6%-Yield Apple Hospitality Stock Up 20% Year-Over-Year

Why APLE Stock Is Worth Considering

Not to sound like a broken record, but interest rates are clearly going to head lower by midyear. There could be three rate cuts in 2024 and more cuts in 2025.

What this means is that capital-intensive companies with debts will see improvements in their margins and profitability. That’s what I expect to see with real estate investment trusts (REITs).

If you’re on the hunt for a monthly income REIT, Apple Hospitality REIT Inc (NYSE:APLE) might be exactly what you’re looking for.

The company owns and operates 223 high-end hotels in the U.S., including 118 Hilton hotels, 100 Marriott hotels, and five Hyatt hotels. It also owns one property that it leases to third parties. The company operates in 87 markets across 37 states. (Source: “Home Page,” Apple Hospitality REIT Inc, last accessed March 21, 2024.)

With overall traveling picking up and business traveling slowly rebounding, the demand for hotels will follow, which should help boost Apple Hospitality stock.

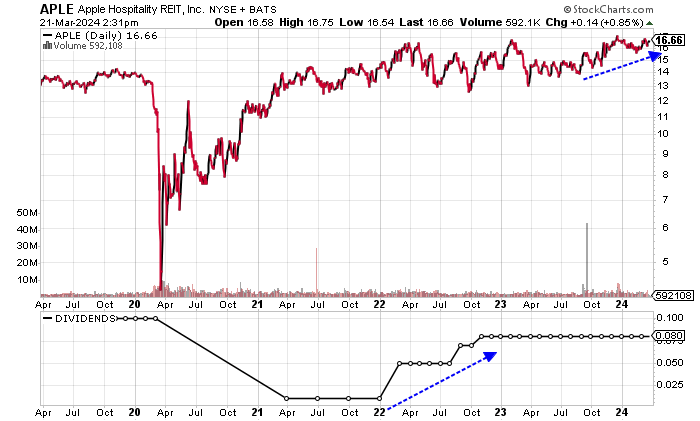

APLE stock’s share price is up by 20.43% over the past year (as of March 21).

The below chart shows Apple Hospitality stock approaching its 52-week high of $17.90 in December 2023. As of this writing, the stock’s price is above its 50-day moving average (MA) of $16.30. It’s also in a golden cross pattern, which is a bullish technical crossover formation that appears when a stock’s 50-day MA is above its 200-day MA.

APLE stock’s record high was $20.97 in December 2015.

Chart courtesy of StockCharts.com

Apple Hospitality Stock Ideal for Monthly Income Seekers

As mentioned earlier, APLE stock pays monthly dividends, which suits investors who seek regular income. Moreover, Apple Hospitality REIT Inc’s shareholders can use their dividends to buy additional shares of the company.

Apple Hospitality stock has paid monthly dividends for 10 straight years, albeit the last time it raised the dividend amount was in November 2022. (Source: “APLE Dividend History,” Nasdaq, last accessed March 21, 2024.)

The stock currently pays monthly dividends of $0.08 per share, which—as of this writing—translates to a forward yield of 5.81%.

| Metric | Value |

| Dividend Streak | 10 Years |

| 7-Year Dividend Compound Annual Growth Rate | -2.4% |

| 10-Year Average Dividend Yield | 7.9% |

| Dividend Coverage Ratio | 1.7 |

Rebound of Travel Industry to Drive Apple Hospitality REIT Inc’s Revenues & FCF

Apple Hospitality has achieved three consecutive years of revenue growth, including two years of high-double-digit growth emerging from its pandemic low in 2020. The company recorded its highest revenues in 2023, and they’re expected to continue rising.

Analysts estimate that Apple Hospitality will increase its revenues by 6.2% to $1.43 billion in 2024 and follow that with growth of 2.5% to $1.46 billion in 2025. (Source: “Apple Hospitality REIT, Inc. (APLE),” Yahoo! Finance, last accessed March 21, 2024.)

| Fiscal Year | Revenues | Growth |

| 2019 | $1.3 Billion | N/A |

| 2020 | $601.9 Million | -52.5% |

| 2021 | $933.9 Million | 55.2% |

| 2022 | $1.2 Billion | 32.6% |

| 2023 | $1.3 Billion | 8.5% |

(Source: “Apple Hospitality REIT Inc.” MarketWatch, last accessed March 21, 2024.)

The company has consistently generated gross margins of more than 40%, except in 2020, when there was a contraction.

| Fiscal Year | Gross Margin |

| 2019 | 45.9% |

| 2020 | 30.3% |

| 2021 | 42.8% |

| 2022 | 45.2% |

| 2023 | 44.7% |

Apple Hospitality REIT Inc has also consistently generated generally accepted accounting principles (GAAP) profitability, except in 2020. Its GAPP-diluted earnings per share (EPS) of $0.77 in 2023 matched its high in 2019 and represents a steady recovery from the COVID-19 pandemic.

The company’s earnings growth is expected to continue, with Apple Hospitality expected to report $0.85 per diluted share for 2024 and $0.90 per diluted share for 2025. The expected EPS for 2025 would be the company’s highest level since 2018. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.77 | N/A |

| 2020 | -$0.77 | -200.9% |

| 2021 | $0.08 | 110.7% |

| 2022 | $0.63 | 660.2% |

| 2023 | $0.77 | 22.4% |

(Source: MarketWatch, op. cit.)

Meanwhile, Apple Hospitality REIT Inc has churned out three straight years of positive free cash flow (FCF), setting a record high in 2023.

The company’s high FCF helps it make capital expenditures, pay down debt, and provide dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | -$21.8 | N/A |

| 2021 | $199.3 | 1012.7% |

| 2022 | $309.1 | 55.1% |

| 2023 | $327.0 | 5.8% |

(Source: Yahoo! Finance, op. cit.)

Apple Hospitality REIT Inc’s positive FCF is important, given that the company is saddled with $1.5 billion of debt on its balance sheet. (Source: Yahoo! Finance, op. cit.)

At this time, I don’t expect any significant problems, given the company’s FCF and profitability. Apple Hospitality has managed to easily cover its annual interest expenses with higher earnings before interest and taxes (EBIT). The company’s interest coverage ratio of 3.6 in 2023 was healthy.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $247.5 | $70.8 |

| 2021 | $206.5 | $67.7 |

| 2022 | $87.0 | $59.7 |

| 2023 | $247.5 | $68.9 |

(Source: Yahoo! Finance, op. cit.)

Apple Hospitality REIT Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a reasonable 6.0, which is above the midpoint of the Piotroski score’s range of 1.0 to 9.0. Apple Hospitality has maintained its score of 6.0 since 2019.

The Lowdown on Apple Hospitality REIT Inc

It would be nice to see dividend growth from APLE stock, but its consistent monthly payouts and its price appreciation over the past year are welcome.

Furthermore, institutional investors love Apple Hospitality REIT Inc, as demonstrated by 439 institutions holding a 90.6% stake in the company (as of this writing). The top two institutional holders of Apple Hospitality stock are BlackRock Inc (NYSE:BLK), with a 15.95% stake, and The Vanguard Group, Inc., with a 14.22% stake. (Source: Yahoo! Finance, op. cit.)

My view is that a recovery by the travel industry will provide bullish tailwinds for the hotel sector in general and APLE stock in particular.