4.3%-Yielding UDR Stock’s Payout Raised for 13 Straight Years

Why UDR Inc’s Outlook Is Bright

Things are looking up for beaten-down real estate investment trusts (REITs) like UDR Inc (NYSE:UDR).

REITs are popular with income investors because they legally have to return at least 90% of their taxable income to investors in the form of dividends. Even in a high interest rate environment, REITs tend to do well, making money from rent, property sales, and interest income.

That doesn’t mean REIT stocks always perform well in terms of share price. Despite the fact that REITs have been reporting excellent financials lately, their share prices are down. The S&P United States REIT index is down by 16.9% year-over-year and 1.9% year-to-date.

Investors might be worried that rising interest rates will hurt REITs, but this isn’t normally the case. Again, REITS can pass on their rising interest expenses to their tenants or sell properties when the time is right. Moreover, most REITs hold a lot of fixed-rate debt, which isn’t affected by interest rate hikes. Rising interest rates are a challenge for REITS when they need to finance their debts, though. Fortunately, REITs have a collective weighted average maturity for their debts of more than seven years.

This bodes well for REITs like UDR Inc, not just because they have solid balance sheets, but because, after taking a beating in 2022, REITs’ valuations are low.

Some REITs have more compelling stories than others, focusing on sectors such as commercial properties, middle-class housing, affordable housing, or retirement homes.

One type of REIT that often gets overlooked by investors is the kind that caters to the luxury rental market. You might think that affluent people would buy their homes instead of renting them, but that isn’t necessarily the case. Rising mortgage rates, high costs associated with home ownership, and a low supply of homes for sale have convinced some Americans that buying housing is too risky an investment.

The number of renter households earning $150,000 or more per year jumped by 87% between 2016 and 2021. In 2021, about 44 million homes in the U.S. were rented. The median income for all U.S. households that year was roughly $71,000. (Source: “Three Million U.S. Households Making Over $150,000 Are Still Renters,” The Wall Street Journal, March 13, 2023.)

High earners have been turning to luxury rentals with features such as nice views, rooftop pools, fitness centers, spas, screening rooms, and close proximity to beaches and vibrant cities.

The city that saw the biggest increase in high-end renters was Austin, Texas, where renter households making $150,000 or more jumped by 154% over a five-year period. Other cities across the U.S. South and Southwest—including Nashville, Atlanta, and Phoenix—also saw big increases in high-end renters.

That’s great news for luxury apartment REITs like UDR Inc.

As of March 31, the S&P 500 company owned or had an ownership position in 58,411 apartment homes, including 415 homes under development. (Source: “UDR Announces First Quarter 2023 Results,” UDR Inc, April 26, 2023.)

Its properties are in the U.S. Northeast/Mid-Atlantic region (39% of its net operating income [NOI]), on the West Coast (36% of its NOI), and in the Sun Belt (25% of its NOI). (Source: “Investor Presentation: May 2023,” UDR Inc, last accessed May 31, 2023.)

In 2006, UDR launched its National Development Program, which the company describes as “targeting construction of new luxury apartments in strategic locations.” Since then, the company has built 5,820 new apartment units in seven states. (Source: “New Developments,” UDR Inc, last accessed May 31, 2023.)

Management Reported Strong Results & Reaffirmed Guidance

For the first quarter ended March 31, UDR announced that its revenues increased by 11.8% year-over-year to $42.3 million. Its net income jumped by 125% from $0.04 to $0.09 per diluted share. (Source: UDR Inc, April 26, 2023, op. cit.)

The company’s funds from operations (FFO) climbed by nine percent year-over-year from $0.54 to $0.59 per share, while its FFO as adjusted (FFOA) went up by nine percent to $0.59 per share. Its adjusted FFO (AFFO) grew by 12% from $0.51 to $0.57 per share.

During the first quarter, the company completed the $145.0-million construction of a 300-home apartment community in Washington, D.C. It also achieved stabilization on two development communities: a $74.0-million, 405-home apartment community in Dallas, Texas and a $68.0-million, 200-home apartment community in Philadelphia, Pennsylvania.

“Our first quarter results, including 9 percent FFOA per share growth and nearly 12 percent same-store NOI growth over the prior year period, demonstrate the strength of our strategy and platform, ” said Tom Toomey, UDR Inc’s chairman and CEO. (Source: Ibid.)

He added, “We are optimistic on the growth trajectory and resiliency of our business moving forward and continue to focus on what we can control: disciplined capital allocation to opportunistically create shareholder value, new and innovative initiatives to drive further margin expansion, and an investment-grade balance sheet with well-laddered maturities and plentiful liquidity.”

For 2023, UDR reaffirmed its prior FFOA-per-share, AFFO-per-share, and same-store-growth guidance.

|

Financial Metric (per Diluted Share) |

2Q Outlook | 2023 Outlook | 2023 Midpoint Outlook |

| Net Income | $0.11 to $0.13 | $0.47 to $0.55 | $0.51 |

| FFO | $0.60 to $0.62 | $2.44 to $2.52 | $2.48 |

| FFOA | $0.60 to $0.62 | $2.45 to $2.53 | $2.49 |

| AFFO | $0.54 to $0.56 | $2.22 to $2.30 | $2.26 |

(Source: Ibid.)

UDR Inc Hiked Quarterly Dividend 10.5%

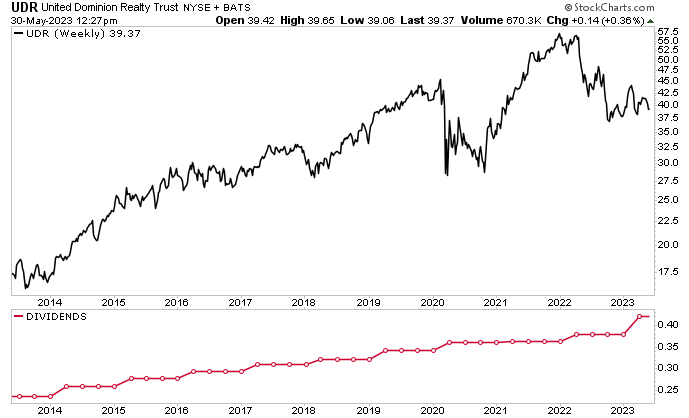

Thanks to its in-demand luxury properties and reliable cash flow, UDR has been able to provide income investors with reliable, growing dividends.

In March, the company’s board declared a regular quarterly dividend for its common stock of $0.42 per share, for a current yield of 4.3%. (Source: “UDR Declared Quarterly Dividend,” UDR Inc, March 16, 2023.)

The distribution, which was paid on May 1, represented a 10.5% increase over the $0.38 per share that UDR stock paid out in the same period of 2022. It also represented the 202nd consecutive quarter in which the company had paid a dividend, and the 13th consecutive year in which it had raised its dividend.

Since 2010, the company’s dividend has expanded at a compound annual growth rate (CAGR) of 6.7%.

UDR Stock Down 16% But Has 25%+ Upside

Lately, it’s been tough to find a REIT that hasn’t been taking a bit of a hit in terms of share price. UDR stock is no exception, down by approximately 16% year-over-year. On the plus side, it’s up by roughly 3.8% year-to-date.

Shares of UDR Inc have a long history of providing big gains. They were trading at record levels before the COVID-19 pandemic sent them tumbling. As you can see in the chart below, UDR stock rebounded, and in January 2022, it hit a record high of $58.02. During the rest of 2022, UDR’s share price retreated, much like the broader market did, but it recently found support around $38.56 per share.

The pullback since January 2022 has put UDR stock in a more attractive trading range, or at least Wall Street analysts think so. Analysts have a 12-month share-price target for UDR Inc in the range of $45.00 to $50.00 per share, for potential gains in the range of approximately 15% to 28%.

Chart courtesy of StockCharts.com

The Lowdown on UDR Inc

UDR is an S&P 500 company and a leading multifamily REIT with a long history of “delivering superior and dependable returns.” The company has paid dividends for 202 consecutive quarters and has raised its dividends for 13 straight years. UDR Inc’s total shareholder returns since 2000 have outperformed those of its peers and the S&P 500.

The outlook for UDR stock is solid. There’s an ongoing shortage of U.S. housing and an increased propensity for Americans—including high earners—to rent their homes instead of buying them.