This Indicator Reveals Top Dividend Stocks Yielding Up to 7%

Where to Find Top Dividend Stocks Today

The sector is hated in the press, but these are some of the top dividend stocks around.

Analysts avoid this group. No one talks about them on the cocktail party circuit.

But for smart investors, they may be a once-in-a-lifetime bargain. Some of these stocks pay out yields up to seven percent. The last time prices were this low, shareholders made triple-digit returns.

Let me explain.

One of my best ways to find new stock ideas is something I like to call the “cocktail party indicator.”

In short, all you have to do is talk to friends and family about their favorite investments. If everyone is talking about the same thing, you can just about guarantee it will be lower in a few years. If they roll their eyes, you might be on to a good idea.

No, you won’t impress MBAs. The cocktail indicator, though, has kept me safe from market bubbles. It has also helped me find some of my top dividend stocks over the years.

Case in point: Europe.

Voters flirt with anti-EU parties, threatening to bring down the whole eurozone project. The daily headlines tally unemployment, stagnant growth, and unstable banks.

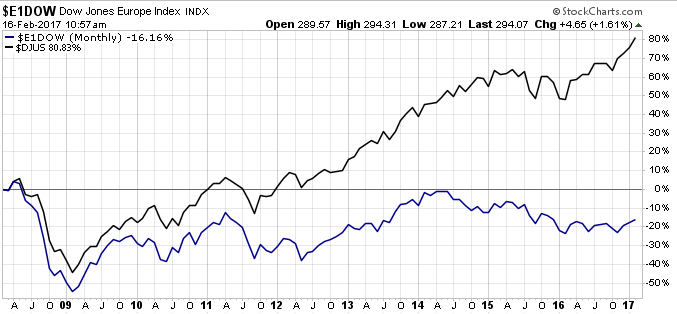

For this reason, investors blacklisted the whole continent. European stocks have lagged American equities over the past nine years. Since mid-2008, the Dow Jones Europe Index has trailed its U.S. counterpart by 100%.

The huge spread, though, presents a compelling value case.

European stocks trade at 14.7 times forward earnings, compared to 17.8 times profits stateside. U.S. firms cut costs to the bone after the financial crisis, so margins won’t improve much further. European profits, in contrast, have bottomed out. Unless we have a big surprise (always possible), they’re poised for a big rebound in 2017.

Source: Stockcharts.com

Never before have we seen such a value gap.

The last time this happened in mid-2003, European stocks soared 172% over the next four years. By comparison, U.S. markets returned 74% during the same period.

The same thing happened in late 1998. That time, European stocks jumped 64% in 18 months. In contrast, the S&P 500 was only up 42%.

How can us “yield hogs” strike our claim?

I’m sticking to “Grade A” assets. Top-tier stocks are bursting at the seams with cash. Slow growth means fewer new projects, too. You can expect that to translate into higher payout ratios via dividends and share buybacks.

Banks look tempting. Sometimes, though, you get what you pay for. Right now, troubled lenders pay big yields. The toxic assets on their balance sheets, however, could put those dividends at risk.

Here’s my shopping list:

| Company |

Stock Price |

52-Week Change |

Yield |

Mrk Cap |

| Royal Dutch Shell plc |

$53.24 |

17.2% |

7.1% |

$220.9B |

| BP plc |

$33.82 |

16.4% |

7.0% |

$108.7B |

| Vodafone Group Plc |

$25.23 |

-16.6% |

6.1% |

$66.4B |

| National Grid plc |

$59.91 |

-13.1% |

5.0% |

$44.6B |

| Deutsche Telekom AG |

$17.05 |

4.3% |

3.7% |

$79.8B |

Source: Google Finance

Oil stocks stand out. The drop in energy prices hammered big yielders like BP plc (ADR) (NYSE:BP) and Royal Dutch Shell plc (ADR) (NYSE:RDS.A, NYSE:RDS.B). But thanks to cost cuts, new projects, and higher oil prices, these payouts look safe.

National Grid plc (ADR) (NYSE:NGG) is the largest utility in Britain. You have to love the steady profits, growing asset base, and fortress-like balance sheet. And after the Brexit fallout, shares now sport a tidy five-percent yield.

Take a look at telecom giants like Vodafone Group Plc (ADR) (NASDAQ:VOD) and Deutsche Telekom AG (OTCBB:DTEGY), too. These wide moat firms gush cash flow. Both stocks trade at a discount to U.S. names like AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ).

Bottom line, everyone hates Europe. You almost never hear it mentioned around the cocktail party circuit. But by sticking to the top dividend stocks, you can pick up some bargains.