Investors Can Beat Inflation With Bullish, 9.3%-Yielding Cross Timbers Royalty Stock

Cross Timbers Royalty Trust Pays Monthly Dividends

The stock market hasn’t bottomed, the Federal Reserve continues to aggressively raise interest rates, inflation is at a four-decade high, and fears of a recession loom. Despite these headwinds, there’s one way investors can kick inflation to the curb and ignore the stock market sell-off. That’s with Cross Timbers Royalty Trust (NYSE:CRT), an oil and gas exploration and production company.

Operating as an express trust in the U.S., the company receives trust net profits income from two major components. Cross Timbers Royalty holds 90% of the net profits interests in certain royalty and overriding-royalty property interests in Texas, Oklahoma, and New Mexico. It also holds 75% of the net profits interests in certain working-interest properties in Texas and Oklahoma. (Source: “About Us,” Cross Timbers Royalty Trust, last accessed July 27, 2022.)

The net profits interests are the trust’s only assets, other than cash held for trust expenses and for distribution to unitholders. XTO Energy Inc. owns the underlying properties from which the net profits interests were conveyed.

Most of Cross Timbers Royalty Trust’s net profits income is from long-lived gas properties in the San Juan Basin of northwestern New Mexico. Because the 90% net profits interests aren’t subject to production or development costs, the net profits income generally only varies due to changes in sales volumes or prices.

The trust’s 75% net profits interests are conveyed from underlying working interests in seven large, predominantly oil-producing properties in Texas and Oklahoma. The net profits income from these properties is calculated separately for each state and is reduced by production and development costs.

Unlike some energy companies, Cross Timbers Royalty Trust doesn’t plow money into developing new wells. Instead, it pays out virtually all of its earnings to CRT stockholders. That’s why Cross Timbers Royalty stock investors are on the receiving end of frothy monthly dividends.

CRT Stock’s Year-to-Date Distributions Up 96% Year-Over-Year

I’d love to say Cross Timbers Royalty Trust raises its distribution on a monthly basis, but it doesn’t. Cross Timbers Royalty stock’s payout fluctuates based on industry prices and volume.

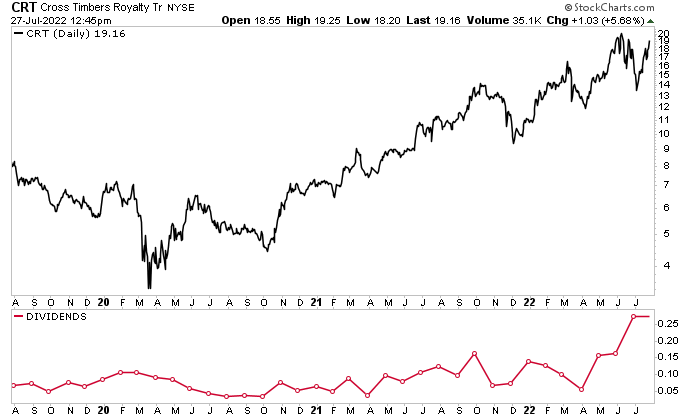

Right now, everything is, for the most part, working in the company’s favor. As you can see in the following chart, CRT stock’s monthly dividend has been on a tear this year.

| Month in 2022 | Dividend Per Share |

| January | $0.125 |

| February | $0.10 |

| March | $0.054 |

| April | $0.156 |

| May | $0.164 |

| June | $0.272 |

| July | $0.191 |

(Source: “Cash Distributions,” Cross Timbers Royalty Trust, last accessed July 27, 2022.)

So far this year, Cross Timbers Royalty stock’s payout has totaled $1.04. Over the same period last year, it stood at $0.53. There are still five months left in 2022, and the company’s distribution is only $0.05 below its full-year 2021 payout. It’s safe to say 2022 will be another year of growth for this dividend stock.

Over the last 10 years, CRT stock’s annual payouts have gyrated along with energy prices, but those payouts have been going up steadily since 2020. Under the right conditions, Cross Timbers Royalty stock’s payout could become even more lucrative. In 2008, its annual distribution was a record $5.15 per unit.

| Year | Dividends Per Share |

| 2022 Year-to-Date | $1.06 |

| 2021 | $1.11 |

| 2020 | $0.77 |

| 2019 | $0.87 |

| 2018 | $1.42 |

| 2017 | $1.00 |

| 2016 | $1.06 |

| 2015 | $1.35 |

| 2014 | $2.65 |

| 2013 | $2.31 |

(Source: Ibid.)

Cross Timbers Royalty can afford its massive monthly payouts because the company has been throwing off a lot of cash. In the quarter ended March 31, its net profits income went up by 44% year-over-year to almost $2.0 million, compared to almost $1.4 million in the same quarter of 2021. (Source: “Cross Timbers Royalty Trust 1st Quarter Report 2022,” Cross Timbers Royalty Trust, last accessed July 27, 2022.)

The big increase in net profits was primarily the result of increased oil production ($3.6 million); increased oil and gas prices ($1.7 million); and decreased taxes, transportation expenses, and other costs ($100,000).

Cross Timbers Royalty Trust’s distributable income in the first quarter of 2022 was $1.7 million, or $0.28 per unit. In the first quarter of 2021, its distributable income was $1.0 million, or $0.17 per unit.

Because the company pays out all of its earnings to unitholders, its payout ratio is 1:1.

Cross Timbers Royalty Trust‘s Share Price Trouncing the Market

Consistently strong financial results have been helping CRT stock trounce the market. As of this writing, Cross Timbers Royalty stock is up by:

- Six percent over the last month

- 26% over the last three months

- 75% year-to-date

- 72% year-over-year

Chart courtesy of StockCharts.com

CRT stock is also up by:

- 13% over its 20-day exponential moving average

- 10% over its 50-day simple moving average

- 36% over its 200-day simple moving average

The Lowdown on Cross Timbers Royalty Stock

Cross Timbers Royalty Trust is a great oil and gas company that provides investors with ultra-high-yield dividends and a market-trumping share price.

It won’t always be that way, though. As an energy stock, CRT stock’s share price and dividends will rise and fall with oil and gas prices and where we are in the economic cycle. So, Cross Timbers Royalty stock isn’t the kind of stock that investors can buy and forget about. But recently, buy-and-hold investors in Cross Timbers Royalty Trust have been enjoying a ride that few stock traders have enjoyed this year.