Earn a 17% Yield By Investing in Oil Wells

Earn Big Yields By Investing in Oil Wells

Today’s chart highlights one strategy quietly paying out double-digit yields: investing in oil wells.

It can be a lucrative business. Small-time operators buy up old wells that used to gush oil, then squeeze out the last few barrels for regular income. Depending on energy prices, owners can earn yields of 15%, 20%, and—sometimes—even 25%.

For those of us who don’t live in oil country, I have the next best thing: SandRidge Mississippian Trust II (NYSE:SDR). This firm owns hundreds of wells across Oklahoma. And while I doubt you’ve heard of it, the trust tops my list of cash cows for a couple of reasons.

First, this isn’t some wildcat business. You’re not drilling in the middle of nowhere hoping to hit it big on the next strike. Instead, these wells have produced oil for years and will keep making profits until they run dry.

You could think of it like drinking the bottom of a milkshake; you’re sucking pretty hard, trying to get the last bit out of the glass. This kind of work doesn’t attract the interest of oil majors, but it can make a great business for small investors.

Better still, you get a lot of tax benefits. Unlike most businesses, the trust pays no income taxes on profits. To qualify for this loophole, however, management must pass on all of their earnings to owners.

Furthermore, all distributions get treated as capital gains, not dividends, which reduces your tax rate. Unitholders can also depreciate part of these assets each year. That lowers your cost basis and provides a nice deduction come tax time.

Finally, this trust cranks out income. During the first three months of 2017, the trust produced 2,400 barrels of oil equivalent each day. Because you have little in the way of overhead, most of these profits gets passed on to owners. (Source: “Form 10-Q,” SandRidge Mississippian Trust II, May 10, 2017.)

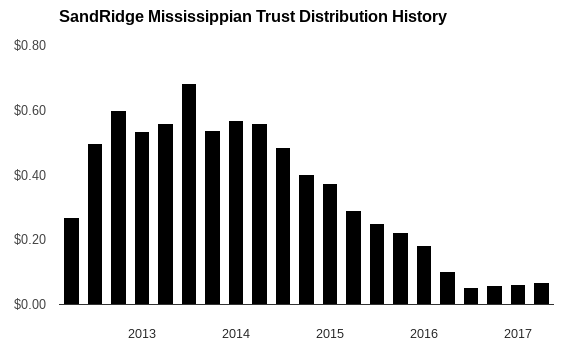

That means big yields. SandRidge paid out a distribution of $0.07 per unit last quarter, which comes out to an annual yield of 17%. As you can see in the chart below, these payments have roughly tracked output and oil prices over time.

Source: Yahoo! Finance

All of that said, your BS detector should go off any time you see a double-digit yield.

In the case of SandRidge, it’s for good reason. If you want quiet, steady income, this trust will keep you up at night.

Payouts here change with oil prices. Any well represents a depreciating asset, which means these distributions will come to an end at some point. Unitholders can expect a declining stream of income until the trust gets wound down in 2031.

That doesn’t make investing in oil wells a bad deal, per se. You’re simply squeezing out the last drops of oil and not much else. But, as long as you know what you’re signing up for, SandRidge can still make a great investment.

Bottom line: as they say in the energy business, oil men go to Vegas to calm their nerves. These old fields, though, can still earn big profits. If you can stomach the ups and downs of the energy patch, take a second look at SandRidge Mississippian Trust II.