6.1%-Yield Antero Midstream Stock Up 16.4% This Year

AM Stock Offers Best of Both Worlds: Income & Share-Price Appreciation

In the current high-interest-rate environment, investors have been purchasing high-yield treasury bonds as an alternative to dividend stocks because of their lower risk. Treasury bond yields continue to be high, but they’ll be coming down, and fixed-income investors will need to replace the yield.

A good alternative for income investors is Antero Midstream Corp (NYSE:AM), a full-service midstream energy company with operations in the energy-rich Appalachian Basin and a market cap of about $7.0 billion.

The company owns gathering pipelines, compression facilities, and interests in processing and fractionation plants, along with water handling systems in the Marcellus and Utica Shale regions. (Source: “About Us,” Antero Midstream Corp, last accessed May 15, 2024.)

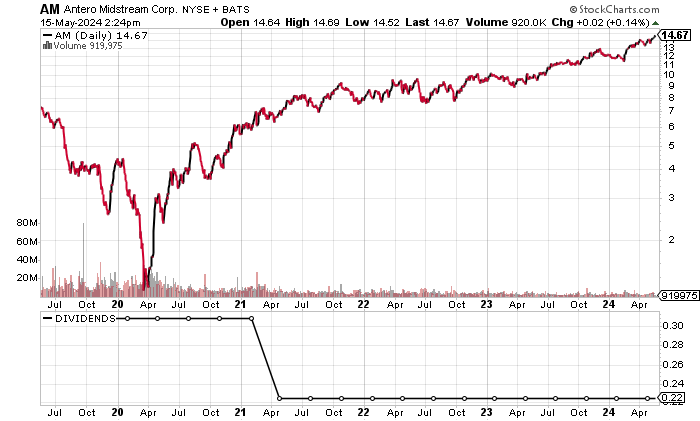

On May 14, Antero Midstream stock reached a 52-week high of $14.65, up by 16.4% in 2024 (as of this writing).

Moreover, for income investors, Antero Midstream has paid dividends for eight straight years.

Chart courtesy of StockCharts.com

Antero Midstream Corp’s Revenues Broke $1-Billion Threshold

Antero Midstream grew its revenues in three of the last four years. In 2023, the company’s revenues surpassed $1.0 billion for the first time in its history.

Analysts estimate that the company will report revenue growth of 6.2% to $1.11 billion for 2024, followed by 3.2% growth to $1.14 billion for 2025. (Source: “Antero Midstream Corporation (AM),” Yahoo! Finance, last accessed May 15, 2024.)

| Fiscal Year | Revenues | Growth |

| 2019 | $849.6 Million | N/A |

| 2020 | $971.4 Million | 14.3% |

| 2021 | $968.9 Million | -0.3% |

| 2022 | $990.7 Million | 2.3% |

| 2023 | $1.1 Billion | 12.3% |

(Source: “Antero Midstream Corp.” MarketWatch, last accessed May 15, 2024.)

Antero Midstream’s gross margins have held steady above the 80% level for the last four years.

| Fiscal Year | Gross Margins |

| 2019 | 77.0% |

| 2020 | 83.0% |

| 2021 | 83.8% |

| 2022 | 81.8% |

| 2023 | 80.8% |

On its bottom line, Antero Midstream Corp generated generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) profits from 2021 through 2023, including a record-high $0.77 in 2023.

Analysts expect Antero Midstream Corp to report higher earnings of $0.87 per diluted share in 2024, followed by $0.99 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.80 | N/A |

| 2020 | -$0.26 | 68.0% |

| 2021 | $0.69 | 368.2% |

| 2022 | $0.68 | -1.7% |

| 2023 | $0.77 | 13.5% |

(Source: MarketWatch, op. cit.)

Moving over to the company’s funds statement, Antero Midstream has been a free cash flow (FCF) machine. For 2023, it reported impressive FCF growth of 223.5% to a record-high $595.1 million.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $230.4 | N/A |

| 2020 | $556.7 | 141.6% |

| 2021 | $476.9 | -14.3% |

| 2022 | $184.0 | -61.4% |

| 2023 | $595.1 | 223.5% |

(Source: MarketWatch, op. cit.)

The company’s balance sheet held debt of $3.2 billion at the end of 2023. (Source: MarketWatch, op. cit.)

Meanwhile, the high-interest-rate environment has affected Antero Midstream Corp’s margins and costs, but it’s not a concern. The following table shows that, in the last three years, the company easily covered its interest expenses via significantly higher earnings before interest and taxes (EBIT) after unusual expenses.

In 2023, Antero Midstream Corp had a healthy interest coverage ratio of 2.8 times.

| Fiscal Year | EBIT After Unusual Expenses (Millions) | Interest Expense (Millions) |

| 2019 | -$398.5 | $110.4 |

| 2020 | -$114.7 | $147.0 |

| 2021 | $537.2 | $175.3 |

| 2022 | $537.2 | $190.0 |

| 2023 | $617.9 | $217.3 |

(Source: MarketWatch, op. cit.)

Antero Midstream Corp’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is an extremely strong 8.0. That’s just a notch below a perfect score of 9.0.

Antero Midstream Stock’s Dividends Could Increase

As mentioned earlier, Antero Midstream Corp has paid dividends for eight years straight. Moreover, AM stock has been paying quarterly dividends of $0.225 per share since May 2021.

As of this writing, that represents a forward dividend yield of 6.14%. Antero Midstream stock’s five-year average dividend yield is higher, at 12.92%. (Source: Yahoo! Finance, op. cit.)

My view is that, given Antero Midstream Corp’s high FCF and its expected higher earnings over the next two years, the company could raise its dividends.

| Metric | Value |

| Dividend Streak | 8 Years |

| 10-Year Average Dividend Yield | 15.4% |

| Dividend Coverage Ratio | 1.9 |

The Lowdown on Antero Midstream Corp

Due to its improving profitability and FCF, Antero Midstream Corp is worth a look for income investors who seek capital appreciation.

A good sign is that AM stock has broad institutional ownership, with 509 institutions holding 53.6% of the outstanding shares (as of this writing). The insider interest of 30.1% of the outstanding shares is high, and company insiders acquired a net 1.12 million shares over the last six months. (Source: Yahoo! Finance, op. cit.)

This should incentivize those insiders to deliver better financial results.