TRMD Stock: 15.86%-Yielder Up 27% This Year

Mid-Cap Midstream Player Near 52-Week High

Energy companies are classified as upstream, midstream, and downstream, or a combination of the three phases.

I’ve been watching a midstream player that is offering a significant dividend yield, plus its stock has advanced a massive 27% in 2024 and 55.5% over the past year to August 26.

I have my sights trained on TORM plc (NASDAQ:TRMD), a major global owner and operator of product tankers that move refined oil products and chemicals. Based out of the U.K., the company has been in operation since 1889. It currently operates a fleet of over 80 vessels, ranging from 45,000 to 114,000 deadweight tonnage (DWT). DWT represents how much weight a ship can carry. (Source: “Our Company,” TORM plc, last accessed August 27, 2024.)

The company is a play on the global economy, so its stock tends to trade with it. The fundamentals have shown strong revenue growth driven by fleet expansion. Shipping is a high-capital-expenditure business, so the expected decline in interest rates should help improve margins.

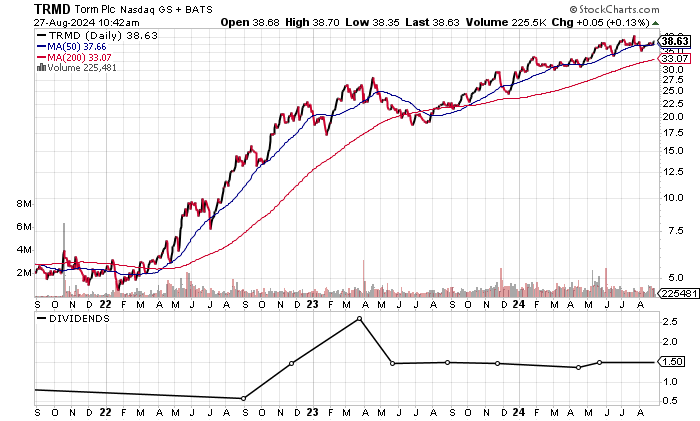

A look at the chart showed TRMD stock trading at a 52-week high of $40.47 on July 23. The 10-year high was $48.86 in April 2020.

TRMD stock is trading above its 50-day moving average (MA) of $37.56 and 200-day MA of $34.58. Moreover, TRMD stock is in a bullish golden cross formation that could signal additional upside moves.

Chart courtesy of StockCharts.com

Revenues Up 145.4% Since 2021

The growth has been strong over the last two years, with revenues jumping 145.4% from 2021 to the record $1.42 billion in 2023. TORM grew revenues in four of the last five years and seven of the last 10 years.

| Fiscal Year | Revenues | Growth |

| 2019 | $692.6 million | 9.0% |

| 2020 | $747.4 million | 7.9% |

| 2021 | $619.5 million | -17.1% |

| 2022 | $1.4 billion | 133.0% |

| 2023 | $1.5 billion | 5.3% |

(Source: “TORM plc (TRMD),” Yahoo! Finance, last accessed August 27, 2024.)

Analysts expect TORM plc to report lower revenues of $1.28 billion in 2024 and $1.23 billion in 2025. (Source: Yahoo! Finance, op. cit.)

Gross margins expanded to five- and 10-year highs in 2023 for the second consecutive year. The last two years were the only 50%-plus gross margin years since 2014.

| Fiscal Year | Gross Margins |

| 2019 | 36.4% |

| 2020 | 45.6% |

| 2021 | 30.4% |

| 2022 | 54.2% |

| 2023 | 57.5% |

On the bottom line, TORM produced generally accepted accounting principles (GAAP) profits in four of the last five years and seven of the last 10 years. The earnings in 2022 and 2023 were the highest on record.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $2.24 | 566.7% |

| 2020 | $1.19 | -47.1% |

| 2021 | -$0.54 | -145.5% |

| 2022 | $6.80 | 1,359.3% |

| 2023 | $7.48 | 10.0% |

(Source: Yahoo! Finance, op. cit.)

Similar to the expected decline in revenues, analysts estimate that TORM will report a drop to $7.15 per diluted share in 2024 and $6.18 per diluted share in 2025. The estimates vary, ranging from a low of $5.01 to a high of $7.60 per diluted share for 2025. The second quarter saw in-line earnings per share after three straight quarters of beats. (Source: Yahoo! Finance, op. cit.)

A look at the funds statement shows positive free cash flow (FCF) in three of the last four years. This will allow TORM to pay dividends and reduce its debt. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | $62.8 | N/A |

| 2021 | -$271.8 | -532.8% |

| 2022 | $382.0 | 240.5% |

| 2023 | $294.9 | -22.8% |

(Source: Yahoo! Finance, op. cit.)

The company’s balance sheet shows $1.26 billion in total debt and $562.2 million in cash at the end of June. I don’t expect any issues given the strong working capital, profitability, and FCF. (Source: Yahoo! Finance, op. cit.)

TORM plc has also easily covered its interest expense with higher earnings before interest and taxes (EBIT) in four straight years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $136.6 | $47.1 | 2.90X |

| 2021 | $1.6 | $42.4 | N/A |

| 2022 | $605.5 | $48.8 | 12.41X |

| 2023 | $712.9 | $60.9 | 11.71X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a reasonable reading of 5.0 for TORM, which is above the midpoint of the 1.0 to 9.0 range.

TRMD Stock: Dividends Surge 20% Year Over Year

TORM recently raised its quarterly dividend to $1.80 per share to be paid on September 11 to shareholders of record as of August 29. The dividend is a 20% increase compared to $1.50 in the same period in 2023. (Source: Yahoo! Finance, op. cit.)

The upcoming dividend adds to the $4.32 per share paid put in the previous three payments. The total of $6.12 per share for the four payments represents a forward yield of 15.86%.

| Metric | Value |

| Dividend Streak | 3 years |

| Dividend Growth Streak | 2 years |

| Dividend Coverage Ratio | 1.7X |

The Lowdown on TRMD Stock

Institutional ownership in TRMD stock is relatively strong, with 221 institutions holding a 72.5% stake in the outstanding shares. (Source: Yahoo! Finance, op. cit.)

TRMD stock is ideal for income investors looking for a high dividend yield and the opportunity for price appreciation.