Warren Buffett Net Worth: 5 Things You Need to Know

Warren Buffett’s Net Worth Is Above $73 Billion

American investor, businessman, and philanthropist Warren Buffett’s net worth is above $73 Billion.

It’s an awe-inducing number to be sure. What’s more amazing, though, is that he didn’t strike it big inventing the latest tech gizmo or stumbling on the next big oil field; rather, Warren Buffett’s net worth was built on buying up shares in wonderful businesses and holding on for the long haul. (Source: “Warren Buffett – Net Worth,” Forbes, last accessed Jul 19, 2017.)

Of course, few of us will ever be a successful as Buffett. But by studying his techniques, there’s a lot we can learn from the “Oracle of Omaha.”

Here are five lessons to be learned from Warren Buffett’s net worth:

1. Start Early

In 1941, Warren Buffett bought his first stock. At the tender age of 11, he purchased six shares of Cities Service (now known as CITGO) at $38.00 each. (Source: “The Evolution of Warren Buffett’s Career from 1936 to 2013,” Old School Value, May 16, 2016.)

Buffett sold his shares a few months later at $40.00 apiece to lock in a small profit. He then watched in disbelief from the sidelines as the stock shot up to $202.00 over the next few years.

For Buffett, the experience was a lesson in patience. The story, though, illustrates one of the most important factors in building up wealth like Warren Buffett’s net worth—get an early start.

Over the last century the U.S. stock market has delivered an average return of six percent per year after inflation. We don’t know what the next century will look like. This six percent number, though, is the best estimate we have.

If you are 25 years old, every dollar you save today will be worth $10.28 by the time you are 65 (and that’s adjusted for historical inflation). If you’re 35, each dollar saved today will be worth $5.75 by the time you reach retirement age.

In contrast, you’re much worse off if you procrastinate. Each dollar you save at 55 will be worth $1.79 by the time you’re 65. If you’re 60, each dollar will be worth $1.33 by retirement.

You can argue with my assumptions. Future stock market returns may be higher or lower than what we’ve seen in the past. But no matter which scenario you choose, the principle doesn’t change.

Buffett kicked his investing career in gear before he could even drive, putting time on his side. An early start is the smartest thing you can do to build wealth.

2. Buy Businesses with Moats

Warren Buffett’s net worth was built on buying wonderful businesses at a reasonable price, then holding on for the long haul. But how do you identify a wonderful business?

For that, we need to turn to HBO’s hit TV show Game of Thrones.

When you own a profitable business, it’s like being the king of an economic castle. In a free market, people will try to take your crown. What you need is some sort of competitive edge, like a moat, that protects your business from attackers.

Warren Buffett is always on the lookout for wonderful businesses with moats. The wider and deeper a moat is, the better. By being able to fend off attackers, Buffett’s businesses are able to crank out oversized profits year after year.

Warren Buffett’s portfolio is a who’s-who of wide-moat businesses: Kinder Morgan Inc (natural monopoly), Visa Inc (network effect), McDonald’s Corporation (intangible assets), and Wells Fargo & Co (switching cost). (Source: “Berkshire Hathaway Inc 13-F Filing,” Securities and Exchange Commission, last accessed May 16, 2016.)

Wal-Mart Stores, Inc. (NYSE:WMT) is a great example of a wide competitive moat filled with angry mutant sharks. Thanks to the company’s raw scale, Wal-Mart is able to bully suppliers into cutting it the best deal. This cost advantage makes it almost impossible for smaller competitors to compete.

That’s the definition of a wonderful business.

Javier/Flickr

3. Understand Compound Growth

There’s a great story about the beginnings of chess in India.

It goes like this: A sage once defeated a local king at a game of chess. As a reward, the king offered to grant the sage one wish. Being a man of modest means, the sage wished for a few grains of rice.

The amount of rice itself was to be determined using the chessboard in the following manner: One grain of rice shall be placed in the first square, two grains in the second square, four in the third square, and so forth. Every square will have double that of its predecessor. The king agreed. But filling the chess board’s last 10 squares would have required 35 quintillion grains of rice—enough to bury the entire country.

The story is a great example of the power behind compound interest: when things grow exponentially, gains are tiny at first, okay in the middle, and then suddenly shoot through the roof.

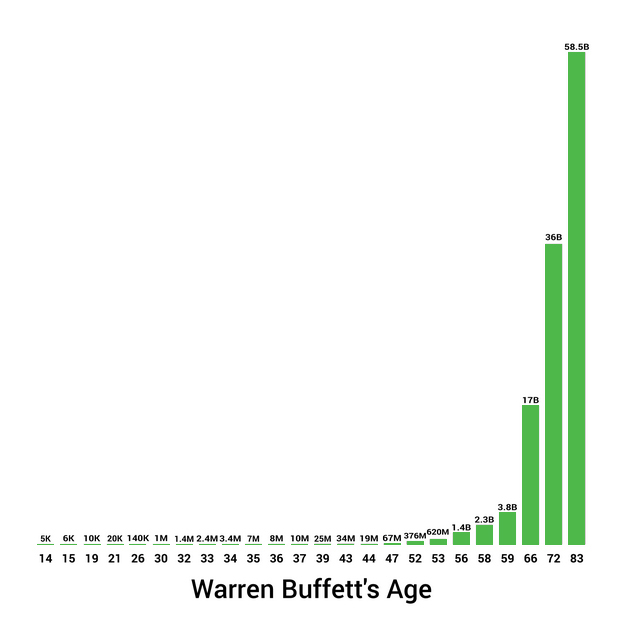

This is the case with Warren Buffett’s net worth. It’s why, of his $66.7 billion fortune, $65.7 billion was added after his 50th birthday, and $63.0 billion came after his 60th. (Source: “From $6,000 to $67 billion: Warren Buffett’s wealth through the ages,” MarketWatch, August 30, 2015.)

Also Read:

Warren Buffett Portfolio Holdings in 2017

The Warren Buffett Guide to Investing in Dividend Stocks

Warren Buffett’s Net Worth by Year

| Age | Net Worth |

| 15 | $6,000 |

| 35 | $7.0 million |

| 50 | $67.0 million |

| 65 | $17.0 billion |

| 85 | $67.7 billion |

As is the case with the sage, the real gains don’t occur until you get to the end of the chessboard. When it comes to compound growth, that’s where the massive gains are.

4. Ignore the Headlines

In 2009, Warren Buffett’s right-hand man Charlie Munger was asked if he was concerned about the 50% drop in Berkshire Hathaway Inc. (NYSE:BRK.A, NYSE:BRK.B) stock. He quickly interrupted the interviewer and responded with the following:

“In fact, you can argue that if you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who can be more philosophical about these market fluctuations.” (Source: “Why Does Buy and Hold Have to be Impossible?,” A Wealth of Commonsense, July 29, 2014.)

Munger isn’t one to mince words.

Owning common stock is one of the smartest financial moves you can make. Since 1950, the S&P 500 has increased more than 12,000% in value. A $1.00 investment over that period would be worth more than $121.50 today.

This isn’t some game of woulda, shoulda, coulda. Actually, it’s quite the opposite. The fact is that investing in the stock market has been a horrible experience over the years.

The S&P 500 suffered seven separate drops of 20% or more. It lost more than half of its value once. It traded below its previous all-time high on 95% of the days during that period.

Welcome to reality, folks.

Most people want to see their portfolio increase a little bit in value from quarter to quarter. It doesn’t work that way. Most of the time, the ups and downs of the stock market are enough to make most of us vomit.

Warren Buffett’s net worth can be credited to his calm stomach (and maybe a bottle of “Pepto-Bismol”). Just staying in the game and waiting out the bear markets is a big key to success in the stock market.

5. Don’t Bet Against America

Pessimism might grab newspapers headlines, but being an optimist is far more lucrative.

It’s an election year. Candidates can’t stop speaking about our country’s problems. Many people feel America has lost its way.

But a quick glance through the statistics shows the march of American progress continues onward:

- In 1960, the average household spent 18% of its budget on food. Today, it’s less than 10%. (Source: “Americans’ budget shares devoted to food,” U.S. Department of Agriculture, April 12, 2016.)

- In the 1960s, less than one in 10 Americans over the age of 25 had a bachelor’s degree. Today, one in three do. (Source: “Employment status of the civilian population,” Bureau of Labor Statistics, last accessed May 16, 2016.)

- In 1973, 49% of new homes had air conditioning. Today, 89% do. (Source: “Air conditioning in nearly 100 million U.S. homes,” U.S. Energy Information Administration, August 19, 2011.)

“American GDP (gross domestic product) per capita is now about $56,000,” Buffett wrote in a recent letter to shareholders. “As I mentioned last year that—in real terms—is a staggering six times the amount in 1930, the year I was born, a leap far beyond the wildest dreams of my parents or their contemporaries.” (Source: “Berkshire Hathaway 2015 Letter to Shareholders,” Berkshire Hathaway, February 27, 2016.)

“For 240 years, it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs,” Buffett notes. (Source: Ibid.)

Bottom Line on Warren Buffett’s Net Worth

Many people faced with the task of investing are quick to say, Hey, I’m no Warren Buffett!

But really, who better than Warren Buffett to emulate? Rather than embrace “sexy” tech stocks and complicated financial mumbo jumbo, Buffett simply bought wonderful businesses and held on for the long haul. This sort of commonsense has made him one of the most successful investors in the world.

No, few of us will ever match Warren Buffett’s net worth, but there are a lot of lessons we can learn from this billionaire investor.