the U.S. based on their market cap.

These companies’ products and services are known worldwide, which helps with global revenue generation. As a result, investors also focus on these companies to invest on a long-term basis and on a short-term one as a trade.

The 10-year Treasury note yield is used due to the nature of utility stocks that pay out a dividend. The yields on the two investments are often looked and assessed with risk factored in. The 10-year Treasury note is considered a risk-free asset because it is issued by the U.S. government, which is guaranteed to still be around in the future.

When the yield on the 10-year Treasury note is higher than a utility stock, than the Treasury note is worth considering, since a higher yield would be owned with less risk. A utility stock would be owned when the yield is higher than the 10-year Treasury note; for taking the additional risk, the reward is the higher yield.

The chart above covers a 10-year period. From the starting point, the S&P 500 Utilities Index outperformed the S&P 500 Index. The return is based on both the capital appreciation of the stock price and the dividend income earned. The dividend from utility stocks tends to increase over time because of the constant and predictable income. Even though the utility index may be considered a boring investment since there is no new technology or nobody is talking about it, the returns speak for themselves. The 10-year Treasury note yield over this period is moving on a downtrend, which is the opposite of what would happen with a dividend growth stock.

What Are Water Utility Stocks?

These are stocks for companies that provide water-related services to customers, such as supplying water to households and commercial residents. These services are possible thanks to water pipelines built around or in certain areas of the country. Other services include sewage management and disposal and water purification.

These types of businesses have not seen much change over the last century, making those on this water utility stocks list worth considering.

Water Utility Stocks List

| Company Name | Stock Symbol |

| American States Water Co | AWR |

| American Water Works Company Inc | AWK |

| Aqua America Inc | WTR |

| AquaVenture Holdings Ltd | WAAS |

| Artesian Resources Corporation | ARTNA |

| Cadiz Inc | CDZI |

| California Water Service Group | CWT |

| Companhia De Saneamento Basico Do Estado De Sao Paulo | SBS |

| Connecticut Water Service Inc | CTWS |

| Consolidated Water Co. Ltd. | CWCO |

| Global Water Resources Inc | GWRS |

| Middlesex Water Company | MSEX |

| Pure Cycle Corporation | PCYO |

| SJW Group | SJW |

| York Water Co | YORW |

What Are Electric Utility Stocks?

Stocks under this category are companies that provide electricity for everyday use. These businesses own the likes of generation plants and/or transmission utility assets in either focused areas or spread across the country. Below is the list of electric utility stocks for 2017.

Electric Utility Stock List

| Company Name | Stock Symbol |

| Algonquin Power & Utilities Corp | AQN |

| ALLETE Inc | ALE |

| Alliant Energy Corporation | LNT |

| Ameren Corp | AEE |

| American DG Energy Inc | ADGE |

| American Electric Power Company Inc | AEP |

| Atlantic Power Corp | AT |

| Avangrid Inc | AGR |

| Avista Corp | AVA |

| Black Hills Corp | BKH |

| Brookfield Infrastructure Partners L.P. | BIP |

| Brookfield Renewable Partners LP | BEP |

| CenterPoint Energy, Inc. | CNP |

| Centrais Eletricas Brasileiras SA | EBR |

| Centrais Eletricas Brasileiras SA | EBR.B |

| CMS Energy Corporation | CMS |

| Consolidated Edison, Inc. | ED |

| CPFL Energia S.A. (ADR) | CPL |

| Dominion Energy Inc | D |

| DTE Energy Co | DTE |

| Duke Energy Corp | DUK |

| Edison International | EIX |

| El Paso Electric Company | EE |

| Empresa Distribuidora y Comercializadora Norte SA | DN |

| Enel Americas SA | ENIA |

| Enel Chile SA | ENIC |

| Enel Generacion Chile SA | EOCC |

| Energy Company of Minas Gerais | CIG.C |

| Energy Company of Parana | ELP |

| Entergy Corp | ETR |

| Eversource Energy | ES |

| Exelon Corp | EXC |

| FirstEnergy Corp | FE |

| Fortis Inc | FTS |

| Genie Energy Ltd | GNE |

| Great Plains Energy Inc | GXP |

| Hawaiian Electric Industries Inc | HE |

| Huaneng Power International Inc | HNP |

| Idacorp Inc | IDA |

| Innovative Industrial Properties Inc | IIPR |

| Just Energy Group Inc | JE |

| Kenon Holdings Ltd | KEN |

| Korea Electric Power Corp | KEP |

| MGE Energy Inc | MGEE |

| National Grid PLC | NGG |

| NextEra Energy Inc | NEE |

| NorthWestern Corp | NWE |

| NRG Energy Inc | NRG |

| NRG Yield Inc | NYLD |

| NRG Yield Inc | NYLD.A |

| OGE Energy Corp | OGE |

| Pampa Energia SA | PAM |

| PG&E Corporation | PCG |

| Pinnacle West Capital Corp | PNW |

| PNM Resources Inc | PNM |

| Portland General Electric Co | POR |

| PPL Corp | PPL |

| Public Service Enterprise Group Inc | PEG |

| SCANA Corp | SCG |

| Southern Co | SO |

| Spark Energy Inc | SPKE |

| Stone Harbor Emerging Markets Income Fund | EDF |

| The AES Corp | AES |

| TransAlta Corp | TAC |

| Unitil Corp | UTL |

| Valeritas Holdings Inc | VLRX |

| Vistra Energy Corp | VST |

| Vivopower International PLC | VVPR |

| WEC Energy Group Inc | WEC |

| Westar Energy Inc | WR |

| Xcel Energy Inc | XEL |

What Are Gas Distributor’s Utility Stocks?

There are many different segments for gas distributors, but at the end of the day, they all provide natural gas to homes and commercial buildings. Natural gas is used for heating, appliances, fuel for vehicles, and air conditioners.

Some companies will have operations that go from the start of the business process all the way to the end, while others only cover a single part. Examples of the different segments in gas distributors are natural gas storage, gas product marketing, and transportation services. Below is a list of gas distributors stocks that trade on the exchanges.

Gas Distributor’s Utility Stock List

| Company Name | Stock Symbol |

| Atmos Energy Corporation | ATO |

| Chesapeake Utilities Corp | CPK |

| Clean Energy Fuels Corp | CLNE |

| Delta Natural Gas Company, Inc. | DGAS |

| Dynegy Inc. | DYN |

| Ferrellgas Partners, L.P. | FGP |

| Gas Natural Inc | EGAS |

| MDU Resources Group Inc | MDU |

| New Jersey Resources Corp | NJR |

| NiSource Inc. | NI |

| Northwest Natural Gas Co | NWN |

| ONE Gas Inc | OGS |

| RGC Resources Inc | RGCO |

| Sempra Energy | SRE |

| South Jersey Industries Inc | SJI |

| Southwest Gas Holdings Inc | SWX |

| Spire Inc | SR |

| Star Gas Partners LP | SGU |

| Suburban Propane Partners LP | SPH |

| UGI Corp | UGI |

| Vectren Corp | VVC |

| WGL Holdings Inc | WGL |

What Are Alternative Power Utility Stocks?

Alternative power generation stocks are ones that offer solar power systems, hydroelectric power (hydropower) systems, and wind systems. Solar power comes from solar panels that are placed on resident homes or commercial buildings and are also found in farmland areas. Hydropower uses water to create electricity for homes and businesses. Lastly, wind power uses wind turbines to create electricity.

These methods of generating electricity differ from the other methods because they are environmentally friendly, leaving behind no pollution. Below is the list of alternative power generation utility stocks.

Alternative Power Generation Utility Stock List

| Company Name | Stock Symbol |

| 8point3 Energy Partners LP | CAFD |

| Atlantica Yield PLC | ABY |

| Azure Power Global Ltd | AZRE |

| Calpine Corporation | CPN |

| Charles Schwab Corp | SCHW.PR.C |

| Covanta Holding Corp | CVA |

| Hydrogenics Corporation | HYGS |

| Medigus Ltd. | MDGS |

| NextEra Energy Partners LP | NEP |

| Ormat Technologies, Inc. | ORA |

| Pattern Energy Group Inc | PEGI |

| Sky Solar Holdings Ltd (ADR) | SKYS |

| TerraForm Global Inc | GLBL |

| TerraForm Power Inc | TERP |

| US Geothermal Inc | HTM |

Investing in Utility Stocks

One way of investing in utility companies is simply by buying shares in companies from the lists above. Of the four different categories, you could focus on only one or choose a few each list. I would recommend doing some research to ensure that you choose the best utility stocks that meet all your investment needs.

Since the utility sector is divided into different sub-sectors, it could be time-consuming to purchase stocks in each category. Also, purchasing a lot of individual stocks will add to the commission fee that will be paid to the broker. To avoid this and keep more money in your pocket, consider an exchange-traded fund (ETF). This would provide exposure to the entire group without having to pick and choose each stock. And ETF will also provide diversification.

One ETF worth considering as an investment opportunity is Utilities SPDR (ETF) (NYSEARCA:XLU). The holdings within XLU are from the S&P 500 Utilities Select Sector Index. Some of the names that are held are also included in the lists above, such as NextEra Energy Inc (NYSE:NEE), American Water Works Company Inc (NYSE:AWK), and Southern Co (NYSE:SO).

The dividend from XLU is paid out on a quarterly basis and has seen a consistent boost over its history. This is because the holdings see an increase in their dividend, which is then passed along to unitholders.

This is a good option for an investment because it is so cheap and liquid. Its management expense ratio (MER), which is paid to the people who look after the capital and investment decisions for XLU, is 0.14%. This means that for every $10,000 invested in XLU, $14.00 will be paid annually. As for the liquidity, the shares are easy to both buy and sell.