456 Institutions Bullish on 11%-Yielding Blue Owl Capital Corp

Blue Owl Capital Stock Hits Record High

While there are concerns about a full-out trade war from President Donald Trump’s proposed tariffs, the U.S. economy remains fundamentally solid. The Federal Reserve left interest rates unchanged at about 4.5%, but it’s still expected to cut interest rates twice in 2025. This would bring rates down to around four percent.

This environment should continue to be positive for business development companies (BDCs), or what we like to call “Alternative Banks” here at Income Investors.

BDCs are an economic lifeline for America’s small- and medium-sized businesses; companies that are too small for traditional financial institutions to get involved with. BDCs also allow ordinary investors like you and me to invest in a broad range of American businesses.

The best part? You can invest like a private equity firm without needing to hand over $1.0 million for the privilege of investing in America. An investor can take a similar position in an Alternative Bank like Blue Owl Capital Corp (NYSE:OBDC) for just $15.00 per share.

There’s an added bonus for passive income investors, too. Thanks to a federal loophole, BDCs have to legally distribute at least 90% of their taxable income to shareholders in the form of ultra-high-yield dividends. This can result in some of the most generous payouts and highest dividend yields on Wall Street.

About Blue Owl Capital Corp

Blue Owl Capital Corp is a specialty finance BDC that provides direct lending to U.S. middle-market companies. It invests in companies with market leadership positions and highly recurring, often contractual, cash flows. (Source: “February 2025 Investor Presentation,” Blue Owl Capital Corp, last accessed March 27, 2024.)

The BDC’s current $13.2-billion portfolio and $136.0 billion in assets under management include 236 portfolio companies diversified across 30 industries, such as internet software and services (10.5% of total portfolio), insurance (7.6%), food and beverage (7.3%), and health-care providers and services (6.3%).

It’s portfolio is primarily made up of senior secured loans (83% of asset mix), of which 78% are first lien investments. The vast majority of its debt financing, 96%, is floating rate.

While some investors may be concerned about how BDCs like Blue Owl will perform during market downturns or recessions, it’s important to remember that the company makes its loans for five to seven years.

According to management, when the BDC makes its loans, it actually has to take into consideration what could go wrong with the company or whether there’s going to be a recession during that period of time and model its loans to these scenarios.

As a result, Blue Owl doesn’t make loans to companies that can’t withstand those types of changes. This gives management the confidence that its portfolio of companies will hold up during recessions. In fact, financing recession-resistant companies is what Blue Owl is known for.

Fourth Quarter Concludes Another Strong Year

As an Alternative Bank, Blue Owl is good at making money. In the fourth quarter ended December 31, 2024, the BDC reported net investment income (NII) of $184.2 million, or $0.47 per share. This was in line with the third quarter and exceeded the regular dividend of $0.37 by 27% (Source: “Blue Owl Capital Corporation Reports Full Year Results and Fourth Quarter Net Investment Income Per Share of $0.47 and Net Asset Value Per Share of $15.26,” Blue Owl Capital Corp, February 19, 2025.)

Fourth-quarter net income increased 14.5% on a sequential basis to $154.8 million, or $0.40 per share. During the quarter, the BDC made new investment commitments of $1.7 billion.

Commenting on the fourth-quarter results, Craig W. Packer, Blue Owl’s chief executive officer, said, “Our fourth quarter results concluded another strong year for OBDC, delivering a 12.4% annualized return on equity, supported by continued strong portfolio performance and robust origination activity.”

Looking ahead, management said that the BDC would be entering an at-the-market (ATM) program under which it may issue up to $750.0 million of its common stock.

Q4 Dividend of $0.37 & Supplemental Dividend

As a result of its strong NII, Blue Owl is able to provide a reliably high quarterly distribution. In the fourth quarter, it paid a quarterly dividend of $0.37 per share. The BDC also announced a supplemental dividend of $0.05 per share, for a quarterly payout of $0.42 per share. This works out to an annual payout of $1.69 per share for a current forward dividend yield of 11.28%. (Source: “Dividends,” Blue Owl Capital Corp, last accessed March 24, 2025.)

Blue Owl pays a quarterly supplemental dividend, calculated as 50% of NII in excess of its regular dividend. The supplemental, or special, dividend, was first introduced in the third quarter of 2022.

OBDC Stock Hits Record High

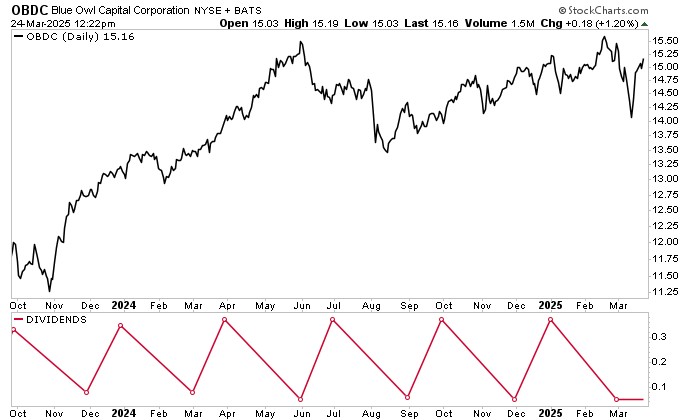

The only thing better than an ultra-high-yield-paying stock is one that’s also trading at record levels. And that’s what you get with OBDC stock. On February 21, OBDC hit a record intraday high of $15.68.

Like the broader market, the stock faced volatility in the back half of February, but it has largely recovered from the sell-off. And OBDC continues to outperform the broader market, too. As of March 24, the stock is up 7.5% over the last six months and 10% on an annual basis.

Conservative Wall Street expects OBDC shares to hit fresh highs over the coming quarters, too, with analysts providing a 12-month share price target range of $16.00 to $17.00 per share. This points to potential upside of approximately 5.7% to 12.3%.

Chart courtesy of StockCharts.com

The Lowdown on Blue Owl Capital Corp

Blue Owl is a great BDC with a diversified portfolio made up primarily of senior secured loans, and the vast majority of its debt financing is floating-rate. The company’s portfolio continues to demonstrate resilience and stable credit quality, and management expects to build on this momentum in 2025.

While it’s anticipated that interest rates will come down slowly in 2025 and 2026, they should remain higher than where they were before the 2020 health crisis. This should help juice Blue Owl’s share price and allow it to provide a growing dividend and special dividends.

That’s excellent news for common shareholders and the 456 institutions that hold 32.4% of all outstanding OBDC shares. The three biggest holders are State of New Jersey Common Pension Fund E, Bank of America Corp, and Morgan Stanley. (Source: “Blue Owl Capital Corporation (OBDC),” Yahoo! Finance, last accessed March 24, 2025.)